Meyer Burger has posted financial results for 2023, with net loss increasing by 318% to CHF292 million (US$330.6 million)

“prices from Chinese suppliers in Europe, coupled with a sharp rise in Chinese production overcapacity and a lack of market protection, led to unprecedented distortions in the European solar market, which had a serious impact on Meyer Burger’s earnings”

company said the proceeds from potential debt financing sources, together with the proceeds from the capital increase, will enable it to start module production in a 2GW plant in Goodyear in the US state of Arizona by the end of the second quarter of 2024. The 2GW cell production plant in Colorado Springs, Colorado, is also expected to ramp up by the end of 2024.

“Assuming that cell and module production at the US sites can be ramped up as planned, the group expects to generate an annual EBITDA of around CHF250 (US$282.63) million per year in the medium term from its business in the US,”

That calculates to $0.1413 per watt of revenue on those 2 GW of capacity that we might see in 2025. If solar project’s price ranges from $1.00 to $3.00/Wdc, then a 10% tax credit adder for buying domestic content hardware is worth $0.10 to $0.30/Wdc.

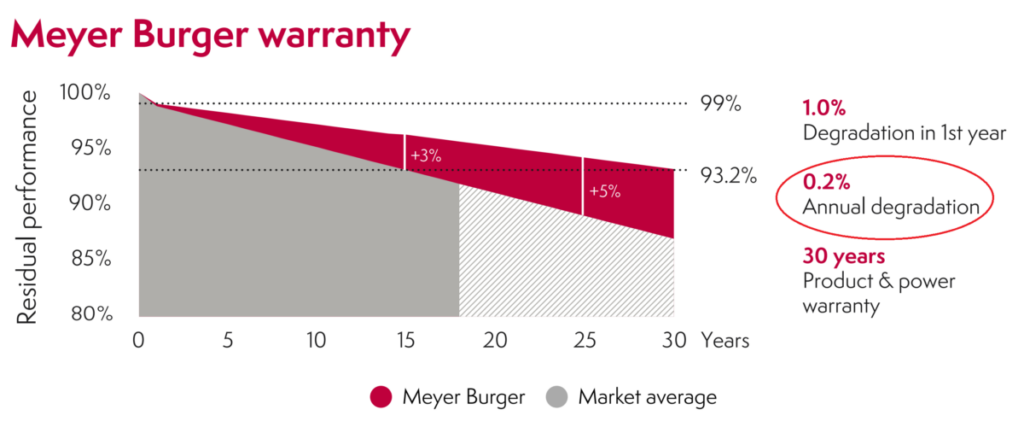

Burger modules have a degradation value of 0.2% per year – however – the CEO has hinted that standard accelerated testing situations found no degradation. A 3 MWac solar project financial model we’re working has 0.5% module degradation, and 0.5% general system losses. If we moved the module degradation to 0.2%, about a half % higher return of investment was had. Going to zero popped it a full percent. This is a long term model though, 35 years, with much of that ROI pumping volume coming from the tail end of the facility. Do people truly purchase production in years 26 through 35?

The company has just over 300 MW of product they need to move, at probably decently higher costs.