The State of Rhode Island offers a twenty year electricity purchase contract to commercial rooftop owners that install solar power. Essentially, CommercialSolarGuy will build a small power plant on your building, and National Grid will purchase all of that electricity. Payments are made through a monthly electronic deposit as National Grid sells that electricity into the market. A chunk of this solar electricity will be used by your own structure, the rest by your neighbors.

In this article we will cover the high level financial aspects of the transaction.

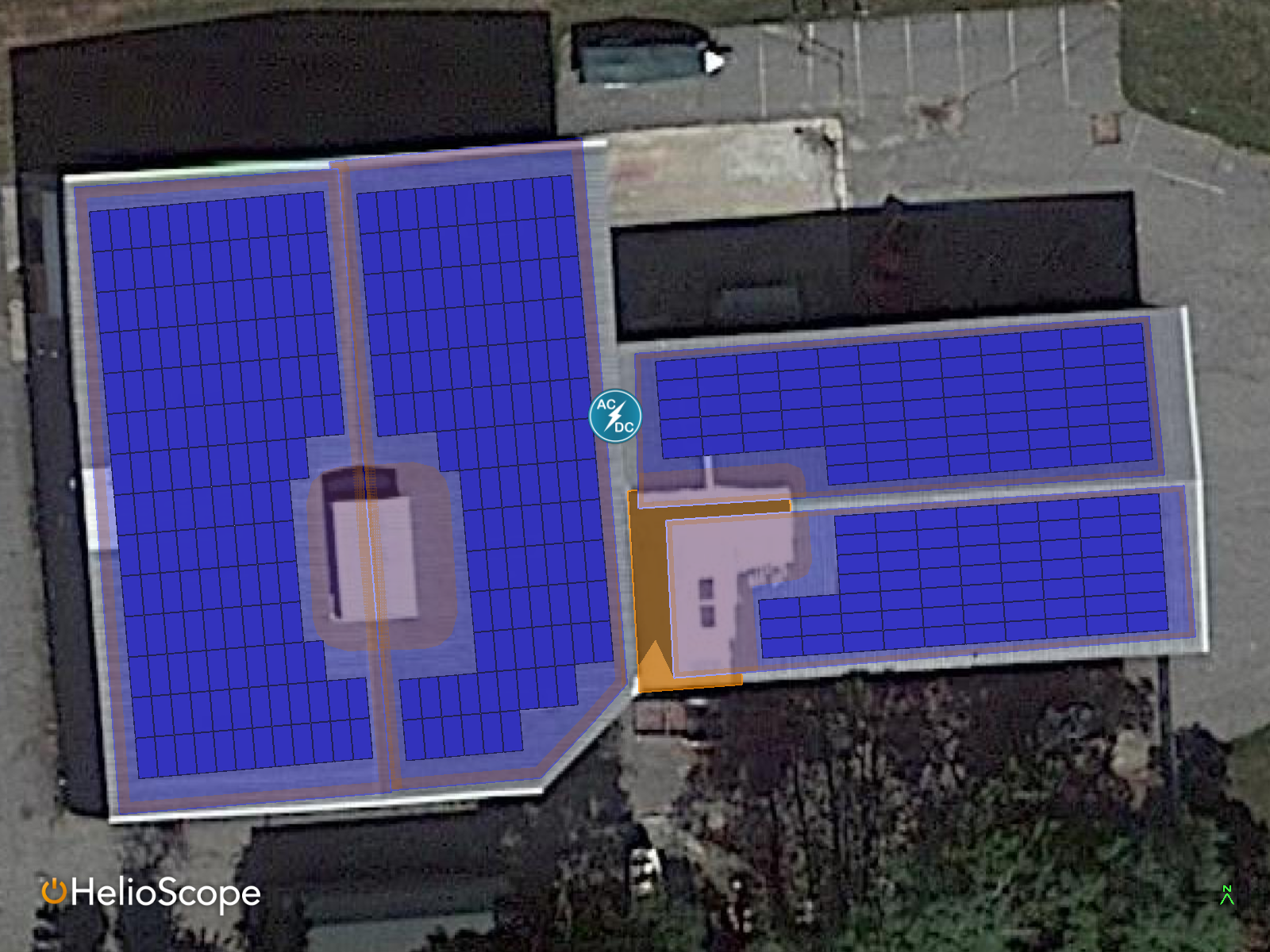

The above structure in Bristol, Rhode Island is a real building we’re working for a customer. The less than perfect roof has space for 414 solar panels, each of which cost $940 each to install based on this roof’s unique characteristics.

For instance, an all new white thermoplastic (TPO) surface repaired the leaking thirty year old metal roof. This surface requires extra labor, accounted for in the project’s projected cost. This site needed an upgraded transformer because the existing unit peaks at 50kW, and our solar system will peak around 150kW. The upgrade will cost roughly $5,000.

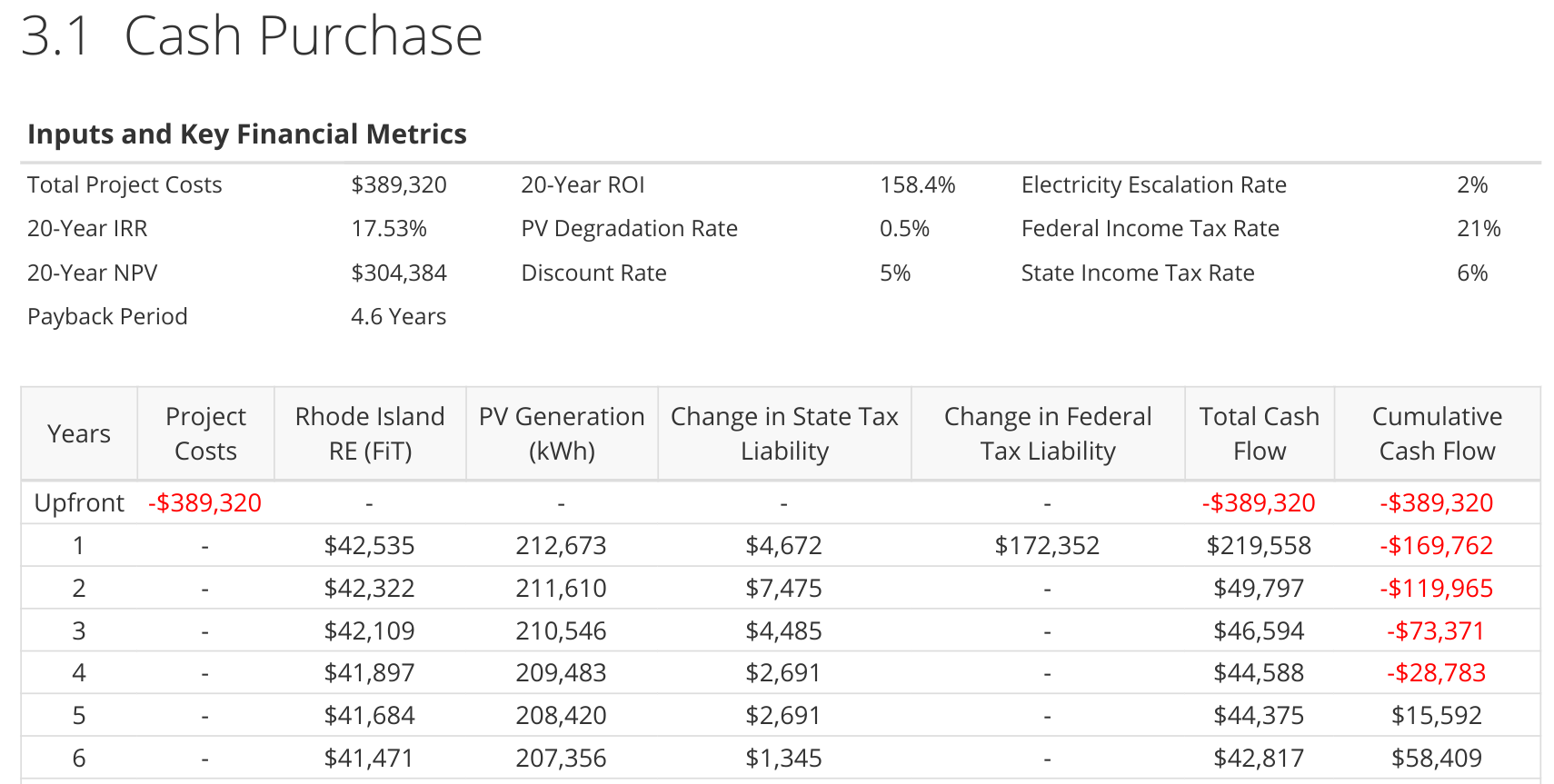

At $389,320, the purchase price includes all aspects of the project. We begin with engineering, permits, and interconnection. After installation we train the onsite team to manage the already running power plant and include 5 years of remote monitoring. This is a standard turn key solar project offering.

In the first six years of this real life financial model, the Rhode Island RE (FiT) column represents the main revenue stream that the project owner will receive. This number is guaranteed by contract with the State of Rhode Island and the electricity utility before construction begins. The rate is fixed and guaranteed for twenty years. Note that the value falls each year. This is the solar degradation value of 0.5%/year – which will stay above 90% for at least 20 years.

Business Energy Investment Tax Credit (ITC) – 26% of businesses that install solar photovoltaic (PV) systems are eligible to receive an (ITC) investment tax credit, which can be used to directly offset federal tax liability on a dollar-for-dollar basis. If the tax credit exceeds your tax liability you can roll the credit into future tax periods for 20 years. Commercial projects that commence construction through the end of 2022 are eligible to receive a 26% tax credit of the total PV system cost. The ITC steps down thereafter: 2023 projects qualify for a 22% ITC, 2024 and later projects qualify for a 10% ITC. Total Incentive Value: $101,223

State(RI) – Modified Accelerated Cost-Recovery System (MACRS) Under the Modified Cost Recovery System (MACRS), businesses may recover investments in certain property through depreciation deductions. The MACRS establishes a set of class lives for various types of property over which the property may be depreciated. Total Incentive Value: $23,359

Federal – 100% bonus depreciation (Tax Reform Bill) The Tax Reform Bill modifies bonus depreciation under Code Section 168(k) to allow 100% expensing for property placed in service after September 27, 2017 and before January 1, 2023. By increasing bonus depreciation to 100 percent, the new tax bill essentially allows eligible entities to deduct the entire allowable tax basis of the system in the first year of operation. Under the federal Modified Cost Recovery System (MACRS), businesses may recover investments in certain property through depreciation deductions. MACRS establishes a lifespan for various types of property over which the property may be depreciated. For PV systems, the taxable basis of the equipment must be reduced by 50% of any federal tax credits associated with the system. Total Incentive Value: $71,129

Three tax benefits that come to a business owner that installs solar power. The first two are depreciation – state and federal. The third benefit is the 26% Federal Investment Tax Credit for solar power. These three solar incentives, when totaled, are worth $177,024 for the average taxpayer in the first year. That’s greater than 45% of the system’s cost.

Combined, those tax benefits – along with $42,535 of electricity revenue and the solar investment – covers 56% of the project cost in year one. The project fully covers initial costs by the second half of the fourth year.