China Photovoltaic Industry Association’s (CPIA) roadmap for Chinese solar industry sees exponential manufacturing growth across the industrial chain

The country will increase the production of polysilicon, wafers, cells and modules by around 50% this year

The industry employed 3.53 million people in 2022, and the numbers will likely grow to between 4.875 million and 5.808 million by 2025

solar module manufacturers are gearing up to deliver more than 750 GW of modules in 2024, representing over 50% annual growth over the 499 GW they delivered in 2023

manufacturing industry produce 820 GW of solar cells, up from the 545 GW in 2023

Silicon wafer output is also expected to exceed 935 GW this year considering the expansion plans of leading companies in the space. Last year, the country rolled out close to 622 GW, having gone up 67.5% YoY

delivering 1.43 million tons of polysilicon last year with a 67% annual increase, China is looking at over 2.1 million tons this year

forecasts China to install up to 220 GW AC new PV additions with land constraints and grid capacity as the major challenges, after growing to 216.30 GW AC in 2023

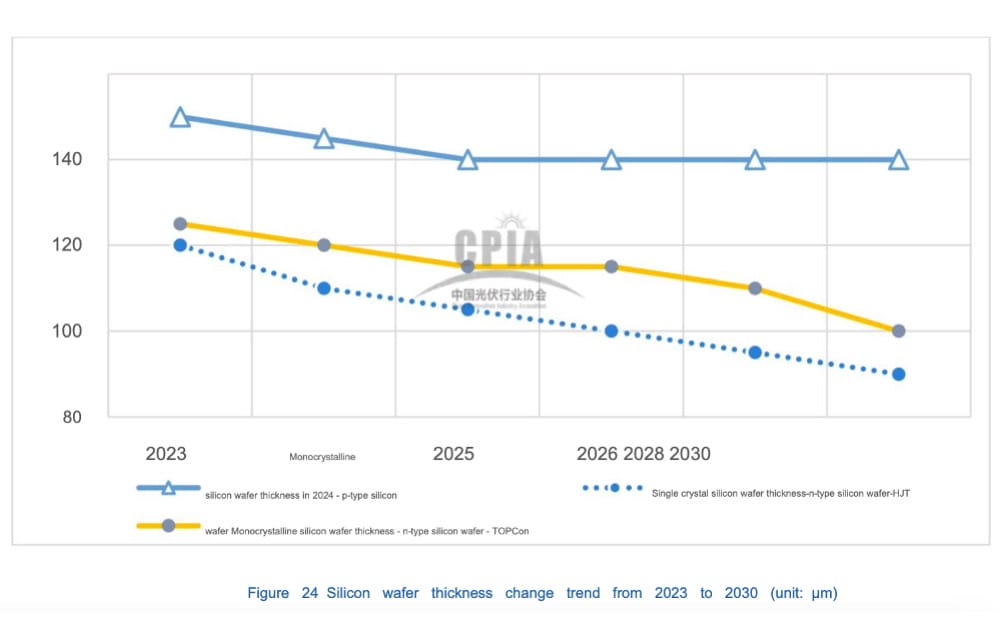

average thickness of polysilicon wafers in 2023 was 170 μm. While the CPIA does not see any change to this value this year, it believes it can change in the later years

Installed close to 22.6 GW of new domestic energy storage capacity with an average storage time of 2.1 hours.

As regulatory support for storage builds up parallel to technological improvements bringing down its costs, China may exceed 31 GW capacity for this technology in 2025