Two solar power development companies ought always have some of your energy attention – 8minute Solar Energy and NextEra. For NextEra, we’d want to look more specifically at their Energy Partners subsidiary.

NextEra is one of the world’s most valuable energy companies. Recent headlines had the total value of their stock above Exxon’s. And much like Exxon, the majority of the company’s revenue comes from fossils. As well, much like Exxon they’re quite apt to do what is needed to get things done.

But the energy enemy – who happens to work in the same company down the hall – is my friend today.

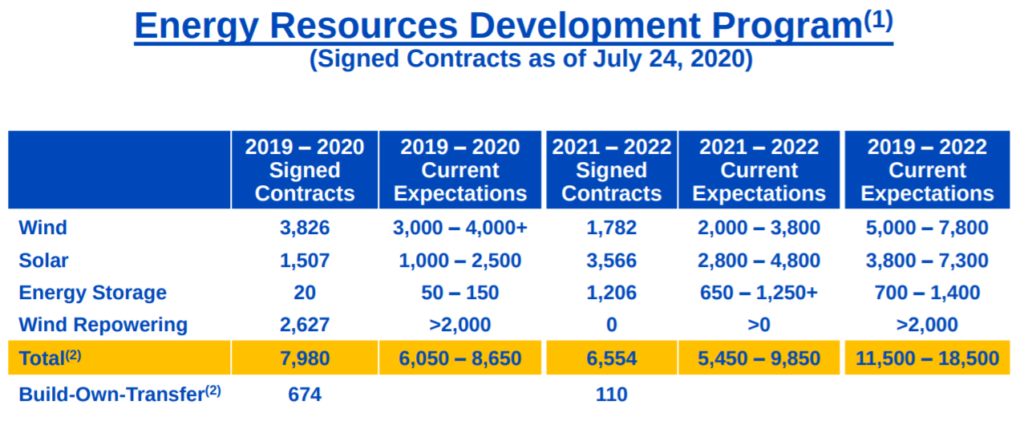

In NextEra’s September 2020 Investor Presentation the company shows off their 2019-2022 current project pipeline expectations. They’re listed as 11.5 GW to 18.5 GW – but knowing NextEra it’ll be closer to 18.5 GW.

Next though, we increase the solar by 140% since NextEra uses AC sizing, versus modules sizing – that’ll bring us to 10 GW. Then we expand the battery number by 400% to represent storage volume deployed – 6.4 GWh. And last, we halve the wind repowering value by 1 GW since that gear is already generating something. That brings the higher end of the pipeline to just over 25 GW.

Last, we add their future pipeline in markets that aren’t as financially viable just yet or are further out than 2022 – noted as greater than 20 GW. That takes us to roughly 45 GW of wind, solar and energy storage that NextEra sees some possibility to sign and deploy.

The company probably has maps and proposals of enough wind and solar capacity to generate 100% of the United States’ needs.

As an author at pv magazine USA, I’ve been able to interview 8minute Solar Energy two times, and both times my consciousness of the depth and breadth of the solar industry broadened. The most recent article involved gas prices in Texas over the next decade– 24 hour solar power plants are on the drawing board, and also – aliens. The first article taught me how in-depth a company goes in order to make sure they’ve got the highest standard product that will consistently produce energy for decades to come.

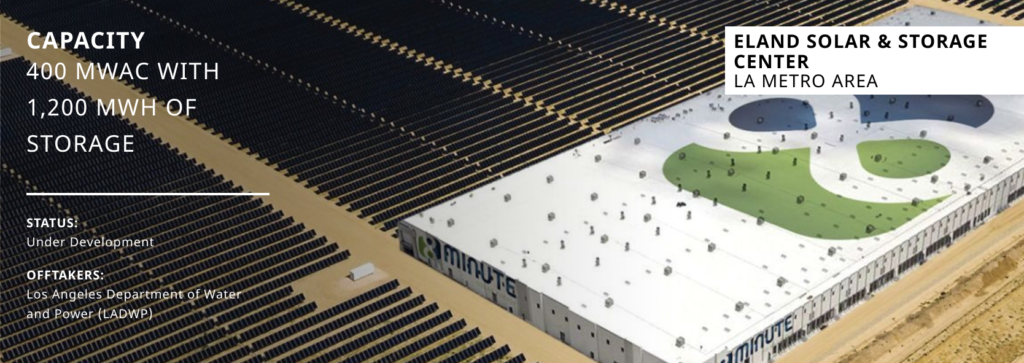

More recently, 8minute made a double headline when they first offered solar electricity for less than 2¢/kWh to Los Angeles – a would be U.S. record. But they made more news as the details of the 400 MWac/700 MWdc solar plus 1.2 GWh energy storage power plant came out– like a 60% (14.4 hours of runtime) interconnection capacity factor and 3.99¢/kWh night time electricity.

Sun’s only up 12 hours…how’d they get to 14.4 hours? Read the articles.

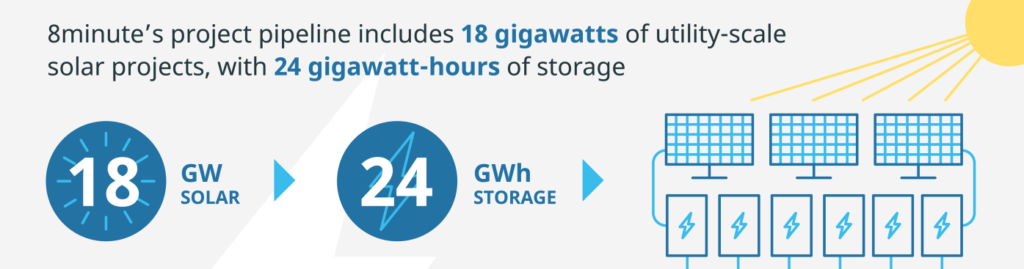

A couple of weeks ago, 8minute CEO Tom Buttgenbach published an article on LinkedIn with an infographic that included the below cutout.

18 GWac of solar power probably means 23-25 GWdc of actual solar modules installed. Add on 24 GWh of energy storage, and we’re just shy of 50 GW total capacity in their pipeline. And just like NextEra, 8minute probably has another few hundred gigawatts of capacity sitting in maps and proposals hoping and waiting for the days of 2 TW of solar capacity being deployed.

That’s close to 100 GW of capacity combined between wind, solar, and storage sitting in the project pipelines of two companies. Yes, the standard caveat of a pipeline is that you’re hearing numbers of sales people who haven’t signed a final deal yet – but dammit – we’re hearing it from two of the best salespeople in the nation who’ve built some of the largest portfolios that the world has seen to date.

Another thing I’ve learned about these two companies is that they’re full of mathematicians, researchers, and PhDs – plus electrical and civil engineers. A former NextEra person once told me about the applied mathematics department of NextEra. 8minute’s CEO has dual-PhDd from CalTech.

And all of this makes absolute sense when nowadays people might bid under a penny for solar electricity for the rights to the long tail gold dust revenue of an eternal interconnection.

Two companies, big projects, and big plans.