The northeast solar power development pipeline – even after accounting for bumps along the way – is long term strong. But, as the venerable Shrek once said, “Layers. Onions have layers. Solar has layers. Onions have layers. You get it? We both have layers.”

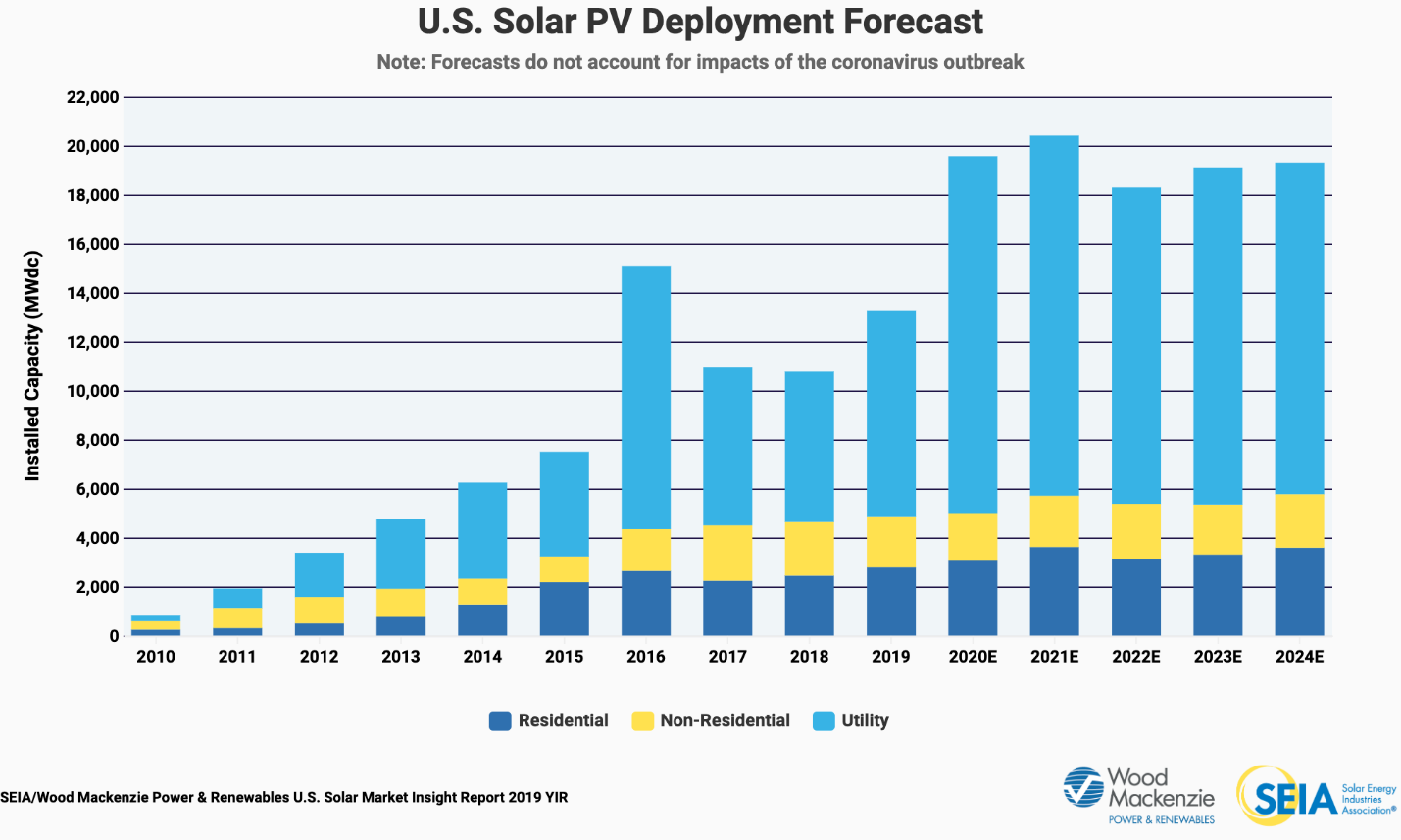

Looking to 2019 on a nationwide basis, SEIA and Wood Mackenzie Renewables and Power, saw 13.3 GW of solar power installed in the U.S. This volume represented 23% growth over 2018’s numbers.

Utility scale solar power totaled 8.4 GW – 63% of the total. More than half of that coming online in the fourth quarter. Residential solar grew to 2.8 MW, roughly 400,000 total systems. However, commercial and industrial solar – building rooftops and smaller than 30 acres of solar – fell by 7%. A lot of this fall was due to the continuing slide of the Massachusetts market.

Overall, 2.6% of all U.S. electricity comes from about 77 GW of solar power installed by the end of the year. Combined with record energy storage deployments and big RFPs coming, there is a healthy long term nationwide industry prognosis.

It’s not exactly cheery everywhere, but its not bad…

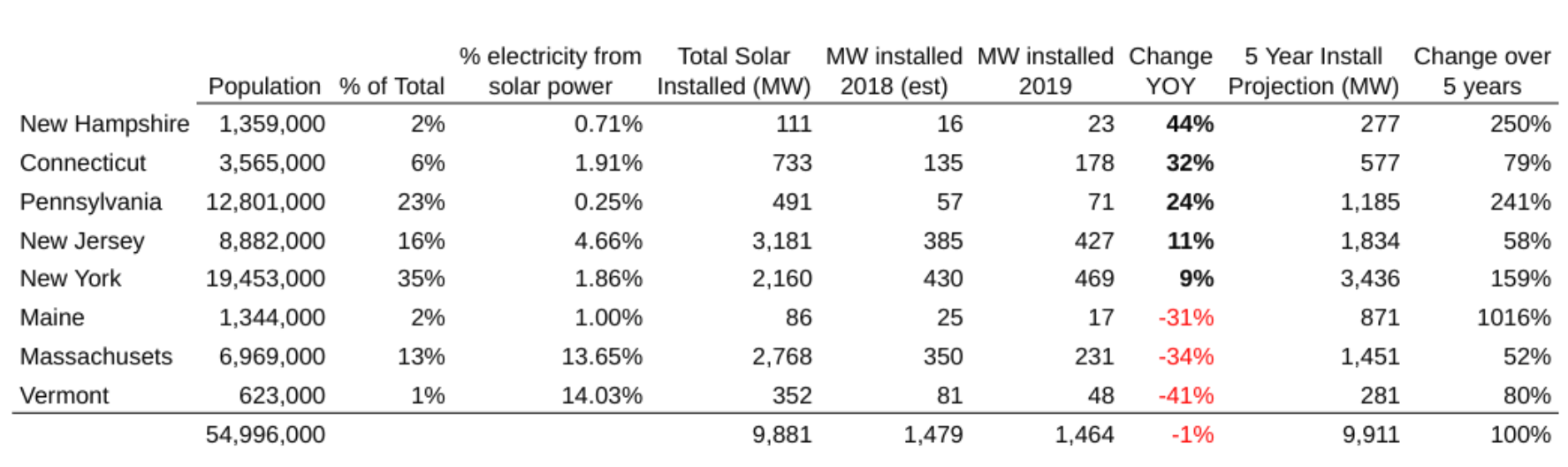

In New England, Connecticut has seen consistent growth hitting about 150 MW last year. As well, New Hampshire did see year over year growth reaching 20 MW installed, after two years of down numbers. Maine and Vermont saw a decrease in volume, installing about 60 MW in total between themselves.

Maine‘s decrease was built on growth in residential and commercial, and pulled back by a slow down in utility. Ongoing right now are a pair of RFPs and community solar solicitations that will lead to greater than 800 MW of projects being installed – which would greatly expand the current 85 MW installed.

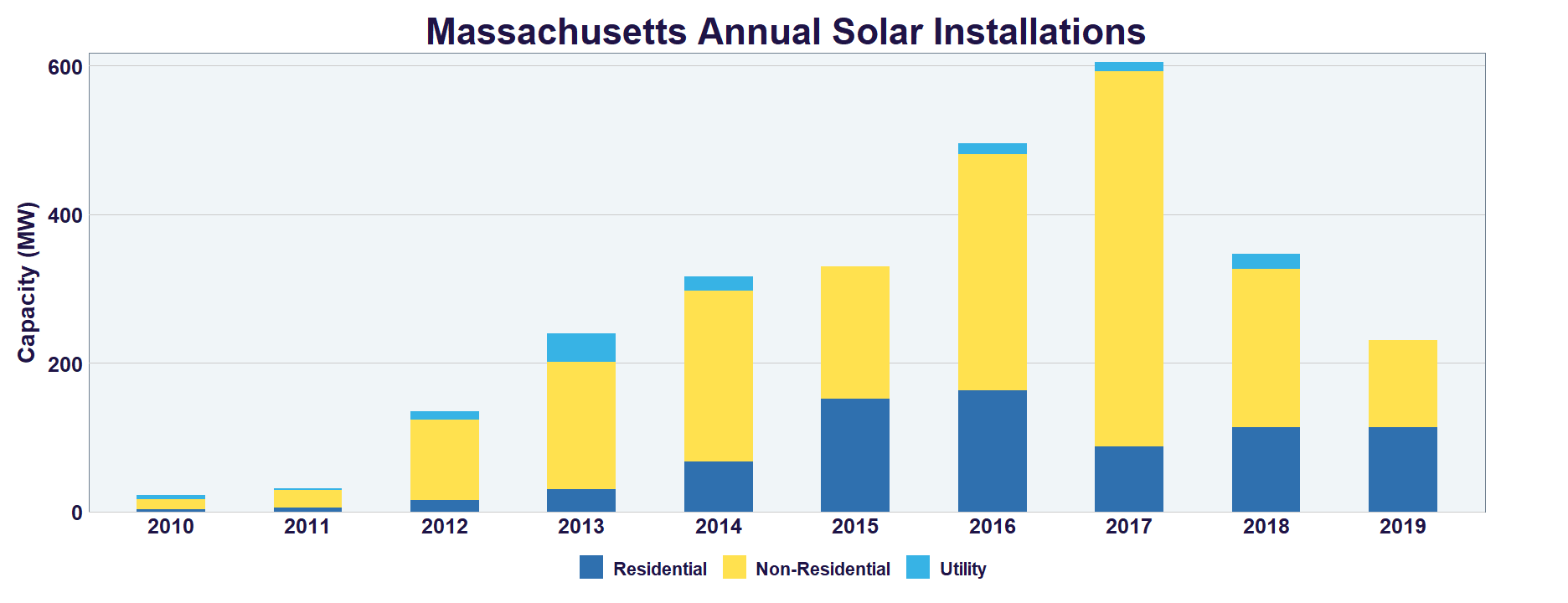

Massachusetts – specifically the commercial and industrial (C&I) sector – has contracted much. It might be that Massachusetts is really just getting back to where it should be, after greater than 1 GW of solar was installed in 2016-2017 as the SREC II program ended. It also is that the state’s major electricity utilities are having issues projecting and managing new solar applications for these larger projects. They had more than 1 GW+ stuck in queues at one point – a value greater than has been installed in a single year in the state.

The state is getting a massive amount of electricity – almost 14% – from its 2.7 GW of installed solar. As well, it is looking to nearly double that total volume in the next few years as SMART projects get installed, and the SMART II extension starts to roll out (this second piece probably not accounted for in the above table). With the residential market humming along and energy storage really starting to grow, the long term – even with today’s solar coaster dipping low – is still looking solid.

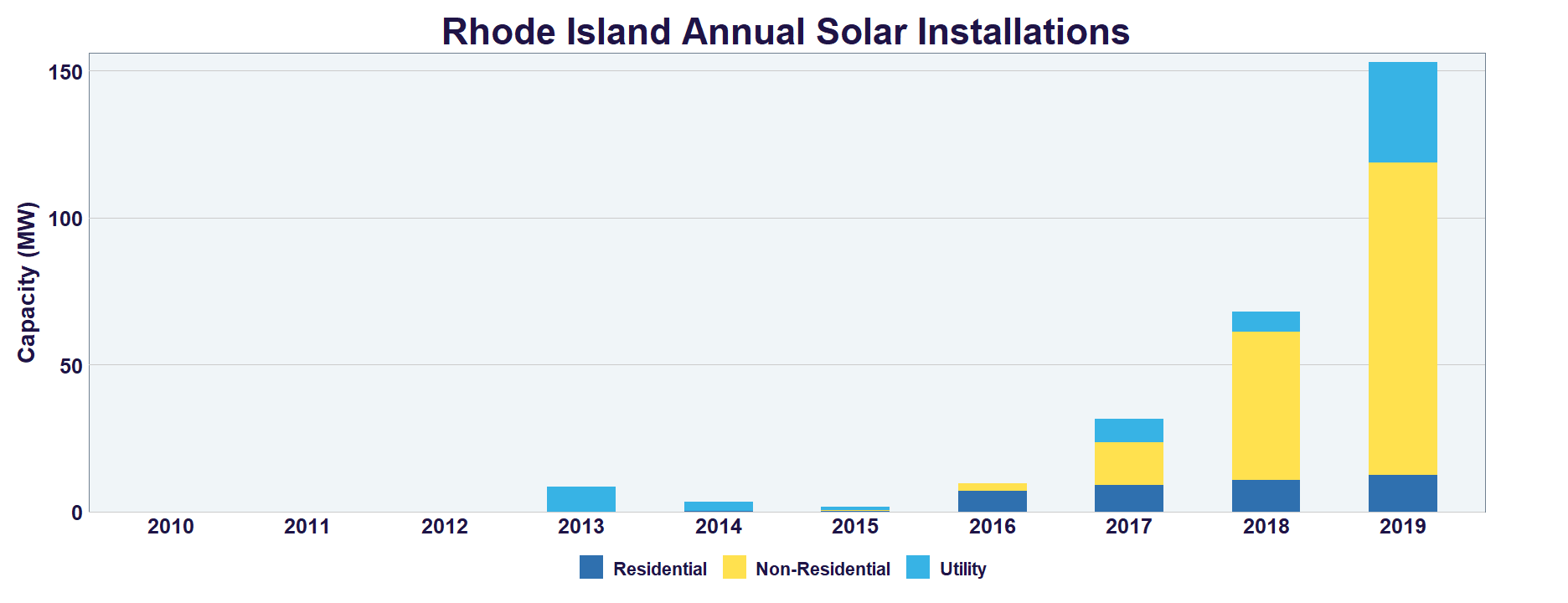

Neighboring Rhode Island is going great. Notice the commercial-sized chunk expanding. The state offers a respectable feed in tariff, but makes you bid on it – so it slows the machine down a bit. The grid is starting to get crowded, large ground mounts are getting neighboring pushback, and there are a *lot* of older structures that add to the structural complexity – but the evidence is clear.

The solar powered future of 40 million people

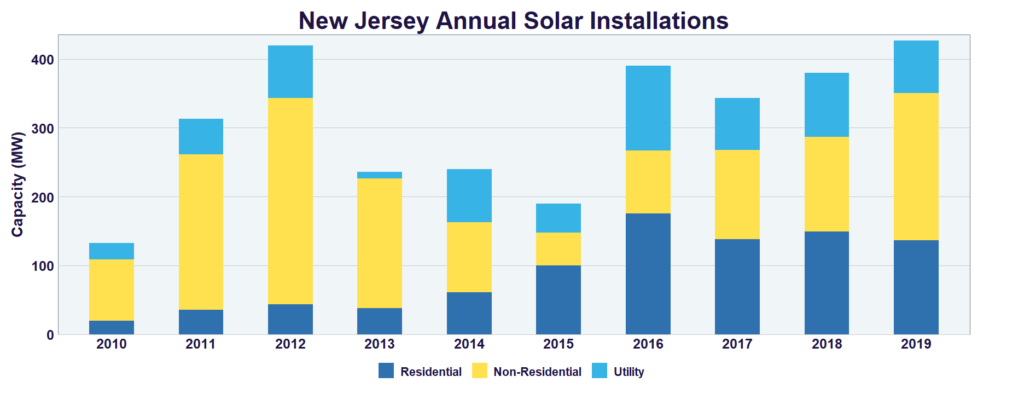

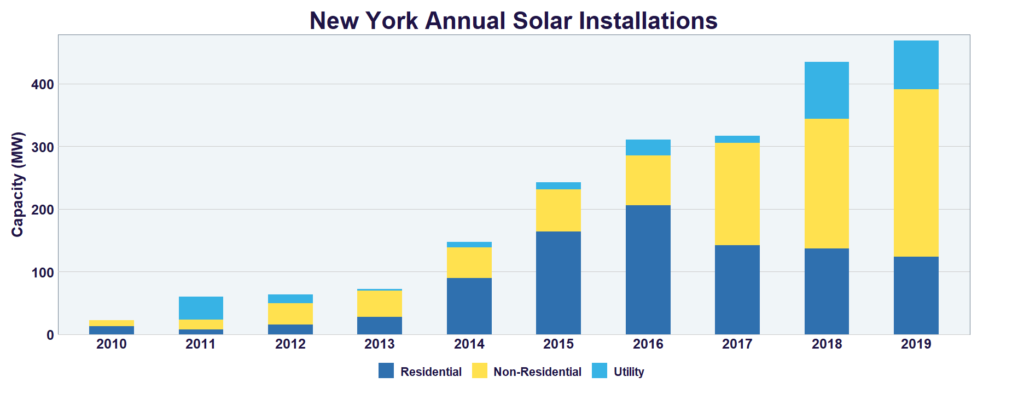

New York and New Jersey installed similar amounts – over 400 MW each – and averaged about 10% growth. Going forward, both have programs that will drive their own respective volumes strongly. For instance, New York just signed up a gigawatt of large scale solar projects (we’re going to cover this in detail later), and they’re going to do it every single year. The state also has plans to deploy many gigawatts of community and small scale solar going forward.

New Jersey really ought be looked at as some sort of example as they’ve managed to hold onto a relatively consistent solar industry for a long time. They did have some post SREC blues after being a national leader for a few years. Recently, the state has signed 100% clean energy legislation, had a pilot community solar program that chose 77 MW of projects, and is seeking large batteries.

And why is Pennsylvania included here? The very large state gets about one quarter of one percent of its electricity direct from the sun. It’s because they now have an instate SREC market, they have future political potential, well priced labor and land – and deals like this being signed. Commercial Solar Guy, as well, is in the state. We’re developing our first piece of land there – 6.5 MW of solar power is our aim.

Looking longer

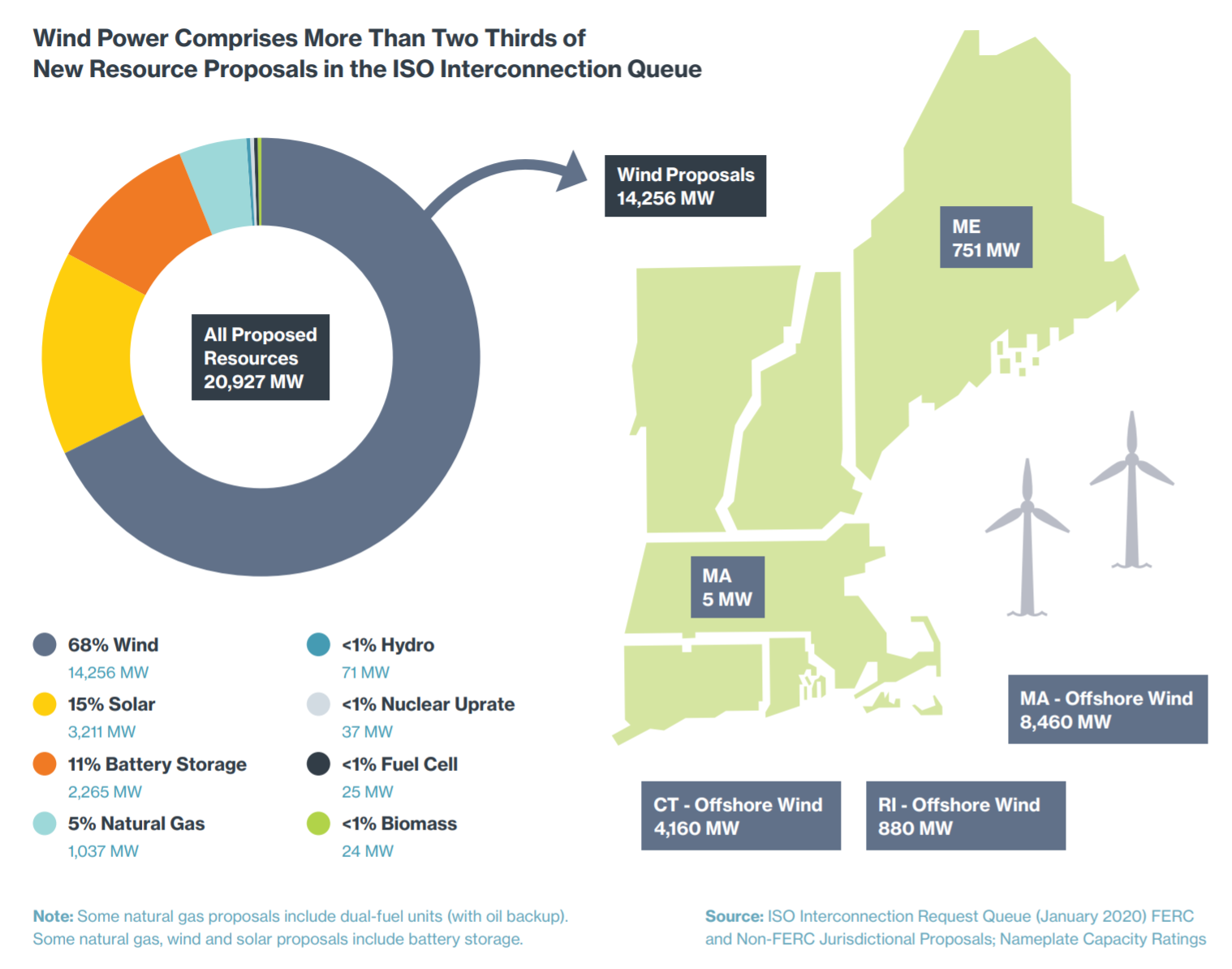

The whole region exhibits political support of clean energy. New Jersey and New York have 100% clean electricity goals. Massachusetts has solid solar power and energy storage incentives. Vermont, New Hampshire, and Maine already have relatively clean electricity – but are aiming for more. Connecticut just signed long term agreements for 45% of its electricity coming from CO2 free sources. And even little Rhode Island is in on some of the nation’s largest offshore wind procurements.

Future utility scale procurement in all of those states (minus Pennsylvania just yet), is dominated by clean energy sources. New England is 95% clean, New York and New Jersey will be soon enough.

With variables like these 100% renewable and clean energy requirements, falling prices of offshore wind and energy storage, as well electric cars coming on hard – one can confidently state that renewables will march on. That macro view is nice and easy when you combine wind, solar, batteries, multiple states, and multiple markets (residential, C&I and utility) – because even though anyone of them might go topsy turvy, there’s a broad set of markets to spread your risk across.

Commercial Solar Guy is starting a residential solar company focused specifically on Eversource territory in the southeast of Massachusetts. The SMART incentive is still going on strong, interconnection is fast, and a small company like ours can make ends meet with a single installation a week.

Our Construction Supervisor License (CSL) means we will sign the contract with the customer, and then start the interconnection process. Here we solicit an engineering firm for electrical and structural designs. We then submit this to the utility, along with the Interconnection Service Agreement. Upon approval from Eversource, we apply for the SMART program. This locks in the long term energy contract with the utility and the state. Last of the paperwork is that we submit permits and order hardware. After a few weeks – and often more – of shuffling documents, the project is now ready to be built.

On the day of construction, a pallet or two will show up at the customer’s house. This pallet will have the gear. Commercial Solar Guy’s Project Management team will support a local electrical crew as they install the solar panels, inverters, racking, wiring, and meters. The lion’s share of the site will be complete in a day. Inspections and sign offs follow. Then we report the work to the utility and the state.

The logic is that we’ll continue to develop the large, higher paying commercial and industrial projects – but we’ll be patient with this arm of the business. We recently signed a commercial deal we started working in 2015. The constant flow of the smaller residential projects (along with consulting, and other revenue generation) will pay our monthly bills though.

Here’s a residential system we built in 2015 in Florida: