We figured out how much rooftop solar we could build in Part 1, and that it made financial sense. Now it’s time to step up the level of work to professional level, which means we will investigate solar tax credits and benefits that might be available to us. And while you’re learning here, check out the images of the Brewster, Massachusetts solar power installation this series of posts is describing.

What can we save in solar tax credits?

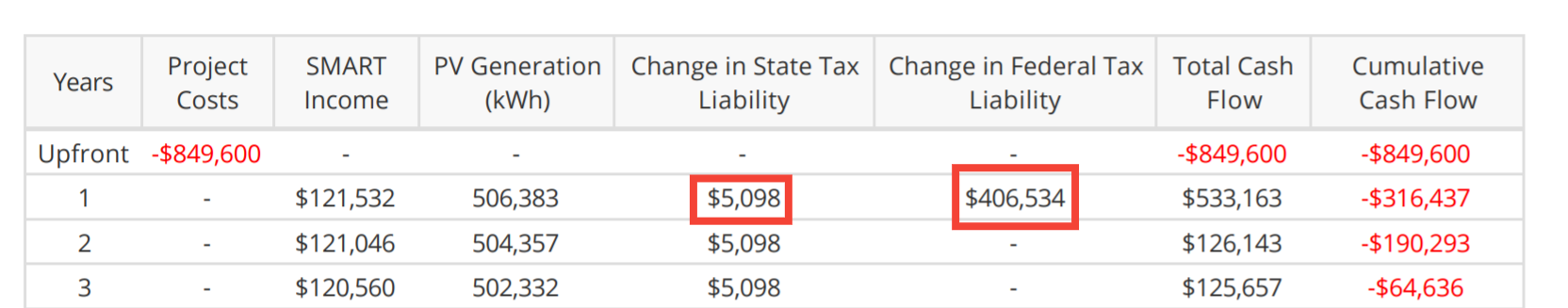

First, we ask a serious question to our Certified Public Accountant (CPA) – as Commercial Solar Guy is not a financial professional – and if we look at the first couple of years of revenue from our solar system, we can see that in Year One, 48.5% of the project can be offset by tax benefits. That’s almost half the system’s cost!

The three tax benefits that come to those in Rhode Island and Massachusetts are:

Business Energy Investment Tax Credit (ITC) –

Businesses that install solar photovoltaic (PV) systems are eligible to receive a tax credit in the amount of 30% of the total PV system cost. Unlike tax deductions, this tax credit can be used to directly offset your tax liability dollar for dollar. If your solar tax credit exceeds your tax liability you can roll the credit into future tax periods for 20 years.

Read the very technical description about this credit on IRS.gov >

Federal – 100% bonus depreciation (Tax Reform Bill)

The Tax Credits in this article are out of date. The signing of The Inflation Reduction Act by the Biden Administration will be in place for the next decade. To learn about how these new incentives would apply to your solar project, please visit this Article we wrote on the topic. The signing of the The Tax Reform Bill modifies bonus depreciation under Code Section 168(k) to allow 100% expensing for property placed in service after September 27, 2017 and before January 1, 2023. By increasing bonus depreciation to 100 percent, the new tax bill essentially allows eligible entities to deduct the entire allowable tax basis of the system in the first year of operation. Under the federal Modified Cost Recovery System (MACRS), businesses may recover investments in certain property through depreciation deductions. MACRS establishes a lifespan for various types of property over which the property may be depreciated. For PV systems, the taxable basis of the equipment must be reduced by 50% of any federal tax credits associated with the system.

Description of the program from true financial professional >

(MA & RI) State Depreciation

Under the Modified Cost Recovery System (MACRS), businesses may recover investments in certain property through depreciation deductions. The MACRS establishes a set of class lives for various types of property over which the property may be depreciated.

If your CPA tells you that these things make sense for you, then we should talk! If your CPA says it doesn’t align just right, then how about you get in touch with me and I’ll pay you for the rights to build on your roof.

This article was written in 2019 and multiple items here are out of date. The Inflation Reduction Act, as well depreciation changes have occurred. For an updated review of depreciation, please see this article.

Can the power grid handle our solar power system?

The next serious question we ask is directly to the electricity utility – in Massachusetts that is Eversource and National Grid, and in Rhode Island it is National Grid. The question we ask is whether or not the power grid has space for our solar power system – and we do this in Eversource territory by filling out Exhibit B: Generating Facility Expedited/Standard Pre-Application Report Form.

While we don’t have a pre-app for the Brewster project (we do have the request receipt though!!), below is an example of what we don’t want to see!

The reason we don’t want to see that is because of all those projects are in line in front of us. That’s a scary sight! It means there will be a long wait until we get our chance to install. There are many places in the Massachusetts marketplace with complex interconnection challenges. Here’s a map in “Tracking Saturation of Distributed Energy Resources in Massachusetts” – and while there will be many installations where the areas are defined as saturated for various reasons , you can see that it takes work to get a system placed well.

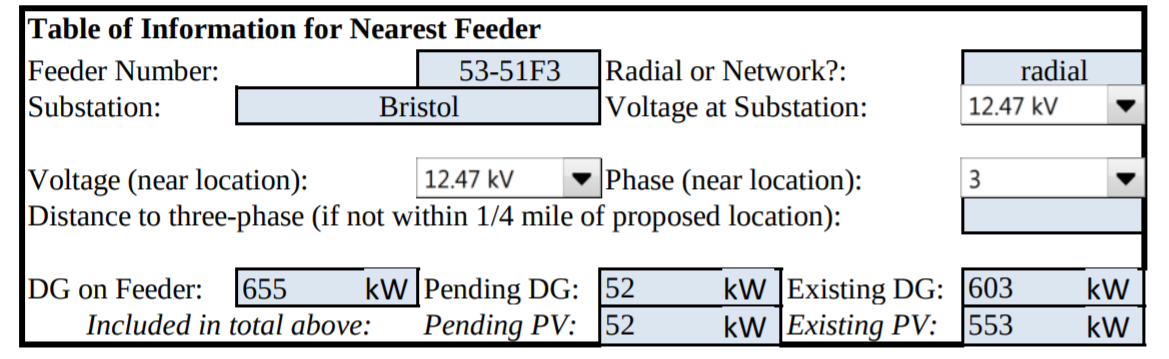

Below is an example of a recent pre-application located in Bristol, Rhode Island. This document looks good!

Do note how it says there is 655 kW of “DG on the Feeder”, and that the voltage at substation is 12.47 kV. The 655 kW means there is that much solar power already installed, or pending to be installed on the same powerlines. The 12.47 kV represents what the powerlines can handle and, if things are going well, the hardware can hold more than 10,000 kW. Since Commercial Solar Guy’s customer’s projects total about 350 kW, plus the existing 655 kW, we’ve got plenty of space – and no waiting for others!

Up next:

Now that we finalized our financial questions, and have been given some preliminary data on the local power grid – its time to move on to the next chapter. Stay tuned right here on the blog.

But don’t forget – check out Installing solar panels on commercial buildings: Part 1 – Feasibility Analysis, and if you don’t mind spoiling dinner – check out the finished images, video and electricity production of the project!