Last year (2019) saw a record volume of residential solar installed in the USA: 2.8 GW, and the mostly pre-COVID first quarter of 2020 at ~800 MW was the best Q1 by a long shot. With homeowners wanting greater residential resilience, and residential pricing down a bit, the long-term pace of growth is expected to continue.

Per the US residential solar finance update: H2 2019, a bit over half of homeowners who upgrade their homes with solar panels get a loan, a sixth of the population pay cash, and the last third rent their roof out to a third party.

Within those numbers were $1.35 billion of residential solar loan ABS (asset backed security) 144A public issuances in 2019, doubling 2018’s $680 million.

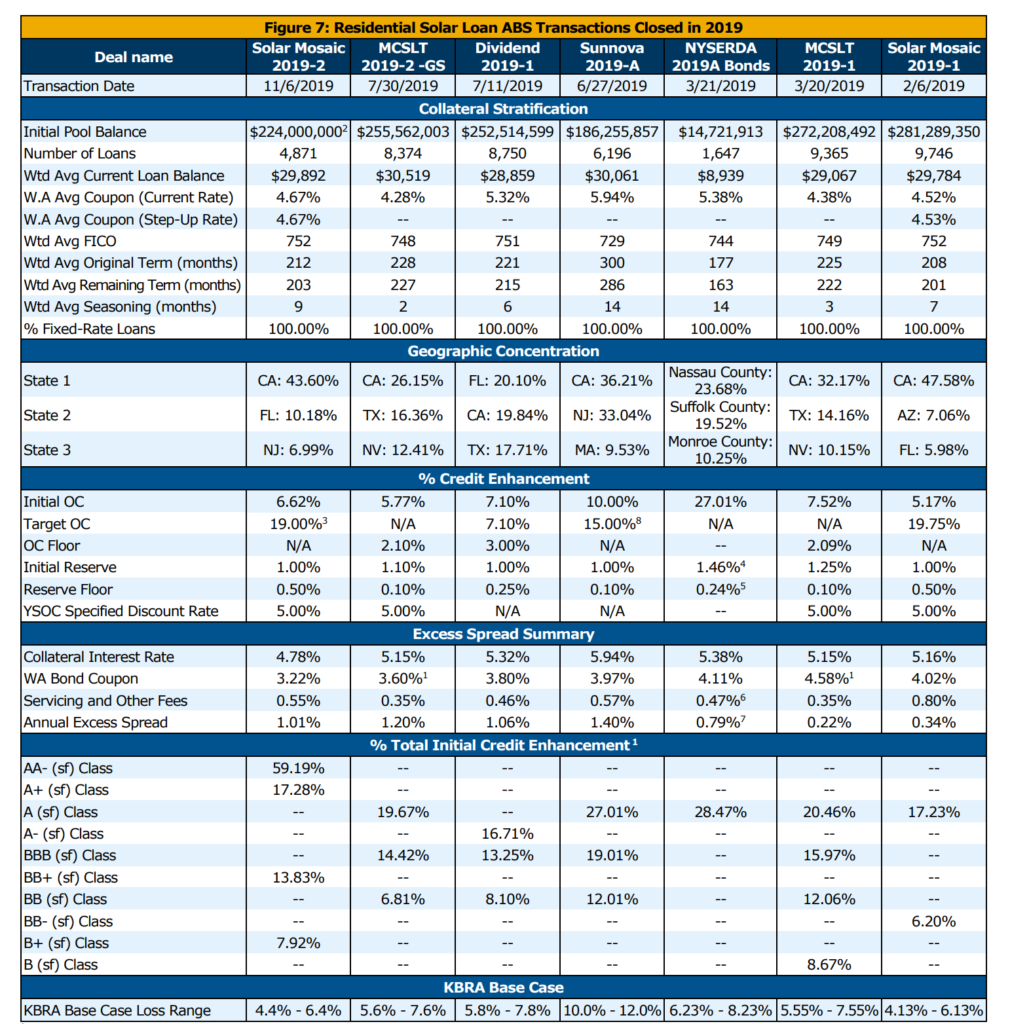

The Kroll Bond Agency (KBRA) has rated all 16 issues of this asset class since its origination in 2016, and review the seven issuances last year in 2019 Residential Solar Loan ABS Year in Review and 2020 Outlook. In total, KBRA rated 3.2 billion of ABS in 2019.

The sectors rating is generally in the single A range, however subcomponents of portfolios that received ratings all the way from B through a Mosaic’s 2019-2 transaction that earned a AA- due to the portfolio’s use of credit enhancement.

The total offerings by the five groups 144A issuances:

- LoanPal (MCSLT) – $459 million

- Sunnova – $168 million

- Mosaic – $468 million

- Dividend – $235 million

- New York State (NYSERDA) – $14 million

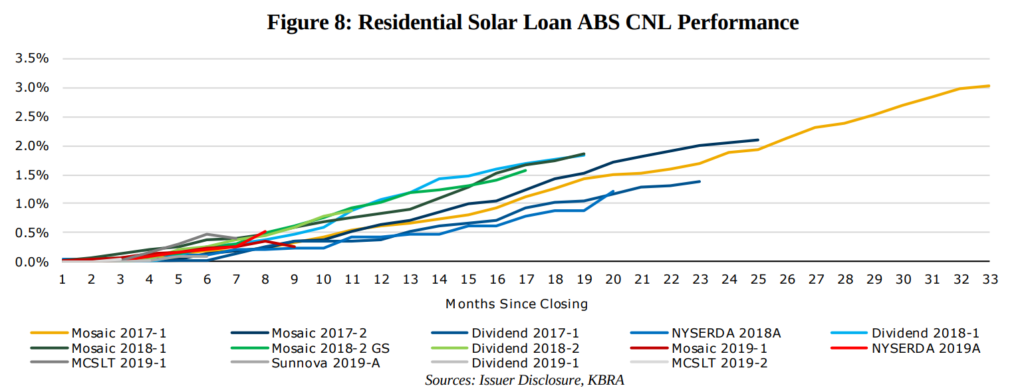

KBRA noted in all prior reviews, that the performance history of residential solar loans is still relatively short compared with the approximately 20-year average loan term, while sector performance has not been tested by economic stress conditions.

The report suggests that the class front loads its failures when the monthly payments increase for those customers financed the tax credit, but choose to keep that money.

This document was published in February. In May, KBRA published a COVID statement:

KBRA is not effectuating any Watch Placements but will continue to monitor the transactions in conjunction with our ongoing surveillance process.

Their March-April data suggested that fewer than 1% of solar loan owners were on finance company hardship programs, but they do expect this value to increase.

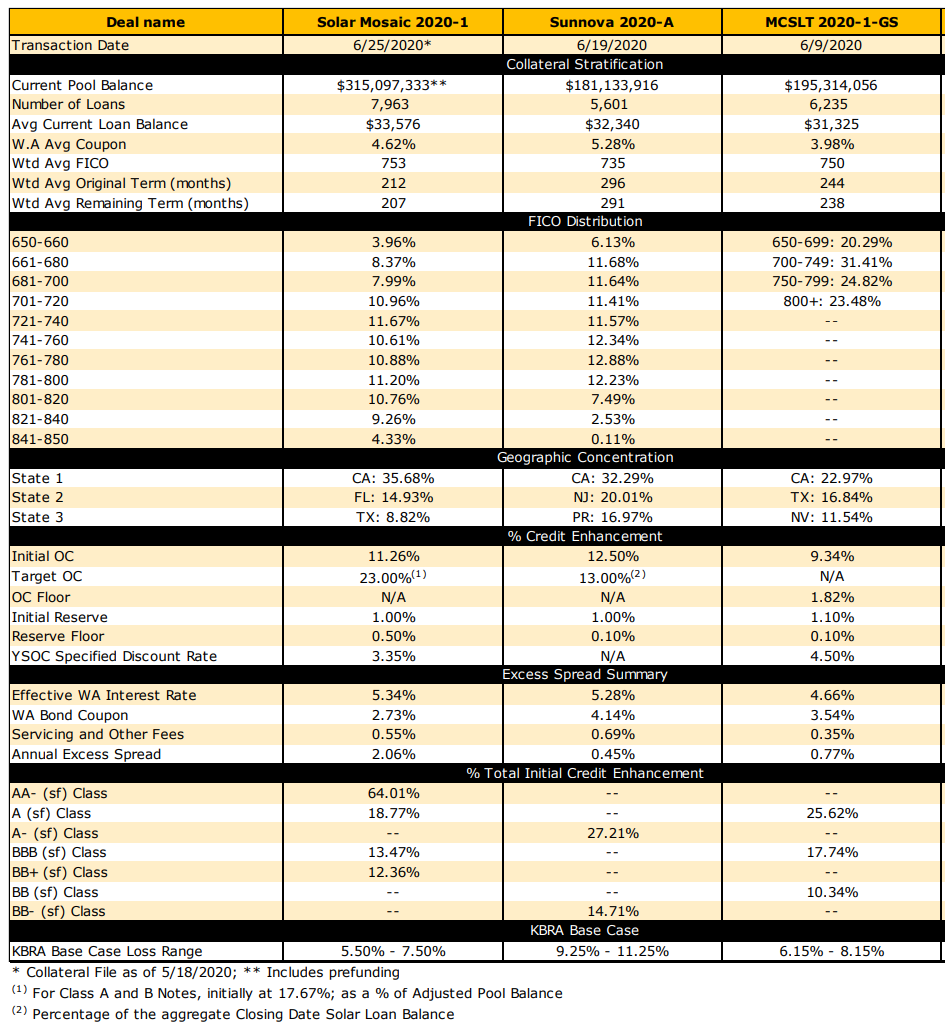

So far in 2020, KBRA has issued ratings on four portfolios of ABS collateralized by a pool of residential solar loans totaling $870 million. Loanpal has done two – one at $195 million, and another $264 million. Sunnova got a mostly A- rating on $158 million, and Mosaic an A on $260 million.

Other forms of finance exist outside of these reviews – for instance Vivint Solar recently secured $300 million in new tax equity financing, bring their committed financing to approximately 185 MWs of solar capacity – well into their 2021 needs.

You can also research solar finance companies via Consumer Affairs review, and Greentechmedia’s 2019 review.

Solar finance tools available to customers of CommercialSolarGuy

Solar financial models always show cash as the fastest payback – there’s no interest payment. And with solar projects in Massachusetts and Rhode Island returning 50% of the investment in the first year or two, for many customers this is an acceptable manner of payment.

However, many customers would prefer to use their cash on hand for business and household purchases– buying product for their company and generating the highest possible returns, or cushioning household bills during complex times.

Most often commercial customers of CommercialSolarGuy arrange payment with the bank that holds the mortgage on their building, or who generally offers them a credit line. Due to the strong financial structure of solar incentives in the Northeast, the mortgage holder is often quite happy to offer an additional cash advance. Commercial customers buy solar power when it increases their company’s financial performance, and the banks clearly see this.

Adam Gent, Director of Residential Services at CommercialSolarGuy, notes five unique finance tools that homeowners tend to use:

- Cash

- Home Equity Line of Credit

- Local bank loan – BankFive or UMassFive Credit Union – no cash down, no lien against home, local customer service

- MA Solar Loan through MassSave for those with qualified incomes

- Ensemble – No cash down, no lien against home, online instant approval

You can also mix and match to see what fits best. A recent customer paid a chunk of cash down equal to the anticipated ITC + State tax credit, and tapped into their existing home equity line for the remainder. The result is a ten year HELOC monthly payment that’s half their previous electric bill, with the initial investment repaid in 2021 tax season.

CommercialSolarGuy is a licensed and insured Massachusetts construction firm. Our team is experienced with many forms of solar power finance, and work closely with the customer’s chosen partner to get a fair deal. If you’re interested in a quote, please contact us at 508-499-9786 or fill out the below form: