Japanese solar developer, Blue Power, has built a 24 hour solar plus energy storage power plant that can run for 24 hours a day at 143-1 Hinode, Akaigawa Village, Yoichi District, Hokkaido, Japan. While smaller solar plus storage facilities have been around for a couple of decades, a utility scale project at this large size might be the first of its kind.

With a unique design, and publicly available income characteristics, we’ve been given an opportunity to pick apart the financials to better understand what a 24-7-365 solar powered future might hold.

Per the press release, the solar power plant’s solar inverters – two 500 kW Sungrow units – were downsized to a total of 845 kWac. The plant’s 14,624 solar modules – 410 watt units from Trina Solar – total 6,000 kWdc. This means that the DC to AC ratio, which is solar panel to inverter sizing, is greater than 7:1.

This ratio is the first piece of unique data. In most solar power systems, the ratio of solar panel peak output to peak inverter output is about 1.3 to 1. In some markets, like Massachusetts which has unique payment structures for solar electricity, an increased ratio could be beneficial.

The main reason is called ‘clipping’.

Clipping is a type of electrical loss. When a solar inverter sees that more electricity is coming from solar panels than can be exported to the power grid, it adjusts settings within the panels so that they no longer generate electricity.

Since, historically, solar panels were *very* expensive, clipping would be a major drawback for a project’s return on investment, and was therefore avoided.

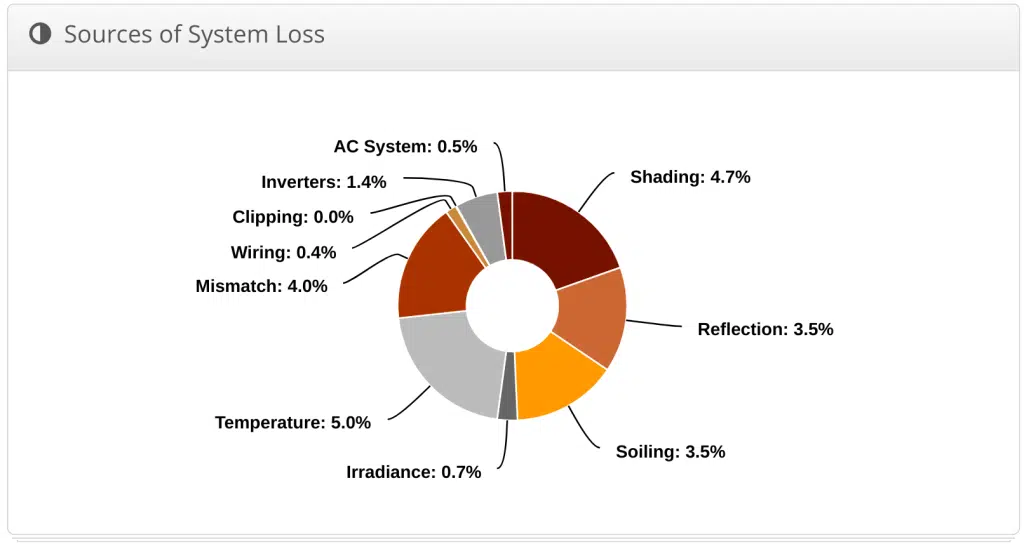

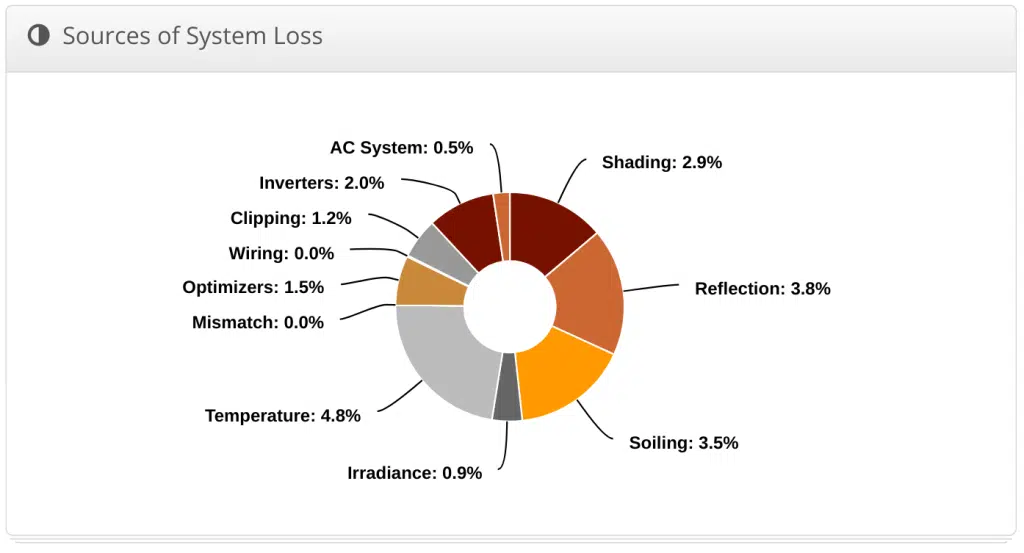

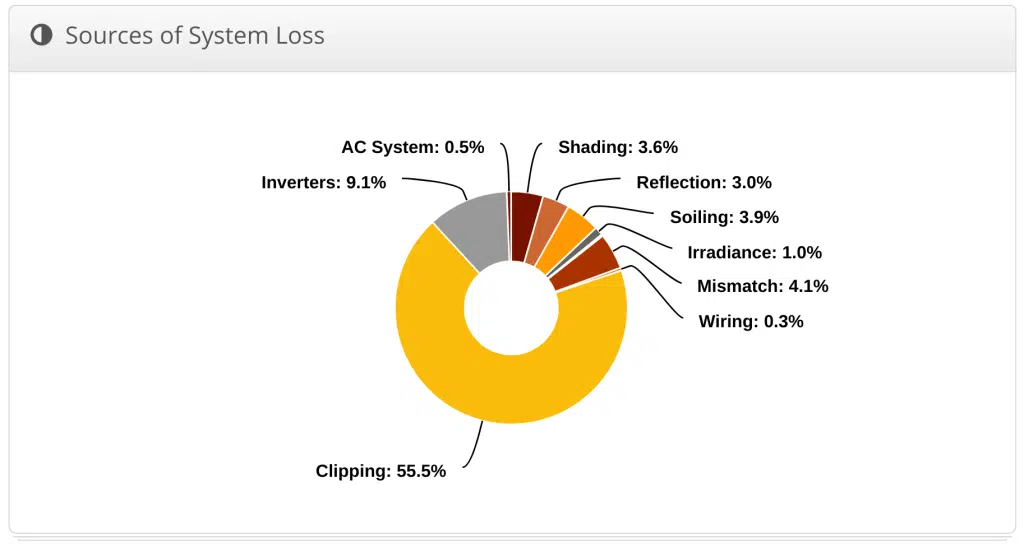

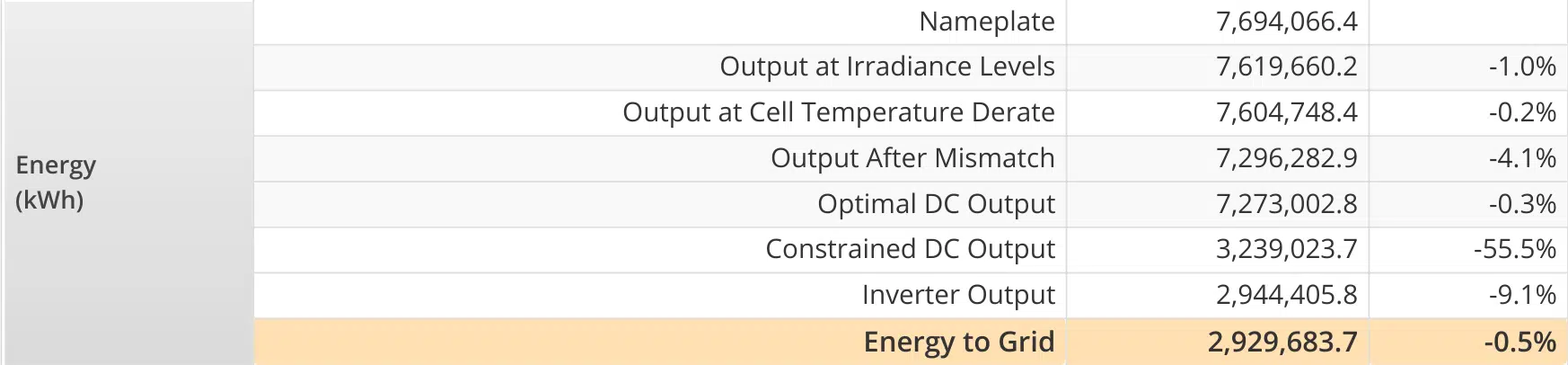

Note the clipping percentages in the above images. The top image is a (nearly) flat roof in Texas, with a DC to AC ratio about 1.2:1. This represents abnormally low clipping, resulting from the flat roof and the relatively low panel to inverter ratio. The middle image shows 1.2% clipping – this number is a touch higher than normal. The bottom image (and also the chart below) – are projections of what happens in an unconventional 24 hour solar power plant like Blue Power has built.

The above chart shows 7.6 million kWh generated by the solar panels, but only 3 million kWh getting to the power grid via the inverter. That’s a lot of wasted clean kWh’s and solar panels.

That’s where the second interesting design piece jumps in. The battery provides 21 MWh of storage capacity and sits behind the same 845 kWac solar inverter. The storage capacity to inverter ratio here is an even greater 24.2 to 1. This means, if the batteries were fully charged – they could output at 100% of the inverter’s capabilities for just over 24 hours.

The nickel manganese cobalt (NMC) batteries with DC-DC power converters and battery management equipment were manufactured by Sungrow, looking a lot like these units (and the image of the actual site at the bottom of this article).

The coupling of those extra batteries with the extra solar electricity that would otherwise have been clipped creates a real world 24-7 solar power plant. Per Sungrow’s press release, the facility will output about 7 million kWh/year at roughly 20¢ each. That’s a site income of $14 million/year.

Image during construction – note the units are planted on top of concrete foundations, with dirt cleared away to allow faster wiring. This will get backfilled after connections are made.

How the money works*

Roughly speaking, the cost of the project can probably be broken down like this*:

- Energy Storage (21 MWh): $400 per kWh installed, total cost of $8,400,000.

- Solar Power (normal portion 845 kWac/1 MWdc): $2 per watt installed, so $2 million

- Extra solar power (5 MWdc): $1 per watt installed, so $5 million more.

- Interconnections and other costs (higher labor?) are likely in the range of a few million.

- Total project cost: ~$16.4 million

Ongoing costs at the site might be:

- Land lease rate – $10,000/acre/year for 20 acres = $200,000/year

- Solar O&M costs at $15/kW/year – $90,000/year

- Energy Storage O&M at $12/kWh/yr -$252,000/year

- Total: ongoing costs of $542,000/year

*Installation costs are much higher in Japan than global numbers. Several million more in costs could easily be added onto this project.

If we finance the solar project 100%, get a 4% interest rate, and a ten year term – that’s a loan payment of about $2 million a year.

So now we’ve got:

- $1.4 million/year revenue

- $2 million/year loan payment

- $542,000/year site costs

- Some sort of downpayment will be needed

Later, CommercialSolarGuy will determine what this system *could* cost – defined as the system’s ‘levelized cost of electricity, versus this math which considers what the site earns.

As a special prize for getting to the end of the article: