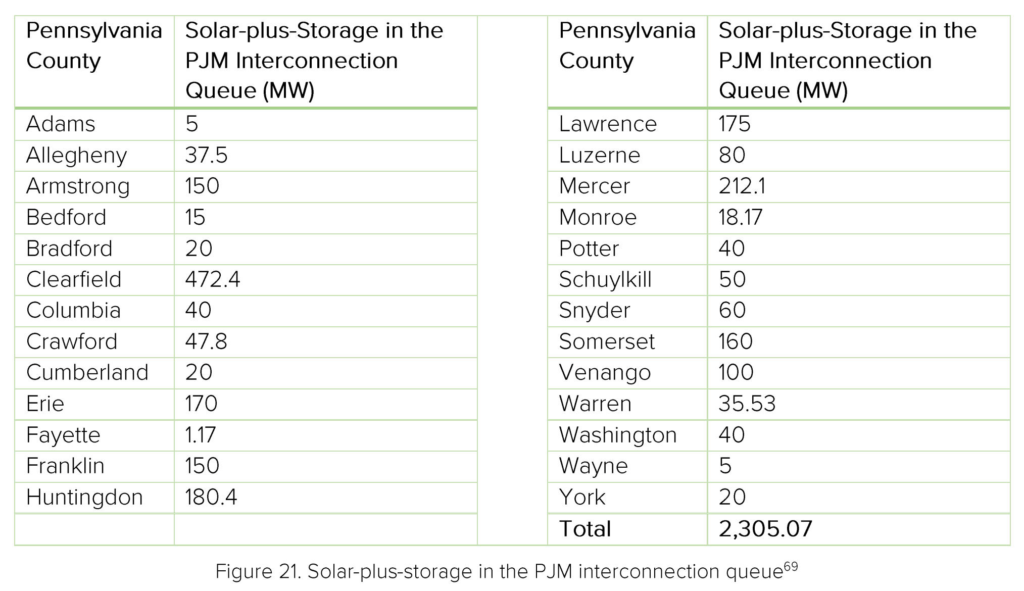

Solar power and energy storage are coming to Pennsylvania in a massive way. As of February 2021, the PJM transmission interconnection queue showed 64 solar-plus-storage projects across 26 Pennsylvania counties, totaling over 2.3 GW/~9.2 GWh.

However, in its current form, the local electricity market’s structure will not support the economics of energy storage.

A new report – Pennsylvania Energy Storage Assessment: Status, Barriers, and Opportunities – offers a promising path forward. The report aims to quantify the financial potentials of energy storage, and identify challenges that may be encountered deploying that storage throughout the state.

The document is just over 100 pages; and contains roughly enough information to put together a college course. With that, obviously we won’t be covering every detail.

In this article we focus on the case studies, located in Chapter 4: Analysis of Energy Storage Potential in Pennsylvania, which analyze the financial benefits of time-matched solar–plus–storage projects.

The report bases its case studies on the state’s goal of reaching 10% of electricity generation from solar power by 2030 – as laid out in the 2018 report: Pennsylvania Solar Future Plan.

An analysis by the College of Agricultural Studies at Penn State University suggested that 1 GW of solar power would drive $2.9 – 4.2 million a year in land lease payments alone, adding $1.8 billion in economic activity per year for the state.

The Solar Future Plan grows the solar deployed volume from 1 GW to 11 GW. Coupled with solar land lease rates which have nearly doubled in recent times, PA land owners will see land lease opportunities totaling $1.7 billion over 25 years.

Jason Kline is CommercialSolarGuy’s Pennsylvania solar land developer. If you’ve interested in solar power – please reach out to him – jason@commercialsolarguy.com.

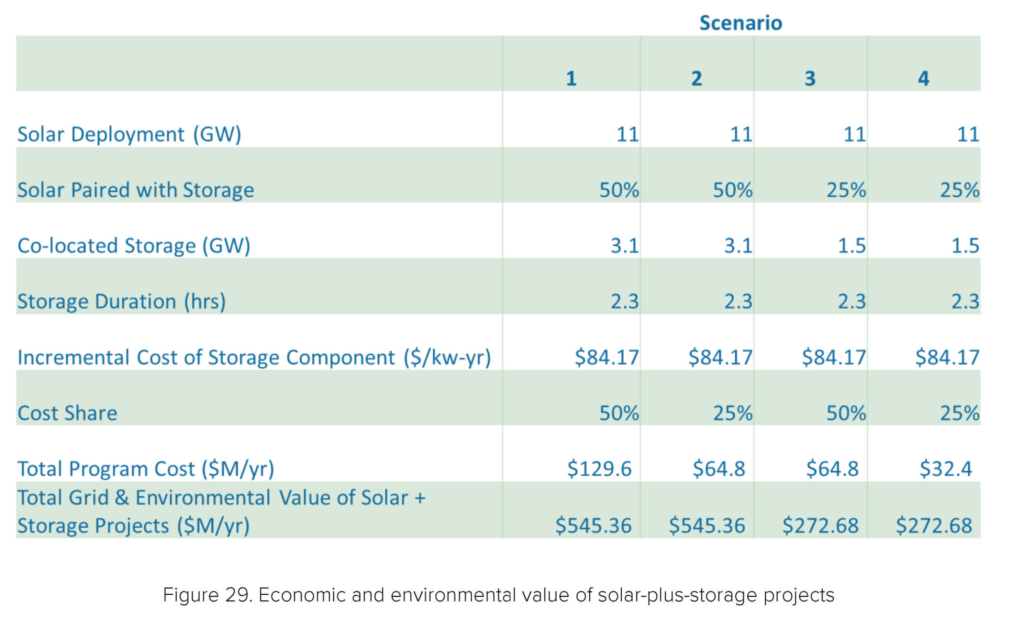

One of the study’s key findings is that combining 25% of the aforementioned 11 GW solar power with 1.5 GW/3.45 GWh battery storage – and $32-64 million of public energy infrastructure investments – would save Pennsylvania energy customers $273 million annually in wholesale energy costs and avoided public health and environmental impacts.

Essentially, the citizens of Pennsylvania could potentially make a 421% to 841% return on their investment. And that’s before we even consider the benefits to local businesses.

Doubling the volume of energy storage – and public support – doubles those financial savings. It’s important to note that these savings go directly to all the ratepayers in the state, not to the businesses or developers that install the solar and energy storage.

And there are additional benefits for the community: fewer doctor visits, less childhood asthma, and less local pollution.Currently, as the authors note, these benefits aren’t recognized, and energy storage owners aren’t compensated for them.

Furthermore, behind the meter (BTM) solar investments in New England saved between$1.76 and $3.2 billion from 2014 through the end of 2019. Most of those savings were passed directly to ratepayers who never invested in solar.

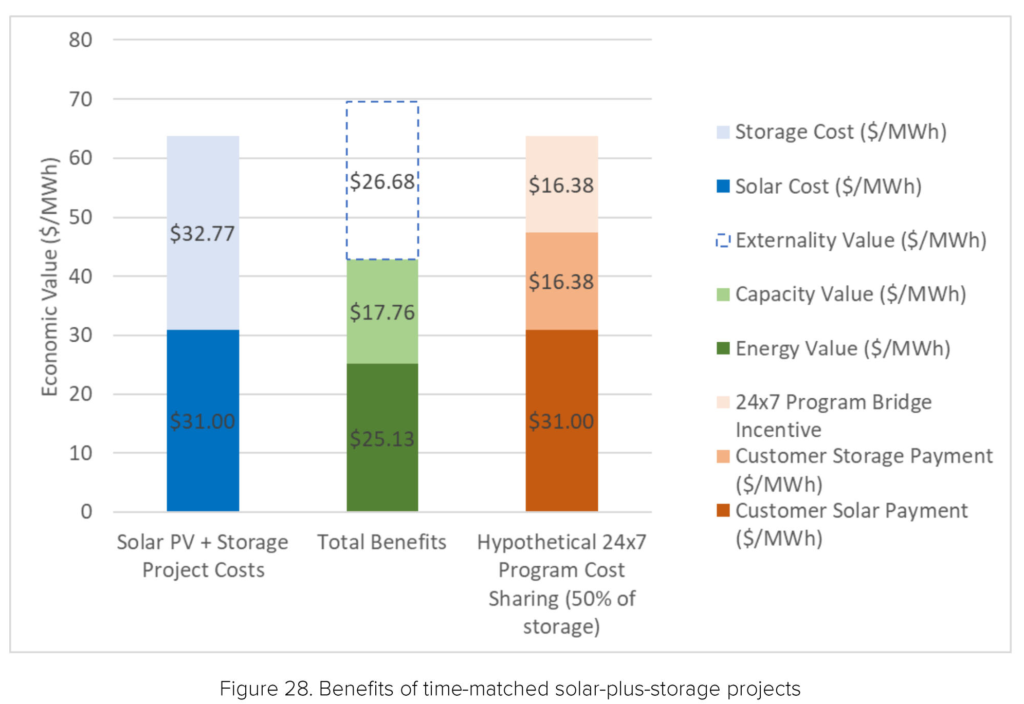

The authors also analyzed how a single energy storage project might pay back – or not – a commercial solar project owner.

Starting with a 2.9 MW/6.7 MWh battery, the authors discovered that the system added a cost of 3.3¢ per kWh to the lifetime cost of the project. This, when coupled with the solar system’s levelized cost of electricity, brought the system’s electricity price to 6.1¢/kWh.

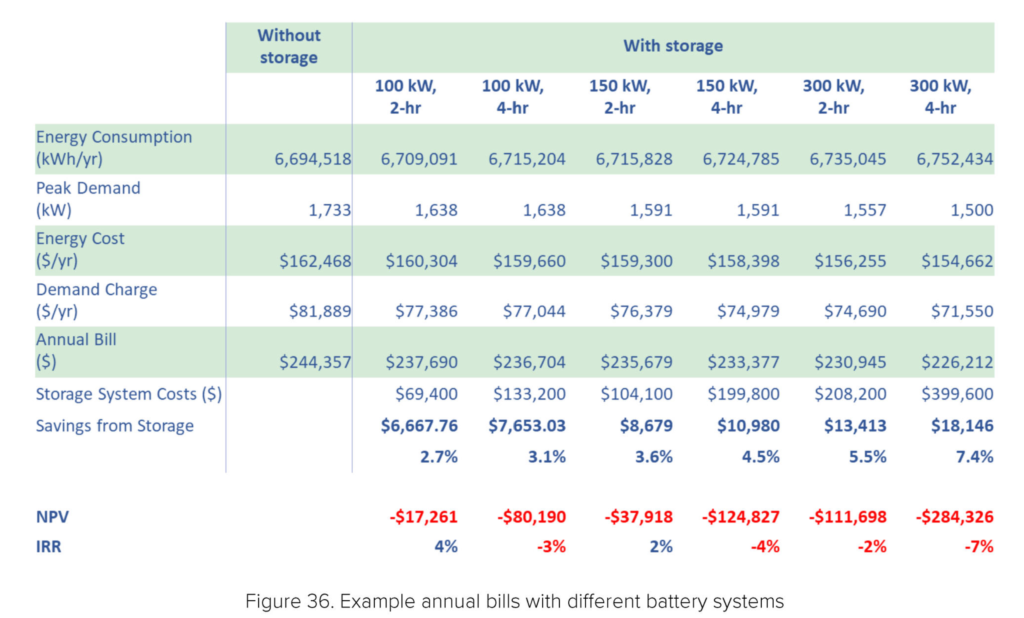

As seen in the chart below, this system would save the business owner money – however – it would not be considered a ‘sound investment’. This is a result of Pennsylvania’s rate design and the current price of energy storage.

Note that these storage systems cost anywhere from $69,400 through $399,600 – with annual savings ranging from almost $7,000 through $18,000. These are paybacks in the middle to late teen years.

Unless we’re buying war bonds or saving massive amounts of cash for our twilight years, this type of investment would not typically be included in a standard investment portfolio. But there are other reasons to install energy storage: business resilience, long term electricity pricing predictability, and the aforementioned externalities of taking care of the earth.

The authors pointed out two additional key pricing sensitivities to consider:

First, if batteries fall in price by 23%, then the smallest system – a 100 kW, 2-hour BTM system – becomes a prudent investment at an 8% IRR. A 34% reduction in battery pricing results in a positive NPV, with the same 8% IRR for a larger 150 kW, 2-hour system.

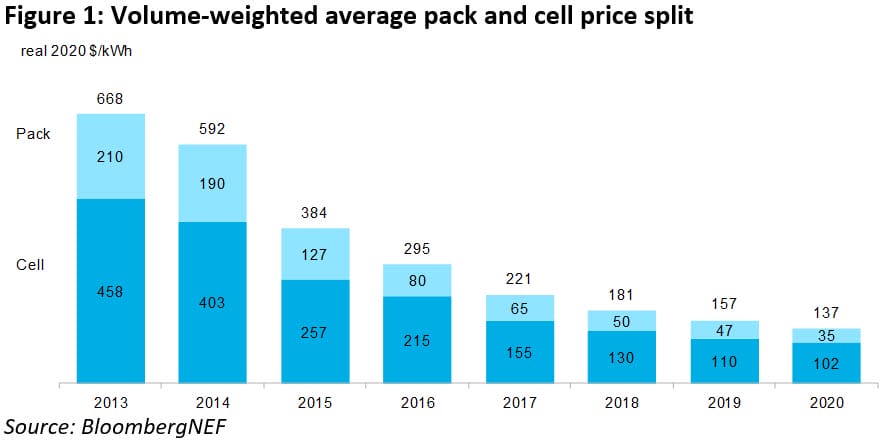

Expect batteries to fall in price by these amounts within two years, much like they have for the past decade.

Second: if demand charges were higher within the state, (specifically, 1.75 times higher), then even the smallest battery would be NPV positive.

This second point leads us to this article’s inevitable conclusion: a list of policy suggestions from the authors. This list will help the state advance energy storage through improved strategies, rate design, R&D, and a few other suggestions that produce a beneficial financial structure.

Barriers to Energy Storage Deployment and Policy Recommendations

The first five recommendations are scheduled for immediate implementation, within the first two years. Suggestions 6-10 are targeted at years two through five. Suggestions 11-14 are long term targets to focus on after five years have passed. The authors’ final recommendation is the immediate, and indefinite support of new technologies via R&D!

- Establish a storage procurement goal or target

- Convene a statewide “Storage Issues Forum”

- Designate public funding to accelerate storage deployment

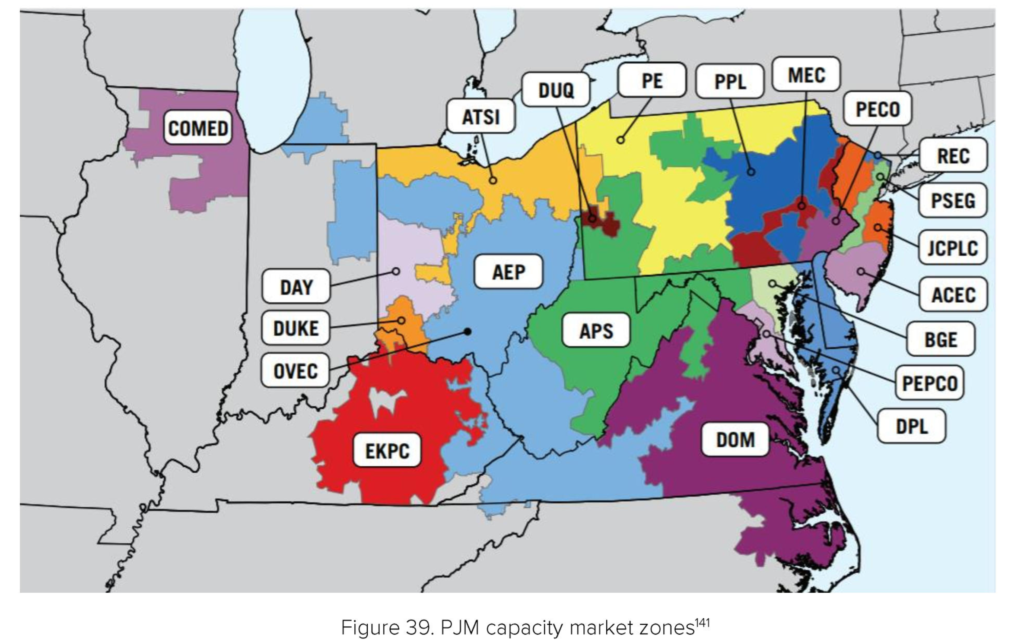

- Seek wholesale market improvements by participating in PJM stakeholder processes

- Consider changes to resource adequacy rules and oversight

- Develop a strategic plan to accelerate microgrid deployment at critical facilities

- Develop a tariff for distribution-connected solar plus storage facilities

- Establish direct incentive programs for storage projects

- Adopt a multiple-use application framework

- Update the interconnection process for distributed energy resources

- Enhance distribution planning and procurement processes

- Enact retail rate reforms.

- Expand retail customer programs.

- Streamline permitting on state and local levels.

- Support research and development of new energy storage technologies.