As solar power is installed across the United States, gaining on 2.5 million total systems installed in the country, questions are arising about what to do with the modules at the end of their life. Local zoning boards are requiring that solar developers specifically note how solar power plants will be “decommissioned”: defined as cleaning up the solar power site at the end of its life.

Developers suggest that the value of the materials themselves will be greater than the cost of cleanup – and there is some evidence to support this. However, local jurisdictions don’t want to risk this.

In Athol, Massachusetts, the Board of Planning posted a Solar Decommissioning Template. The document is a ‘list of labor rates and equipment rates that are to be used in calculating the total cost of decommissioning.’ The board requires that developers provide a short description of each of the decommissioning processes, and a formula to derive the cost of the associated actions.

For instance, the task of removing solar panels is described as:

The panels are clamped in. They slide in a rack. A laborer needs to unclamp the panel and reach over and slide the panel out of the track. It takes approximately 3 minutes to remove each panel (20 per hour). There are 15,000 panels.

You then multiply the hourly cost of the labor needed to remove said panel, times the number of panels removed per hour, and the total number of panels on the job. That 15,000 panel project (~5 MWdc) is then broken down for all tasks, and their projected costs:

| Remove Rack Wiring | $8,274 |

| Remove Cable | $12,256 |

| Remove Panels | $37,500 |

| Dismantle Racks | $13,790 |

| Remove and Load Racks plus Trucking | $51,570 |

| Remove Electrical Equipment plus Trucking\ | $8,572 |

| Breakup and Remove Concrete Pads and Ballasts | $2,720 |

| Remove Power Poles | $3,000 |

| Remove Fence plus Trucking | $19,443 |

| Grading | $3,000 |

| Seed Disturbed Areas | $810 |

| Additional Trucking Costs (Panels, Concrete, etc) plus fuel | $14,700 |

| Total Cost | $175,630 |

| Total Cost after 20 years at 2.5% inflation Rate | $287,798 |

The board notes that it reserves the right to require a Surety Bond that is up to 125% of the cost of removal, as well to increase rates of inflation and labor costs as it sees fit based upon market conditions.

From a price per watt standpoint, that’s about 3.5¢/watt. Obviously, this pricing varies per site. Some estimates and real life prices:

- A document from New York state puts the cost estimates around 3¢/Wdc

- A PE stamped quote from a third party for a 3.37 MWac (about 4.25 MWdc) solar power plant put the price around 4.6¢/Wdc – but that is for a prevailing wage job

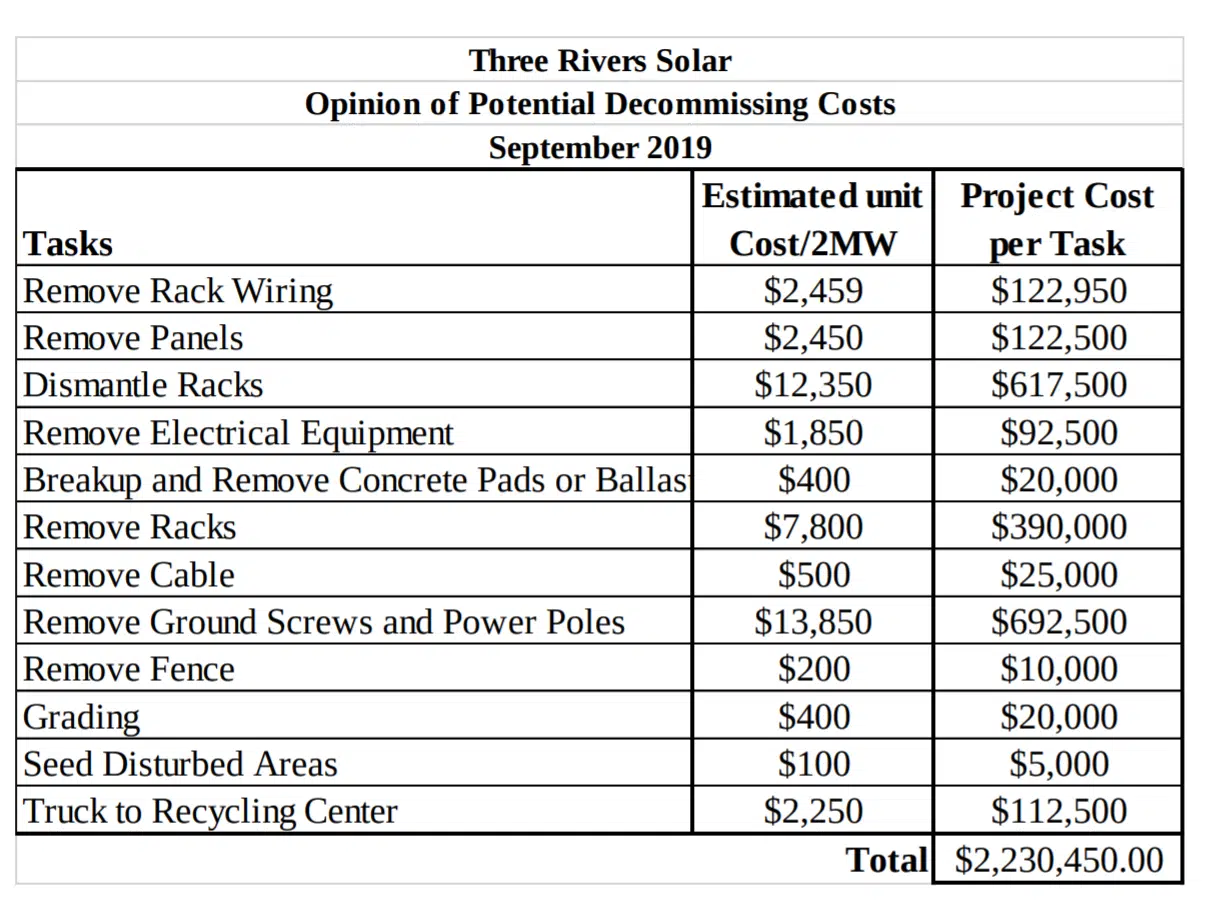

- The 100 MWac/126 MWdc Three Rivers Solar Power Plant in Hancock, Maine put costs at 1.8¢/Wdc. The document notes the Maine model is based on New York and Massachusetts data.

Surety Bond Professionals of Natick, Massachusetts specifically list Solar Decommissioning Bonds as a product of theirs. Matt Leskanic spoke with CommercialSolarGuy about some of the nuances of getting a bond – one of those being that first time developers are going to have to work a little bit harder:

We look at the strength of the developer, to make sure they’re going to be around to remove these solar power systems – otherwise the surety company becomes obligated to do so. A lot of sureties just won’t touch it if it’s the first solar project. It’s a truth that side gig solar people are tougher to bond.

Roughly speaking, as costs vary based on the strength of the company involved, a developer – if they didn’t want to put the whole $287,798 down up front – could pay an annual premium rate of between 1.5-2.5% of the total removal cost.

With a collection of 3 tons of discarded photovoltaic panels in Panama, PV CYCLE achieved the first intercontinental pick-up. Through the global membership program, we provide PV CYCLE services worldwide. pic.twitter.com/eMeEn2JbBs

— PV CYCLE (@PVCYCLEonline) May 7, 2019

Europe recently opened their first solar panel recycling facility, located in France. The facility can handle 1,800 tons of material per year, with plans to scale to 4,000 tons. This factory size is aligned with the projected needs of the continent as a whole.

The factory owner, Veolia, notes a 95% material recovery rate. First the plant separates the materials, then:

Materials are redirected to various industrial sectors: the glass, 2/3 recovered as clean cullet is used in the glass-making sector, the framework in an aluminium refinery, plastic as recycled fuel in cement works, and silicon in precious metal sectors. And as for the cables and connectors, they are crushed and sold in the form of copper shot.

Old solar modules are worth money of course. Recently, modules scheduled for recycling were stolen and sent to Africa to be used by locals. The logic is that it isn’t relevant that the module is only at 80-85% of its original output – since for the new buyer, it still makes electricity. And research suggests that once modules hit that 80% range after a few decades in the field, they tend to stick near that range – meaning 80% output for a few more decades.