It’s no longer a question of if lithium ion batteries will change the power grid. The question is: Can the manufacturers of the world keep up with the demand, and how big will the changes will be?

On July 10, 2020, a U.S. court dismissed a lawsuit put forth by electric utilities – and others – who wished to take over a chunk of the rule making process of energy storage compensation. The court chose to keep that power with the Federal Energy Regulatory Commission and its newly created Order 841.

Some of the guidance put forth by Order 481 states that grid managers must:

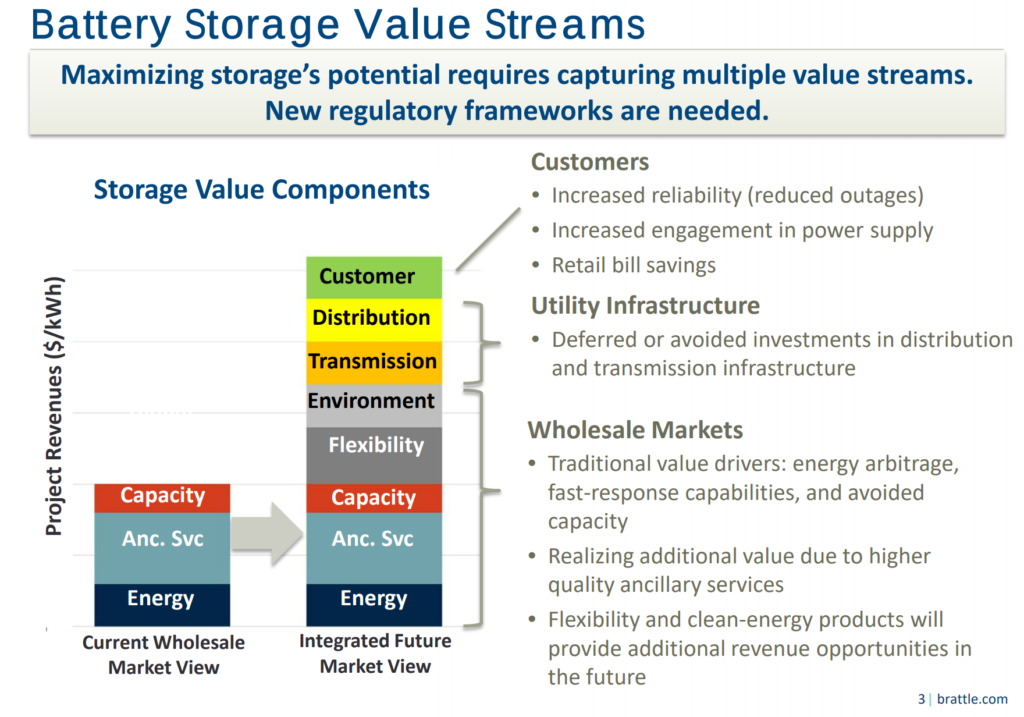

- Ensure participating resources are eligible to provide all capacity, energy, and ancillary services the resource is technically capable to provide

- Execute all storage wholesale transactions at locational marginal price

- Ensure resource can be dispatched and set wholesale prices

- Recognize physical and operational characteristics of storage

- Establish a minimum size requirement that does not exceed 100 kW

- Allow storage to de-rate capacity to meet minimum run-time requirements

That the rule states these regional grid managers are to set and implement policies means entire regions will have consistent business rules. It is suggested that these large markets, as well the rules in the list above, will set a path that investors will jump onto.

A 2018 report by the Brattle Group suggested that the US energy storage market could reach 50 GW of power capacity installed by 2030 if batteries could get to $350/kWh, and the FERC 841 rules were implemented. The report suggests somewhere around half of the 50 GW would be due FERC 841.

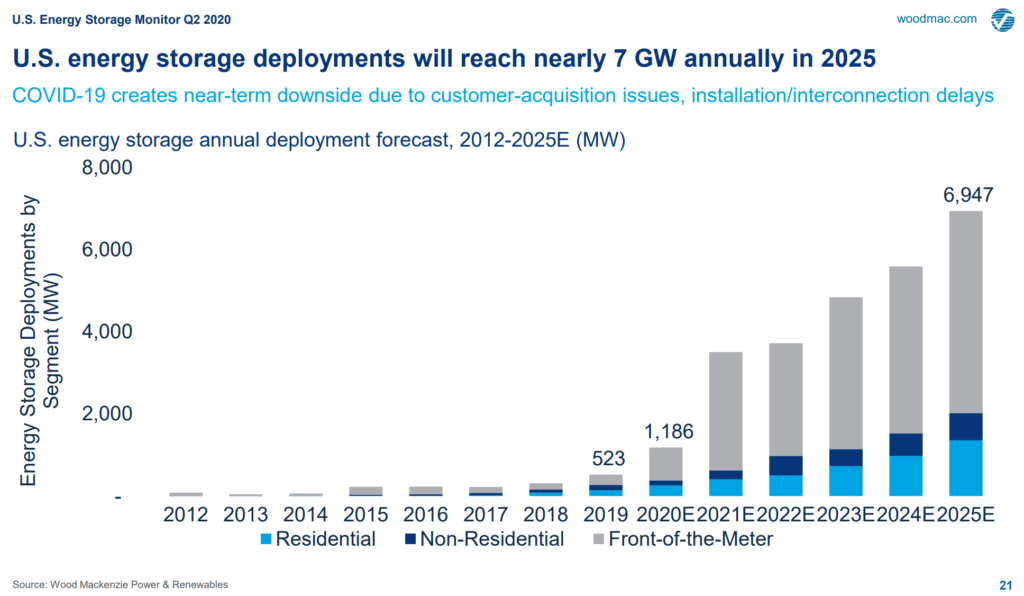

Wood Mackenzie Renewable & Power sees energy storage pricing ranging from $260 to $140/kWh right now, and $160-100/kWh by 2022. This report suggests annual volume deployed will increase 13X from last year’s 513 MW to 2025’s 7 GW. If we followed MoodMacs lead here, we’ll hit the 50 GW number somewhere in 2027.

A significant seeming piece of this ruling is the minimum project size requirements – no greater than 100 kWac. A single residential energy storage project might only be 5-15 kW, but that’s no reason to assume small scale energy storage can’t be a big part of the grid if the projects are managed centrally as one.

Electric utility Green Mountain Power of Vermont has started a program where they subsidize a Tesla Powerwall installation in a private home. The homeowner gets peace of mind and a battery in case the grid goes down, but the rest of the time the electricity utility makes use of the battery to manage its power grid. A 2018 heatwave saw the batteries save the utility $500,000 in one day by chopping off the most expensive electricity. A similar event in 2019 saved about double that amount.

There’s no way yet to earn money from FERC 841 as the rules haven’t been put in place yet, but if there were some advice I’d give it’d be to start installing batteries today – get some training – because tomorrow there’s going to be a lot of work.