After working in the solar industry for a little over 2 years, I’ve seen commercial solar payback take as long as a decade to fully return the original investment. But in Rhode Island, CommercialSolarGuy recently completed a financial model with a solar payback period of only 2.1 years. In this article, we walk through the factors that led to such a fast return on investment—like solar depreciation benefits—and why now may be the best time to be investing in solar.

We also recently completed a 249 kW rooftop solar installation that generates tens of thousands of dollars in additional revenue for the business. While that project didn’t hit a 2.1-year payback, it’s roughly five times larger, making the total return significant.

High Electricity Prices in RI Reduce the Solar Payback Period

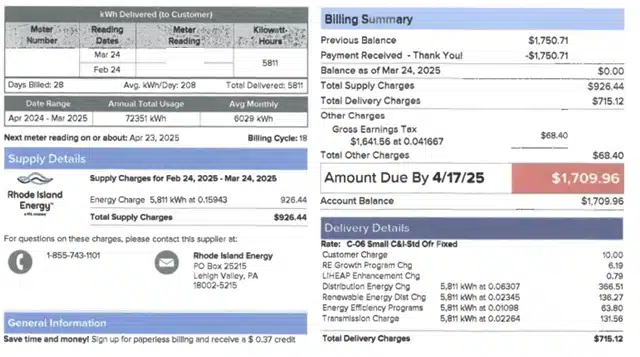

The electric bill below reflects a customer operating under Rhode Island Energy’s C-06 Small C&I Rate Class. With relatively low electricity usage, they stood to benefit greatly from solar due to high retail electricity rates, currently around 30¢/kWh. In this case, high electricity prices worked in the customer’s favor by amplifying the value of each kilowatt-hour of solar energy.

From 2004 to 2024, electricity prices in Rhode Island rose 20% faster than the national average. And under the C-06 rate structure, nearly the entire bill is based on “per kWh” charges. There’s no demand charge, so most of the bill can be offset with solar. Those rules are outlined in the state’s Net Metering program.

For this specific monthly bill (February 24-March 24, 2025), the customer used 5,811 kWh of electricity. The bill includes:

- Supply Charges (kWh-based): $926.44 (at $0.15943/kWh)

- Delivery Charges (kWh-based): $698.14

- Delivery Charges (fixed): $16.98

- Gross Earnings Tax: $68.40 (applied to total usage and not offsettable)

This means a solar system that offsets the full 5,811 kWhs would reduce the bill by $1,624.58—exactly 95% of the total. This translates into an effective net metering credit of $0.2795 per kWh.

If electricity prices increase? That just makes the system more valuable.

Returns like this are virtually unheard of in traditional finance—especially when paired with such low risk. Stocks can dip, interest rates fluctuate, and treasury yields barely keep up with inflation. A 2.1-year solar payback period is like receiving 100% of your investment back in tax-free dividends within just over two years—while still owning the asset. And unlike stock dividends, which are taxed and are never guaranteed, every dollar saved on your electric bill is yours to keep.

State Incentives Make Investing in Solar Power More Affordable

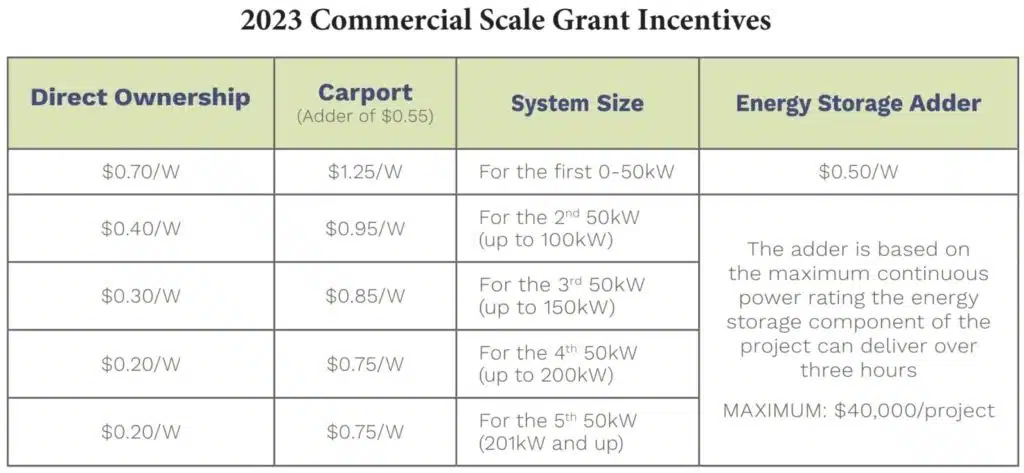

For systems that offset on-site usage (also known as “behind the meter”), Rhode Island offers a grant through its Renewable Energy Fund, based on installed system size. We’ve helped several customers take advantage of the program’s sweet spot—where system size and incentives align most efficiently.

The fund follows a tiered model that pays higher rates for smaller systems, since those tend to cost more per watt. It currently offers $0.70 per watt for the first 50 kW installed. That means a 50 kW rooftop solar system would qualify for a $35,000 state grant, typically paid out about six months after commissioning. In most cases, this covers roughly 25% of the total project cost.

CommercialSolarGuy recently completed a project at Grey Sail Brewery in Westerly, Rhode Island, which used this same program. Their system was just over 50 kW and qualified for the full $0.70/watt incentive. For a deeper look at how we optimized their returns, check out our article on maximizing ROI from commercial solar in Rhode Island. And if you’re in the area, stop in to taste their beer—and check out the solar gear mounted on the building.

The Federal Tax Credit is Huge

The federal solar tax credit applies nationwide—not just in Rhode Island—but it’s a huge part of why this project reached a 2.1-year solar payback period.

Thetax credit covers 30% of system cost, reducing the upfront investment significantly. First signed into law by President George W. Bush and extended by Presidents Obama, Trump, and Biden, the credit has enjoyed long-term bipartisan support.

According to a Pew Research Study from 2021, solar power polls as favorably as apple pie. While support varies by political affiliation and age, no other energy source earned such broad approval across demographics.

Solar Depreciation Benefits Supercharge Returns

By combining the 30% federal tax credit, 25.2% state incentive, first-year solar depreciation benefits of 10%, 11.8% savings in electricity, and 1.5% savings from renewable energy certificates (REC income), the business recovers almost 80% of its investment within the first year.

Adding an additional 11.8% in electricity savings and 1.5% in REC income each year means the upfront cost is not only recouped quickly, it’s followed by decades of growing financial benefit.

In Rhode Island and Massachusetts, a four- to six-year solar payback period is typical, depending on grid upgrades, tree removal, roof work, and other project-specific factors. Nationally, paybacks tend to range from five to ten years, depending on location and incentives.

Short Commercial Solar Payback Periods Are Still Possible—For Now

At CommercialSolarGuy, we don’t often see paybacks quite this short—outside of rare cases like rural REAP grants. But in Rhode Island, thanks to strong retail rates and smart incentives, 50kW systems are beating the odds. As a commercial solar installer, we focus our sales efforts on these smaller systems because of their exceptional return.

As we’ve noted in previous articles, investing in solar in Rhode Island offers some of the strongest paybacks in the U.S. The Renewable Energy Growth Plan is for standalone systems that sell all electricity produced to the grid. This program is lucrative and locks in a fair per-kWh rate for 20-years.

As this project demonstrates, extremely short solar payback periods are achievable under the right conditions. Soon, we’ll share even more strategies in our upcoming article, “Investing in Solar.” In the meantime, get in touch with CommercialSolarGuy to learn just how short your business’s solar payback period can get!