When you choose to buy a house versus renting, it’s often because you want to save over a long term while having a bit more stability. Yes, there are costs associated with home ownership, but for many people their homes often turn into their largest savings account.

We’re also used to paying a monthly rent to the electricity company. For most, there is no other option. But solar changes that for land and building owners.

The purchase process of these solar power plants most often involves a spreadsheet, allowing the buyer to understand the flow of cash around their investment. The spreadsheet is broken into years generally, but must end at a certain point – as solar plants don’t last forever…

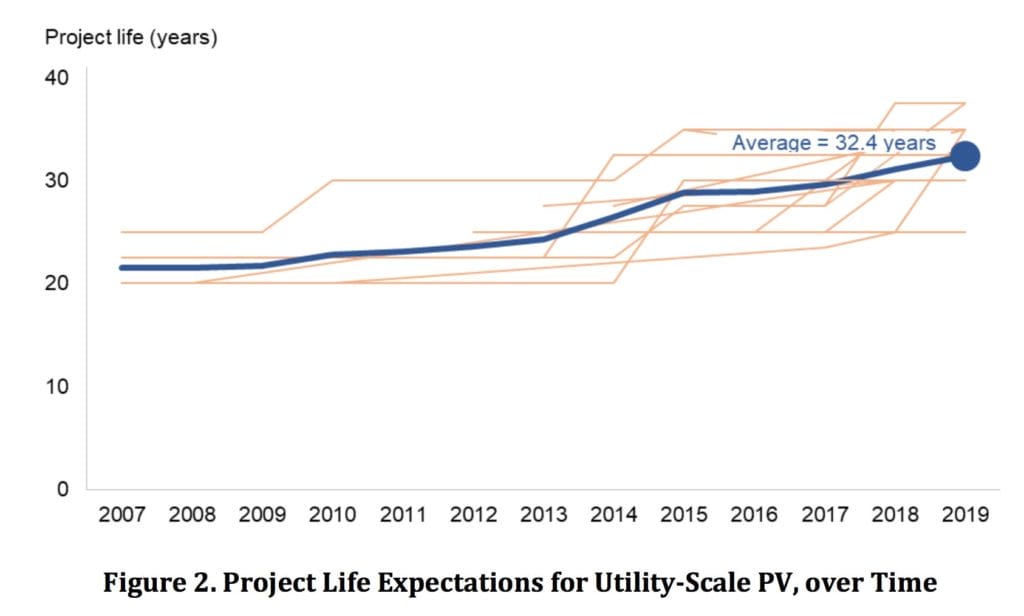

A group of solar power developers and investors were polled by the Electricity Markets & Policy Group at Lawrence Berkeley National Laboratory on expected lifetimes for their projects and the costs of operations and maintenance at those sites. The researchers found, in Benchmarking Utility-Scale PV Operational Expenses and Project Lifetimes: Results from a Survey of U.S. Solar Industry Professionals, that the professionals modeled their project lifetimes, on average, at 32.5 years. These values ranged from 25 to 35 years.

The average value is an increase of just over 50% from the 2007 average of 21.5 years. The researchers suggest that this increase in length of time has lowered the cost of electricity from utility scale solar power projects by 1.1¢/kWh.

For the whole period reviewed, the researchers saw average solar electricity prices fall from 30.5¢/kWh to 5.1¢/kWh.

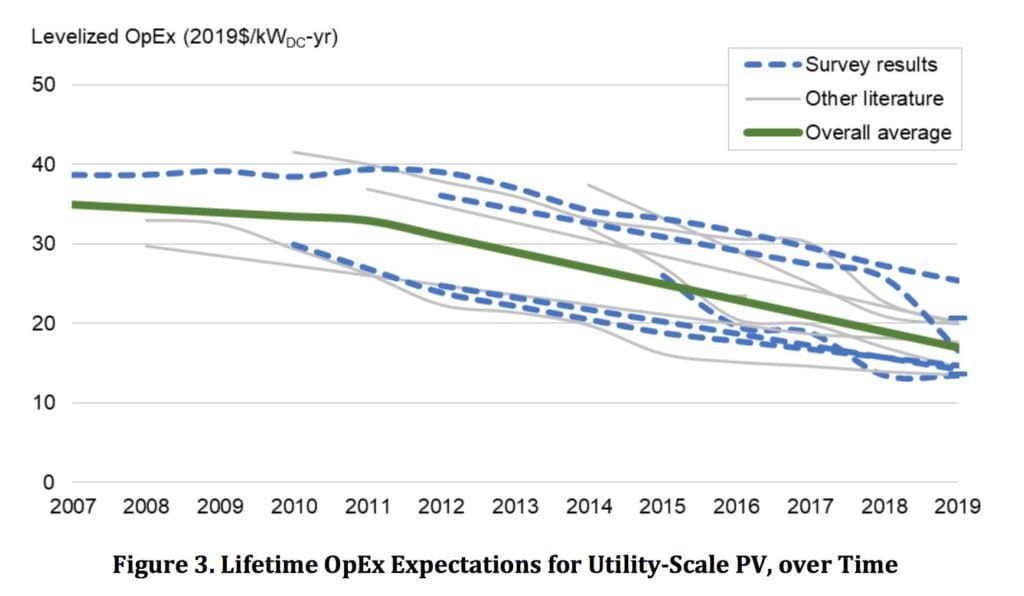

Operating costs (OpEx) have fallen as well, from $35/kWdc-yr for projects built in 2007 to an average of $17/kWdc for contracts being signed in recent years.

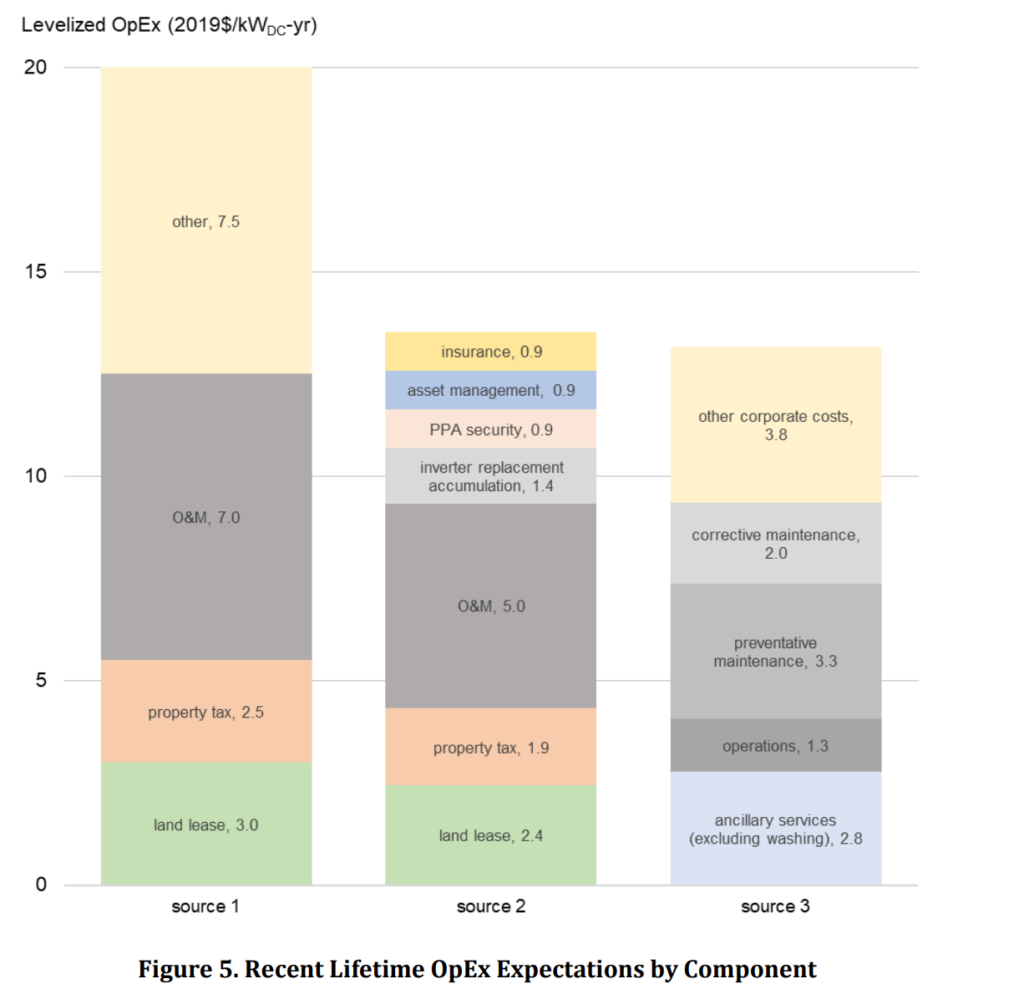

OpEx costs included, but were not limited to, highly variable property tax and land lease costs, module cleaning, land management, security, insurance, and asset management.

Current O&M cost expectations range from $5-8/kWDC-yr in most cases. Respondents saw module cleaning and vegetation management adding ~$1/kWDC-yr. One respondent noted that the five year O&M contracts they had signed fell from ~$15/kWDC-yr in 2010 to $4.5/kWDC-yr in 2019.

Varying project owners had varying operating cost models.

The fall in prices in OpEx costs meant another 1.1¢/kWh off of the price of electricity from these plants.

Increasing solar panel efficiency is part of this equation. The 13-14% efficiency solar panels of 2008 took up twice as much space as today’s 20% efficient bifacial modules sitting on single axis trackers.

Solar plants have long lives, second lives, bigger visions

Solar plants living longer is of no surprise.

Kyocera, back in 2011, showed off a 1991 installation which it says ran with a “near-constant” efficiency level. The company has another solar power plant, recently verified, that’s been running since 1984 in Japan. SunPower’s modeling – backed by field research – suggests that 99% of their products have a 40 year useful life (meaning above 70% of original output). And SolarCity has suggested that standard solar modules from the big, cost focused players can run just fine for 35 years.

Module warranties used to range from 20-25 years, with panels losing 1% a year of efficiency. Now, modules have up to 35 year warranties. It’s being suggested that the very strong seal from the weather for glass on glass bifacial modules will lead to those units lasting well beyond warranted periods – with some researchers seeking whether a 50 year lifetime is possible.

CommercialSolarGuy has helped site owners review land lease agreements from large utility scale developers which started with a 25 year period, and requested a 25 year extension. Nuclear power plants have had their licenses and interconnection agreement renewed for 80 years.

In Massachusetts, CommercialSolarGuy is reviewing a project whose Solar Renewable Energy Certificate (SREC) contract is ending after ten years. In Portugal, the lowest priced European solar power plant signed a 15 year deal. It’s got two more of those following it.

The question becomes, now what do we do with the site? We do still have an interconnection agreement, how much more electricity can we get out of this site? Who can we sell it to? At what price? What upgrades can we do to the system? How about repowering with new solar panels? What about adding batteries and getting into the Massachusetts Clean Peak Program?

These are questions that long term asset owners are going to have to deal with.

Repowered solar plants offer savings

A repowered solar power plant will offer significant savings over a new site. There will be some base costs – the OpEx costs noted at the top of this article specifically – as well, new hardware and construction costs to re-optimize the site to modern gear. This might lead to solar for less than a penny per kilowatt hour.

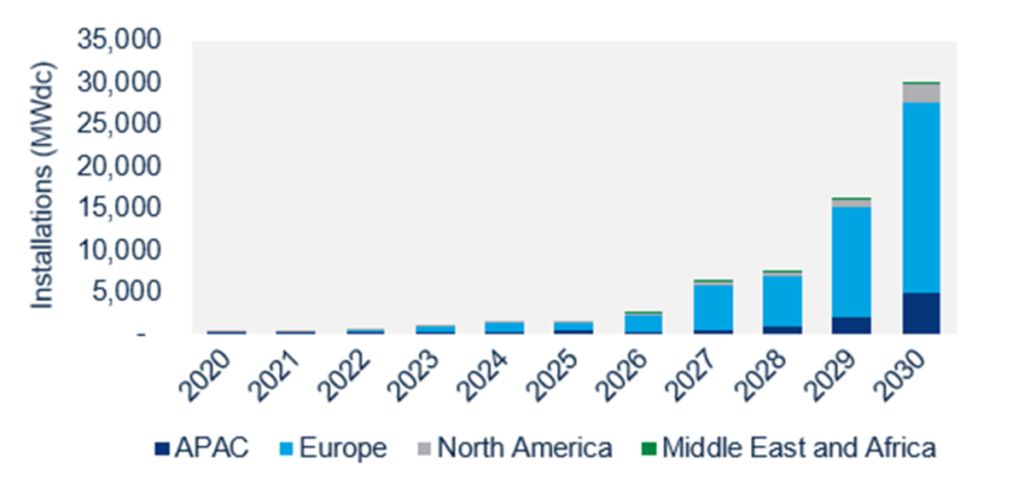

Whatever is done, it’s going to be big business. Already, solar inverter replacements are a $1 billion a year business globally – representing 10% of all inverter sales. Wood Mackenzie Renewables & Power sees the global whole solar power plant repowering market hitting 30+ GW/year of facilities by the end of the decade. That’s tens of billions of revenue opportunity.

Big business for decades.