The Peck Company filed their Q1 2020 earnings report; you can read the press release and full SEC filings online.

The company’s pipeline has increased to $40.8 million, an increase of 36% from the $30 million reported at the end of 2019. No specific volume in megawatt terms was included in the filing.

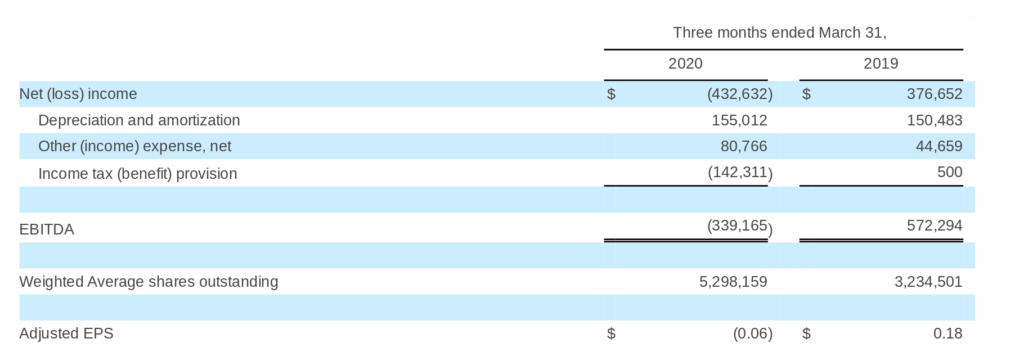

Gross profits were down for the quarter to $300,000 from $800,000 in Q1 2019. However, revenue was up a bit from $3.85 million to $3.98 million comparing the two periods.

The lesser profits, along with additional costs due to being a publicly traded company per Peck, meant an operating loss of $600,000 in Q1’20 versus Q1’19. Gross margins were 7.5% in the quarter.

Two items of interest in the filing were the line of credit available, as well as the value of solar arrays owned by the company. The line of credit was valued at just over $5.6 million, while the solar arrays were booked at just under $6.4 million. The line of credit might be more valuable to consider in terms of what it can be used to create – ie – develop and build projects that can be sold. The cost of the credit would be interesting to know.

The calculation of the value of the solar arrays is a second item that investors ought pick apart. Does the $6.4 represent the cost of the systems? Does it represent future cash flows? What about tax benefits, are they included?

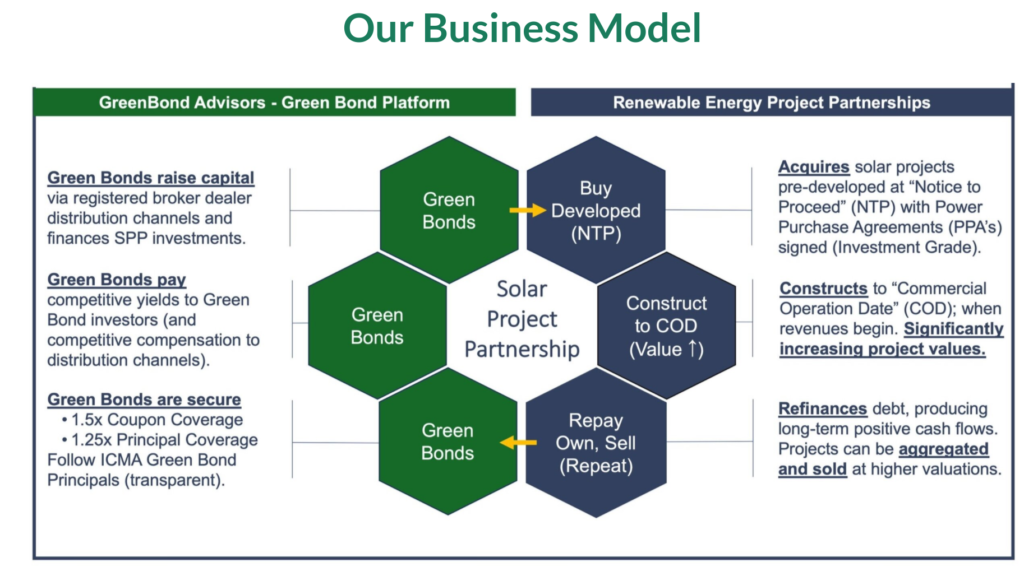

Beyond the company’s performance, is a new relationship developed. Peck “announce(d) a new investment partnership designed to increase Peck’s access to capital for the construction of new solar projects”. The partnership is with “GreenSeed Investors LLC and its affiliate GreenBond Advisors LLC“.

The group’s business model is to offer capital to green investments. Bond’s market perceptions are as low risk monetary tools, thus one would assume that the cost of capital to Peck from GreenSeed would be quite agreeable. In 2019/Q4 earnings call, one of the callers specifically asked how Peck might fund future development of projects, and thus seemingly a valuable tool.

CommercialSolarGuy will report further on GreenSeed, both for purpose of elucidating readers, but also as a potential tool we might use.

While the price of the stock is up over 50% since the start of the year, it is still down significantly from its original offering price near $10/share. However, since their prior filing on March 20th for all of 2019, the stock is up over 100%.