There is more than enough more money to rebuild the estimated at $5 trillion U.S. power grid into a modern, quick thinking, borderline self aware machine. U.S. GDP in 2019 was just over $21 trillion, and annual electricity costs run in the $400 billion range. Separately, there is a significant amount of capital available to rebuild the nation’s just over 1 TW of electricity geneating capacity.

The question we all hope to be the first to realize is: who will be the groups that best capture this value creation opportunity? A few recent transactions give some examples of the movements.

Southern Sky Renewables – Capstone Partners – Rhode Island

Buying and selling solar projects and portfolios

Nautilus Solar bought a 3.5 MW community solar project in Cranston, Rhode Island, fromISM Solar Development. The project is atop a closed landfill that is a former EPA superfund site. We visited (and took nice pictures of) a landfill project – also located in Rhode Island – built by Southern Sky Renewables and bought by the investment firm Capstone Partners.

On the larger scale, Glidepath sold four Pennsylvania projects totaling 278 MW to Canada’s Grasshopper Solar. Grasshopper will invest $300 million in the facilities. The development fees paid to Glidepath weren’t disclosed, but 10% isn’t out of the question (though possibly strong in the very competitively priced local frack fed electricity market of Pennsylvania). Glidepath also placed 887 MW with an unnamed independent power producer.

In a deal involving dancing, we saw Greenbacker sell two portfolios composed of 3,668 rooftop solar projects totaling 27.6 MW to Spruce Financial. Spruce says they’re the nation’s largest private residential solar asset owner, now with greater than 200 MW of capacity under management. With the transaction, Greenbacker has exited the residential market to focus on the commercial and industrial market.

Buying projects though, that’s triple A ball

Goldman Sachs, via its Alternative Energy Investing Group, has closed on a $275 million joint venture with Andrew Chester via TESLOS Clean Energy. They will develop, construct, own and operate distributed solar power projects for commercial, industrial and municipal customers. Goldman Sachs will combine multiple capital sources to offer tax equity, debt, and sponsor investments from a single financial sponsor.

The company Chester had worked for, Greenskies, was recently purchased by the JLC Infrastructure fund – founded by Earvin Magic Johnson. In the press release, it was noted that Greenskies offers a “fully-integrated development platform that originates, designs, constructs, finances, owns, and operates solar plus storage projects.” While no deal terms were noted, numbers included that Greenskies controls over 100 MW of contracted solar projects to be completed over the next 18 months and a pipeline of more than 500 MW in various stages of development.

The majors not only want to buy the projects, but the machines that make the projects.

That solar will need batteries

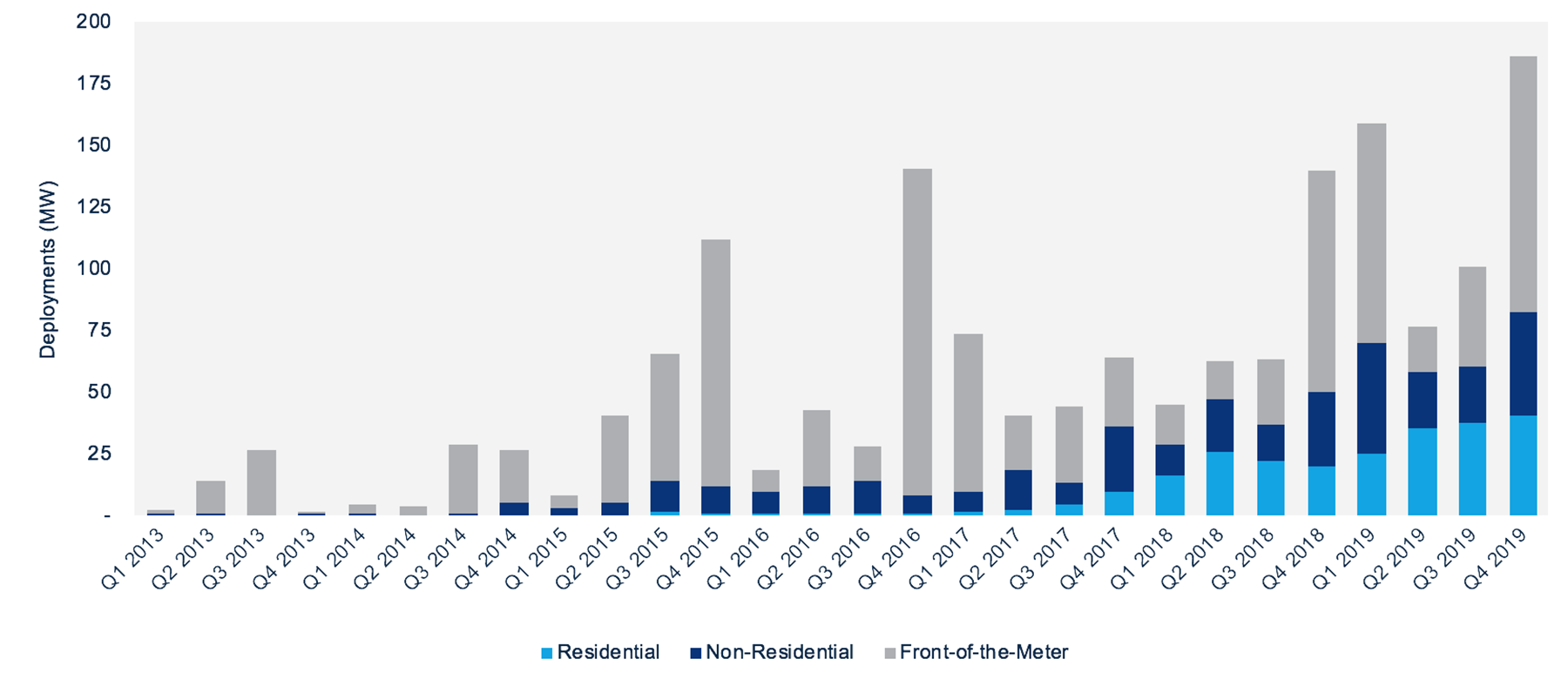

As much as there is an opportunity in wind and solar, there is one in energy storage. Last year, we saw volume deployed break 1 GWh in the United States, with 12X growth projected in the next couple of years. With potential volumes of 5 TWh and larger, electric utilities now regularly seeking hundreds of megawatt hours at a time, and huge cutting edge projects already starting to be signed – hundreds of billions of hardware will be installed that generate decades of revenue.

Projects that Commercial Solar Guy has recently completed construction of or have reached NTP:

- Commercial Solar Guy – 692 kW, Brewster, Massachusetts

- 250 kW, Norfolk, Massachusetts

- 125 kW, New Bedford, Massachusetts