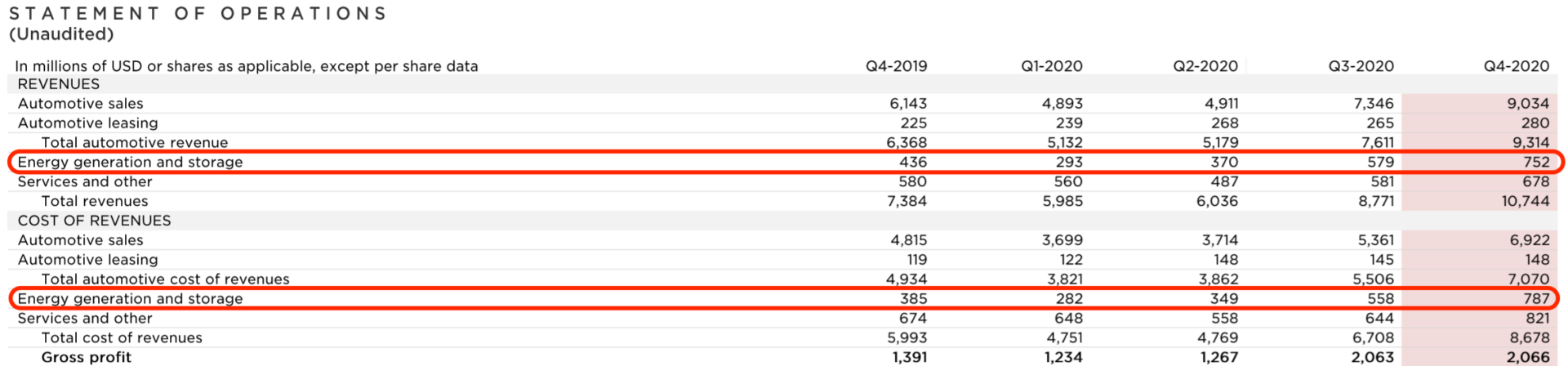

Tesla reported their fourth quarter earnings. The company earned $752 million in revenue from energy generation and storage, but they spent $787 million to earn that.

The company noted during the earnings call that SolarRoof ramp costs were weighing on the energy department profitability.

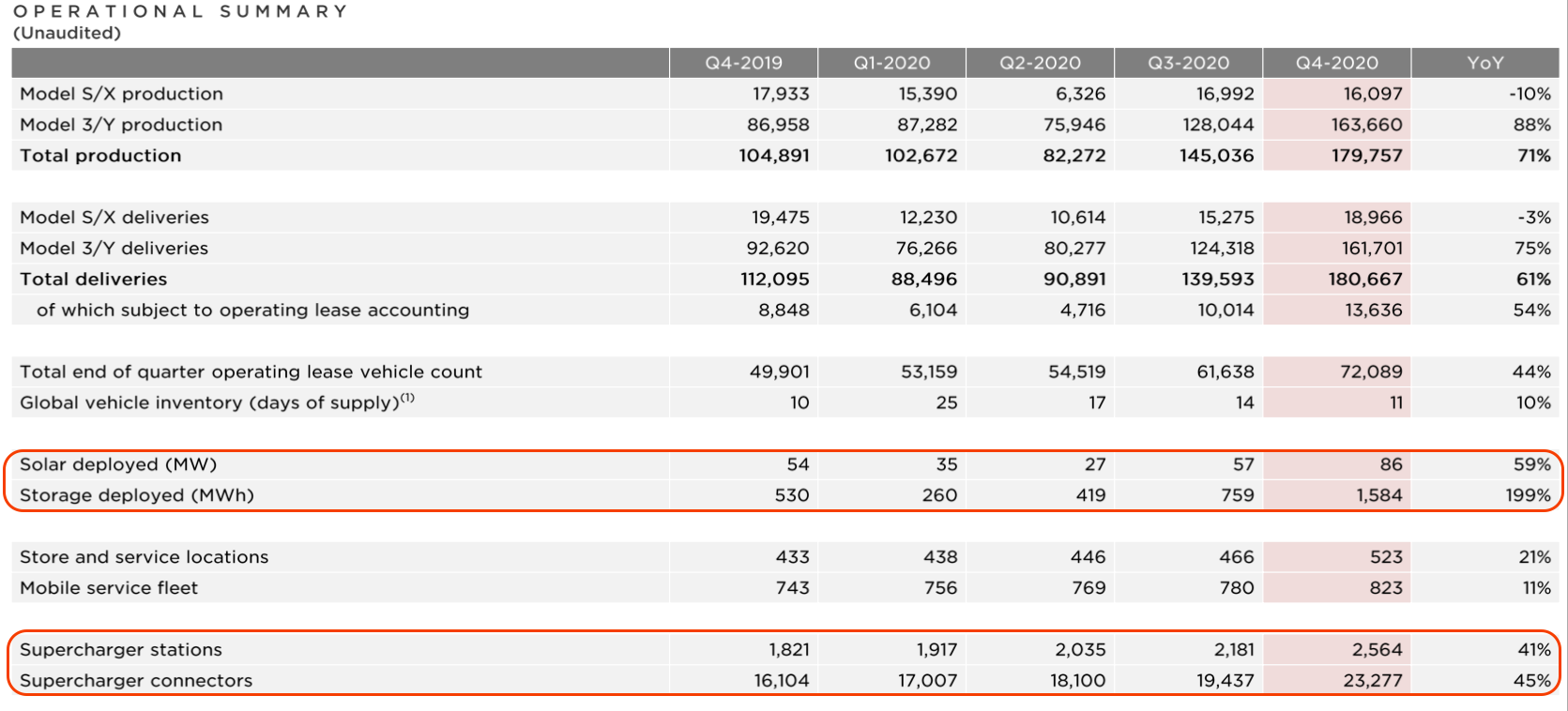

Total energy storage deployment, 3,022 MWh, was up 83% for the whole of 2020 vs 2019. The 4th quarter number 1,584 MWh deployed doubled Q3’20, tripled last year’s Q4 of 530 MWh, and was almost equal to what Tesla’s entire 2019 production of 1,651 MWh.

The company noted that much growth was driven by the popularity and high deployment speed of its utility scale energy storage product “Megapack.”

The company also noted their car charging infrastructure numbers. Supercharger locations increased by 2,181 in the quarter, and actual charging plugs at those stations increased by 19,437. That works out to roughly 21 cars sold per connection added.

Did close to 3,500 miles on a camping trip for holidays in a @Tesla #ModelY.

Car now over 9,300 miles after ~three months of ownership. pic.twitter.com/KCPwD4jEm1

— Commercial Solar Guy (@SolarInMASS) January 1, 2021

Anecdotally, CommercialSolarGuy traveled 3,500 miles over the holidays on a camping trip across the East Coast of the USA. We mostly used Superchargers and had no issues finding electricity.

Starting out the question portion of the earnings call, an investor asked about the slow solar power roll out, and future growth. Tesla noted that significant amounts of attention was being focused on the deployment of the Model 3, and solar power was left behind a bit.

Elon Musk said

“we do actually expect to become the market leader in solar and then go far beyond it…There’s also a tremendous way to go on solar power, although it’s exciting to see the advent of very cost-competitive wind and solar and geothermal. And of course, we need a large volume of stationary battery packs. I mean basically, maybe the three legs of a sustainable energy future are sustainable energy generation, led by solar, wind, geothermal and hydro and a few others.”

There was no explicit data detailing Teslas battery capacity delivered in 2020. A rough estimate adding the nearly 500,000 new cars produced in 2020 (averaging ~80 kWh each) with the 3 GWh of stationary energy storage delivers estimates of roughly 40 GWh of battery cells. The 499,647 vehicles produced in 2020 represent more than double Tesla’s auto production in 2018, when they rightfully boasted about delivering 245,240 vehicles that year. The 2018 production numbers were a significant milestone: Tesla produced nearly as many vehicles in 2018 as it had produced in the company’s entire history.

Tesla has been rapidly upgrading their Fremont Factory to launch a new Model S and Model X, featuring a heat pump for more efficient climate control, an entirely new interior, and updated powertrain components developed for the Model 3 and Model Y. Gigafactory Berlin and Gigafactory Texas will begin delivering vehicles in 2021, while Gigafactory Shanghai continues production and expansion. Officially, 2021 will also bring the first deliveries of Tesla’s Semis, but Musk cautioned, “Semi would use typically 5x the number of cells that [a] car would use, but it would not sell for 5x what a car would sell for. So it kind of doesn’t make — it would not make sense for us to do the Semi right now, but it will absolutely make sense for us to do it as soon as we can address the cell production constraint.”

On Tesla’s Battery Day the company projected a 3,000 GWh/year battery cell manufacturing capacity target – half the amount needed to build 20 million cars, the other half for stationary storage. The company’s 2022 battery cell manufacturing target is 100 GWh, with a goal doubling of capacity to 200 GWh/year by the end of 2022 as multiple factories around the globe complete construction.