Navigating the tax intricacies of commercial solar depreciation is crucial for business owners looking to maximize their return on solar investments. It can get complicated, particularly as projects increase in scale. However, for business owners, the tax benefits associated with solar investments, particularly those found with commercial solar depreciation, can significantly accelerate the return on investment.

Understanding Commercial Solar Depreciation in Solar Power Projects

Depreciation is an accounting principle enabling businesses to distribute the cost of a tangible asset over its anticipated lifespan. As components like solar panels and inverters age, their value diminishes. Spreading this upfront investment across multiple years through depreciation helps alleviate a business’ tax burden.

Applying Depreciation to a Solar Power Project:

- Determine the asset’s cost: Include all costs to make the solar system operational: equipment costs, installation charges, and other direct expenses.

- Identify the asset’s useful life: Solar panels generally last 25-30 years, but over time, that efficiency may decline. It’s important to consult manufacturer’s specifications and industry standards.

- Choose a depreciation method: Common methods include:

- Straight-line depreciation: Divide the asset’s cost equally over its useful life. For a $25,000 project with a useful life of 25 years, the annual depreciation expense is $1,000.

- Accelerated depreciation (like MACRS): MACRS stands for “Modified Accelerated Cost Recovery System.” This method prioritizes the earlier years of the asset’s life, which can be tax-advantageous.

Homeowners (No Depreciation Benefits)

Homeowners investing in solar are eligible for a 30% tax credit, but can’t utilize solar depreciation. This credit offsets federal income taxes directly. For example, a $20,000 solar system results in a $6,000 tax credit.

Whaling City Solar, a sibling company of Commercial Solar Guy that specializes in residential solar, recently highlighted residential solar tax credits and other energy efficiency tax credits in a blog post highlighting Biden’s Inflation Reduction Act.

Residential Energy Efficiency Incentives:

- Breaker box: 30% tax credit, capped at $600 (no cap when combined with rooftop solar)

- Rooftop solar: 30% tax credit, with an average credit of $4,700 for a typical 6kW installation costing $19,000

- Heat pumps: 30% tax credit, capped at $2,000 annually (resets each year) for both air and water heat pumps

- Weatherization and insulation: 30% tax credit for energy assessments and upgrades like insulation, doors, and windows

- Residential battery system: 30% tax credit, with an average credit of $4,800 based on an average $16,000 cost

- Electric vehicles (new): Discounts up to $7,500 for those earning less than $150,000 (single), $225,000 (head of household), or $300,000 (joint filers). Retail price must be less than $80,000 for vans and pickup trucks or $55,000 for other cars.

- Electric vehicles (used): For those earning under $150,000 (filing jointly), $112,500 (head of household), or $75,000 (all other filers). Retail price must be less than $25,000.

In specific scenarios, residential solar projects can be depreciated, but this is typically when a business owns multiple projects, similar to operations like Sunrun or Sunnova.

Business Owners (Depreciation Available)

Note: While we do offer Commercial Solar Installation and Consulting Services, Commercial Solar Guy does not provide tax advice. Methods like Section 179, accelerated depreciation, and MACRS are most relevant to solar buyers.

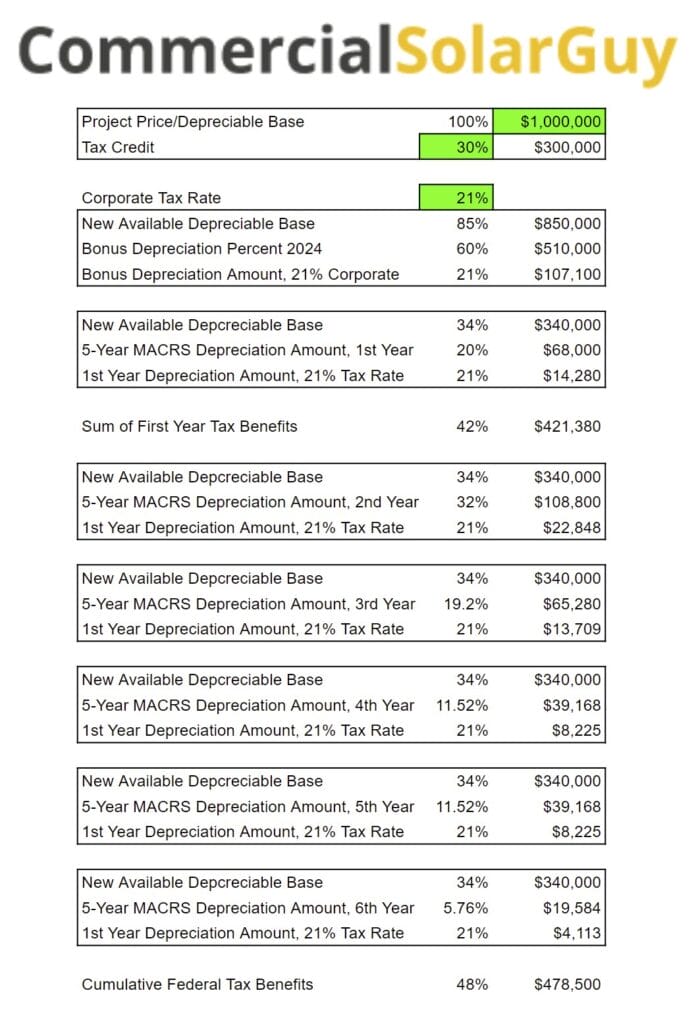

To determine the depreciable base, start with the Investment Tax Credit . This credit offers an overall return of 30% dollar for dollar tax credit for the solar project’s total cost.

Halve the Investment Tax Credit and subtract from 100% to find the depreciable base. For example, a 30% credit equates to an 85% depreciable base. (Note: State incentives might affect the depreciable base, but that’s a topic for another discussion.)

With the depreciable base established, it’s possible to determine how much of a solar project can be depreciated in any particular year. First, we must consider that the Tax Cuts and Clean Jobs Act of 2017 introduced “Bonus Depreciation” for the initial year of solar projects, enabling a portion of the project’s depreciable base to be depreciated in year one.

Upcoming Bonus Depreciation Rates:

- 2022 = 100%

- 2023 = 80%

- 2024 = 60%

- 2025 = 40%

- 2026 = 20%

- 2027 = 0%

To calculate the Bonus Depreciation for a project, start by identifying the depreciable base. For instance, using our calculated above 85% depreciable base, then multiplied by the 60% Bonus Depreciation rate set for 2024, resulting in 51% of the project’s total cost eligible for Bonus Depreciation.

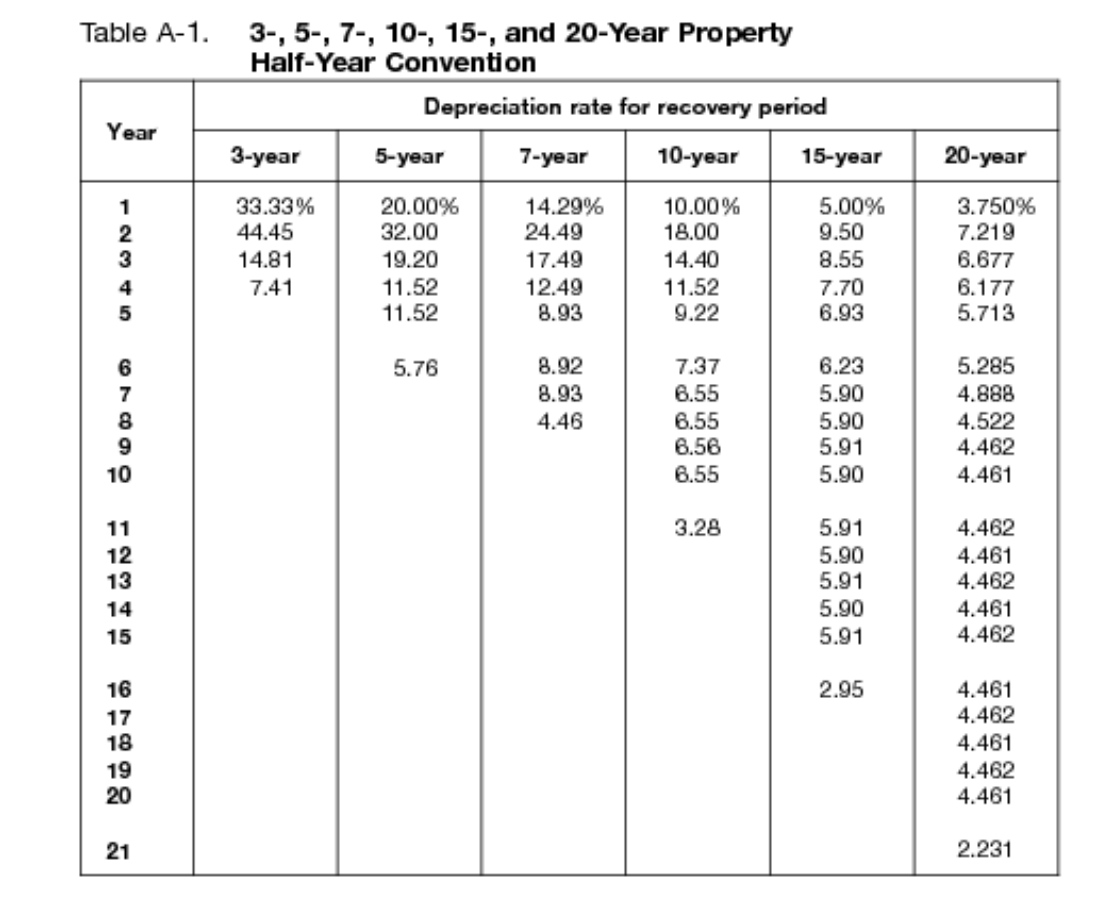

The next step is to apply the standard depreciation values according to MACRS mandated by the IRS. The IRS stipulates a five-year depreciation period for solar projects at the federal level.

State-by-state depreciation rules differ, but solar, like all hardware, can be used to offset state taxes. For instance, Massachusetts solar projects follow a five-year depreciation schedule that aligns with IRS guidelines. Meanwhile, in Rhode Island, projects are depreciated over a ten-year period.

To get a better understanding of this concept, consider the visual examples below, which illustrate how a $1,000,000 solar project benefits from tax incentives and depreciation in 2023:

To learn how these principles apply in a real-world scenario, we invite you to examine a detailed analysis we conducted for a commercial rooftop installation in Rhode Island. This case study delves into the financial intricacies of the project, showcasing how various tax incentives, including the Investment Tax Credit and MACRS, along with electricity revenue, come together to offer significant returns on investment. By the second half of the fourth year, the project fully covers its initial costs.

For a more detailed breakdown or to explore how depreciation might benefit your unique scenario, please reach out to Craig@commercialsolarguy.com to receive insights tailored to your building and business needs.