Some of the highest returns on investments in the solar power industry are in developing projects from scratch and actually owning a solar plant. Manufacturing can be challenging with high equipment hardware costs, coupled with constant downward pricing pressure. Construction margins are lower, but the absolute amounts of cash earned are great. Which leads to the question most ask:

Where should I invest?

I have no idea. However, a friend of mine, Joshua D. Collinsworth, who directs all research and portfolio management activities for his creation Nomadic Value Investment Partners, has published his Second Quarter Letter to Partners that includes references to two solar related companies.

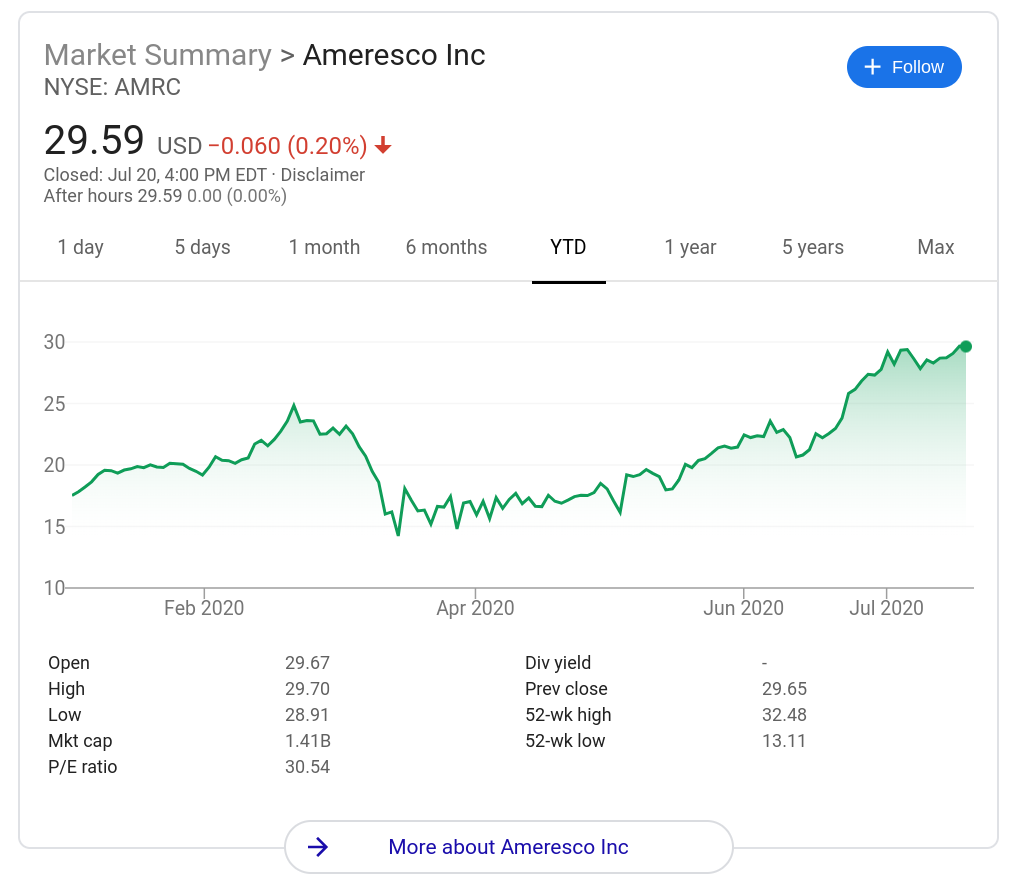

Ameresco (AMRC)

The first solar related company reviewed is Ameresco (AMRC). The Massachusetts-based entity was founded twenty years ago, and went public a decade ago. They are an ‘energy performance contractor’ who holds an energy services contracting – or ESCO – license. This roughly means, Ameresco engineers will visit your site, and:

- Analyze your energy bills – heat, electricity, and water

- Break down your usage into digestible components – light bulbs, HVAC, insulation, site controls based on occupancy

- Recommend upgrades

- Financially model the performance of those upgrades

- This point is key: offer a loan whose payments are equal to the *guaranteed* savings offered

- And then support the construction of such upgrades

That finance solution is what makes an ESCO an ESCO. These groups have been licensed by the Department of Energy to offer these solutions to municipalities, K-12 schools, universities, and state and federal government buildings. As Collinsworth states in his quarterly letter,

These contracts are unique in that the ESCO guarantees the expected energy savings, and then finances the equipment to the government entity. The goal is for the energy savings to pay back the equipment cost, interest expenses, and the ESCO’s profit, allowing a budget neutral, off balance sheet CAPEX and longer-term cash flow savings to the government.

What makes this a solar play is three aspects of Ameresco’s business.

1. The company includes solar power in many of their broad site efficiency and energy upgrades.

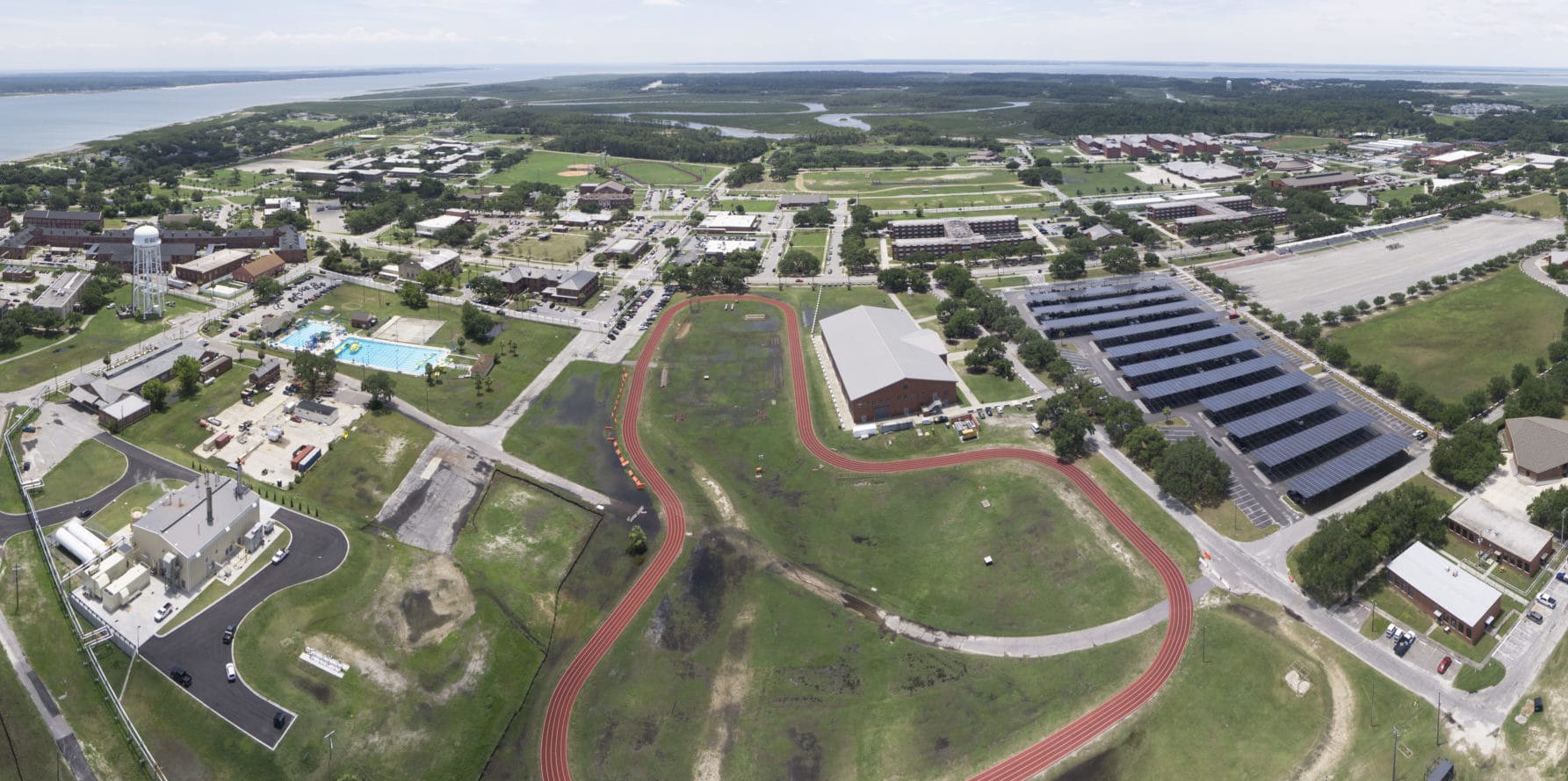

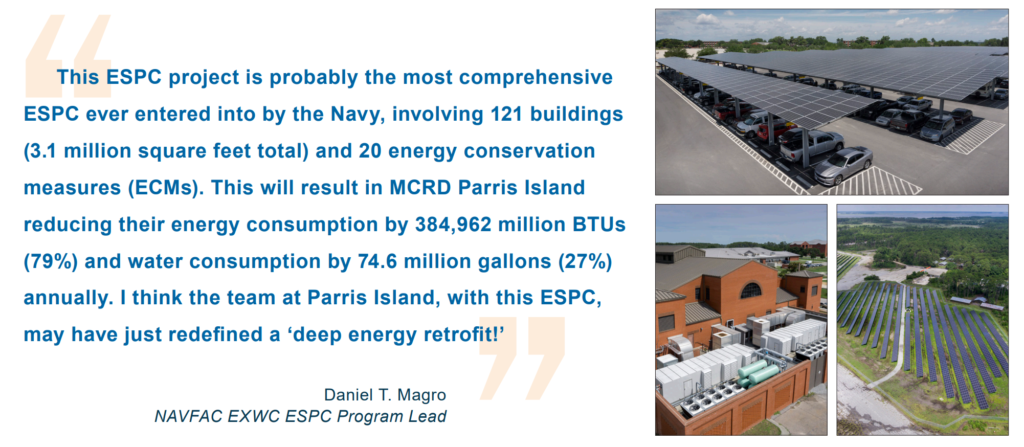

The U.S. Marine base on Parris Island took on greater than $91 million in upgrades including – but not limited to – boiler plant & chiller improvements, adding an energy management control system, hot water/steam distribution systems, HVAC, lighting upgrades & controls, solar energy, a battery energy storage system, and water system upgrades. The system’s $6.9 million a year in savings will cover the hardware and installation loan 100% over the course of the 22.5 year contract.

The solar power was broken into a 1.6 MW carport, and a 5.1 MW ground mount system. The 4 MW/8 MWh Tesla energy storage system turns into a microgrid management system controlling the solar power, as well other onsite electricity generation hardware totalling 10 MWac.

Parris Island Tesla Energy storage system

2. They build solar power projects for customers.

Overall, the company has deployed or is constructing 235 MW of solar power across the USA. Last summer, a press release noted the company being awarded seven commercial and industrial sized projects totaling 10 MW and 221 residential sized projects totaling about 2 MW worth. This single announcement is worth roughly $25 million in revenue.

3. They develop and own solar facilities sited at commercial and industrial facilities.

They then sell the electricity to the site’s occupant. There are a litany of reasons for a company to purchase electricity from a solar plant on site, and not own it themselves.

A California project CommercialSolarGuy is working on has a customers that cannot use the incentives which affects payback significantly, and a very complex piece of hardware that they wish for a third party to have operations and maintenance responsibility over. Some companies don’t want to spend their capital on upgrades that only pay back over 5+ years, as main business purchases payback very quickly.

For Ameresco to be able to tell a business that they can spend $1 million plus on these projects, or, Ameresco will spend the big money gives the sales team a very compelling argument about the value of the specific solar power project. The company is ready to put their money where their mouth is. Peck Solar is doing the same.

CommercialSolarGuy thinks it quite telling that solar developers and EPCs are looking to own, in addition to selling.

MMA Capital

The second solar related company that Collinsworth has invested in is MMA Capital. The group is a mezzanine lender who has deployed over $2 billion in capital since 2015 in greater than 150 wind, solar, and other clean energy projects across ~150 projects. Collinsworth suggests that even though the market is challenging, and project deployment is complex in the current Covid settings, there is going to be a strong demand for the types of debt that MMA offers. Part of the reason for his optimism in demand is the personal experience in the industry:

Speaking from my own experience having worked in it, the industry has navigated an endless maze of state legislation changes, sporadic and now declining federal support, cut-throat competition, high profile fraudulent actors, all (and I mean ALL) the incumbent resistance, recessions, etc. Meanwhile, capacity additions to the grid have gone parabolic and support from the bottom up has only grown.