The Clean Power Hour – a weekly clean energy headline review and commentary podcast run by Tim Montague, and yours truly – the CommercialSolarGuy – John Fitzgerald Weaver.

First of course, here’s the podcast – Episode 26.

Now, to the news!

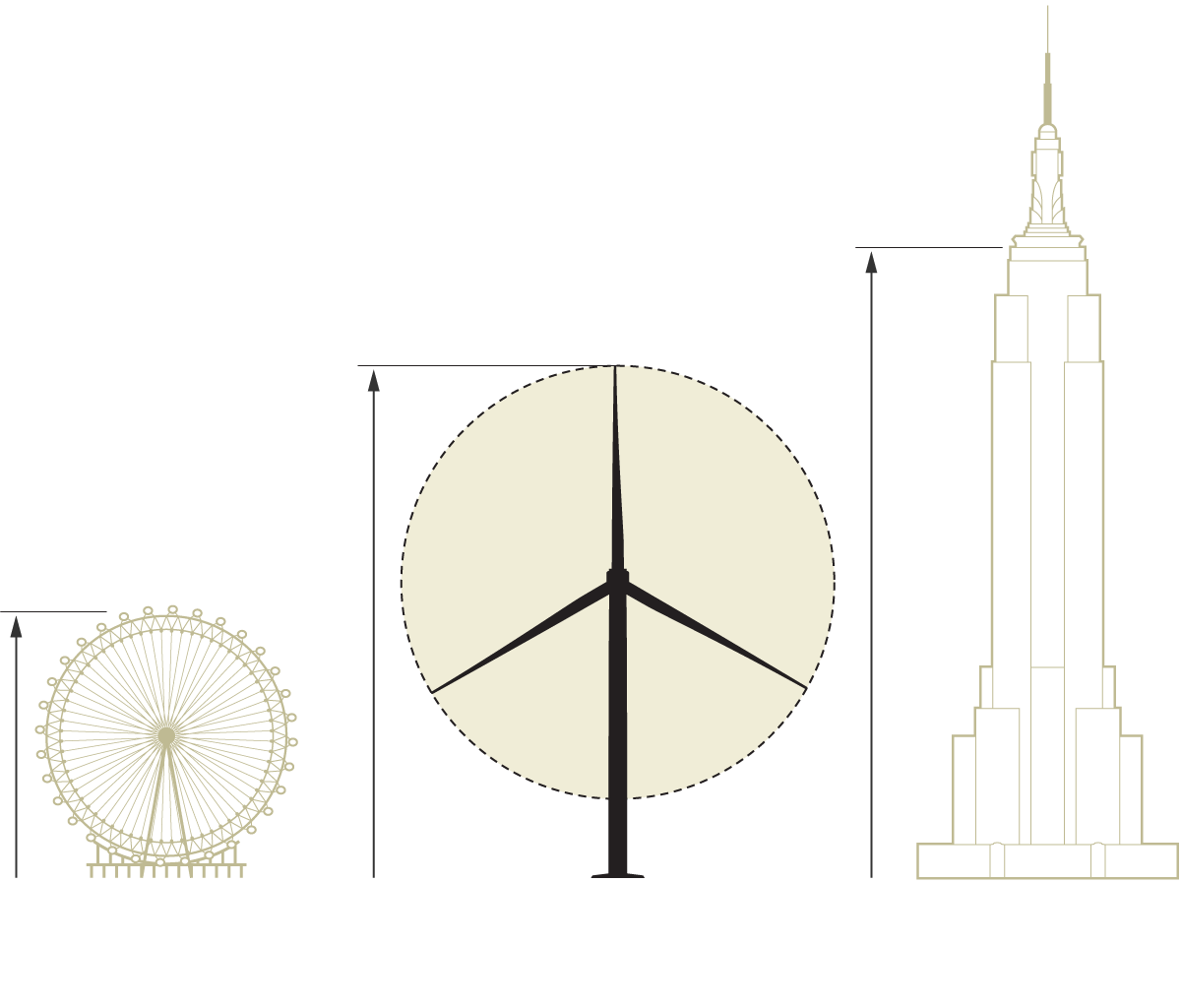

The new GE offshore wind turbine platform is huge – the NYTimes artiles here covered their 13 MW unit. Since then, they signed their first contract with the 14 MW unit. They’re using the same hardware – same blade length, and same nacelle size – to go from 12 ro at least 14 MW now, and more coming! Platform is called, ‘Haliade-X’. Personally, I think offshore wind power is going to dominate electricity generation globally. There’s enough wind that we could have floating cities of wind turbines that power the whole world using small areas of the open ocean.

The G.E. machines will have a generating capacity that would have been almost unimaginable a decade ago. A single one will be able to turn out 13 megawatts of power, enough to light up a town of roughly 12,000 homes. Source

Hitting Elon Musk’s 2014 prediction that Tesla’s will deliver 500,000 cars by 2020, has made him the wealthiest person in the world per the standard measures – somewhere near $200 billion. Of course, Tesla isn’t only a ‘car’ company – they’re an energy storage company, who has a niche solar product as well. And they’re a lifestyle.

In 2020, we produced and delivered half a million vehicles, in line with our most recent guidance. In addition, Model Y production in Shanghai has begun, with deliveries expected to begin shortly. Source

The world’s largest lithium ion battery has come online in San Francisco – 300 MW/1,200 MWh. The facility is five times larger than the world’s second largest battery in San Diego. Coolest part is that it’s going to possibly grow 5X it’s current size! On the show though

…recorded on December 19, 2020, most of the 3 MWh Megapacks were already installed on the concrete slabs. In total, there will be 256 Tesla Megapacks (on 33 concrete slabs), ready for launch in early 2021 with full commercial operation expected in Q2 2021. AEMO’s South Australian Electricity Report for the financial year 2019/2020, released in November, attributed 42.9% of the 59.6% renewable penetration in South Australia to wind generation, and 15.7% to solar generation (11.6% rooftop). Source

“UK installs 5 MW ultracapacitor as ‘sonar’ to detect power grid inertia” – don’t know exactly how this works, but super interested in ultra capacitors. Wonder where they’ll get used in the long game.

That aim will lead the system operator to deploy the world’s largest grid-applied ultracapacitor, rated at 5 MW, for ‘sonar-style’ detection of power system inertia. Grid tech provider Reactive Technologies has been tasked with deploying its GridMetrix measurement service to accurately determine power system inertia. Source

A report that I covered last week had the below chart noting that there were ~370,000 solar installation in the USA in 2019. Knowing the 2020 growth numbers, and projecting some numbers for 2021 – we could see 500,000 installations, and 3,000,000 total power plants before the end of 2021.

At the end of 2019, @BerkeleyLabEMP estimated there were 2,363,054 distributed solar power plants in the United States – with just over 374,000 added in 2019. 400k in '20?

Infinity years for first million in 2016, 2 million late '18/early '19, and we'll break 3 million in 2021. pic.twitter.com/8l0a7qbUqi

— Commercial Solar Guy (@SolarInMASS) January 4, 2021

And speaking of the report, on this website we did a two article covering of Berkeley report on pricing for solar power projects up to five megawatts AC. Biggest thing noted from the report is the solar pricing decreases have slowed immensely, they’re still going on, and covid and tariffs might be affecting tings

At the highest levels considering pricing, the report notes the lowest 20% of residential systems were priced below $3.10/watt, while the highest 20% were above $4.5o/W. And while residential solar pricing did fall 1%, it was the slowest price decrease in almost 15 years. Pricing remained essentially flat for small non-residential systems, but did fell by 4% for large non-residential systems. Source

And now, onto the podcast!