Hanwha Q Cells solar panels are the leading market share products in the residential and commercial markets per research firm Wood MacKenzie Renewables & Power. The manufacturer supplied 25.2% of all residential solar modules, and 13.3% of commercial modules. Considering the residential market installed 2.8 GW, and the commercial space 2 GW in 2019 – that means Hanwha supplied 705 MW to homes, and 266 MW to business.

The report says the company is up from 14.2% and 8.3% of market share last year.

Hanwha opened the largest solar module factory in the Western Hemisphere in Georgia in 2019. A month later, First Solar – who is focused only on utility scale projects – upped them by 200 MW of manufacturing capacity.

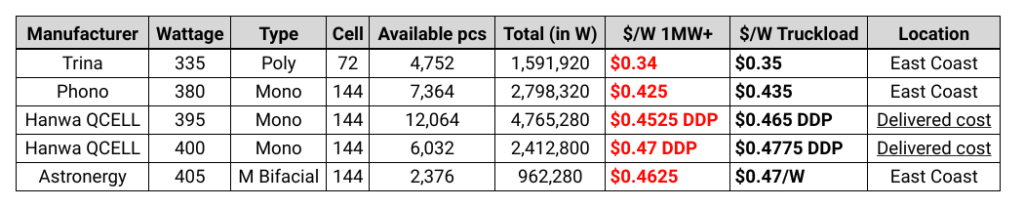

CommercialSolarGuy gets this product’s pricing from resellers in his inbox, often via Nick Gotsev of Ontility. The above list is from the end of March. Generally, buying from a guy like Nick means you’re buying a shipping container worth.

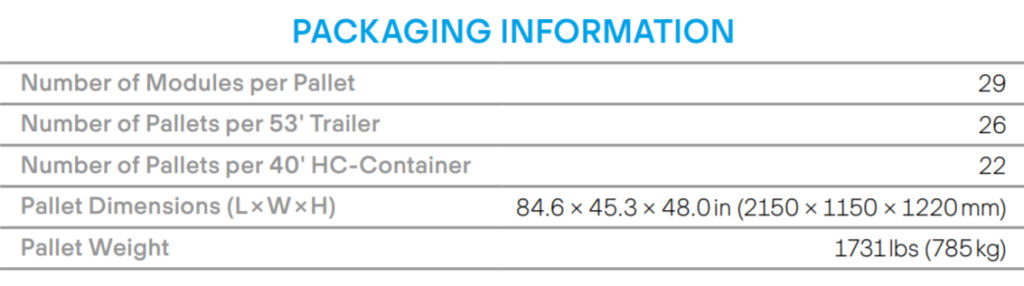

Hanwha notes their 72 cell product (generally for commercial projects) fits 29 modules per pallet, and 26 pallets per 53′ trailer. That means a minimum order might be 754 modules, which will cost $141,000. I’d bet half a trailer could be bought, but no less. You probably need a 10 MW purchase to buy direct from the factory.

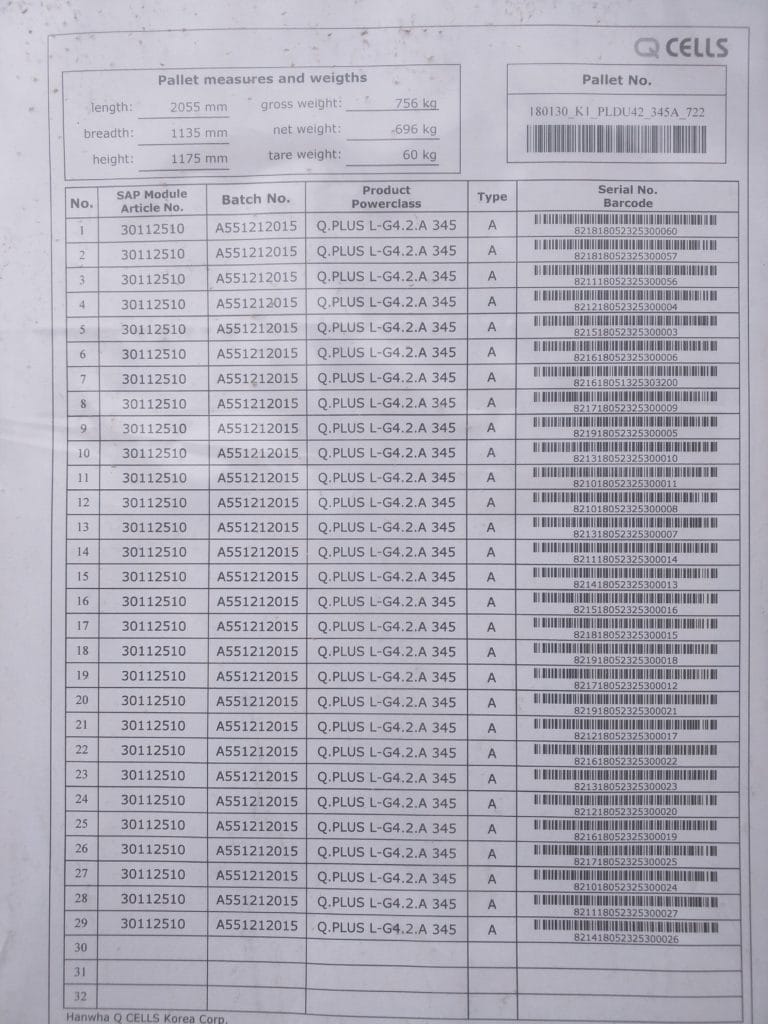

A recent project of CommercialSolarGuy‘s used Hanwha solar panels. We installed 2,006 of the company’s 345 watt units.

- Q-Cell 345 W Solar Modules

- Q-Cell 345 W Solar Modules

One of the reasons we went with this product is that the company is very strong economically outside of the solar panel manufacturing business. The Hanwha Group had $63 billion in sales in 2019, and holds greater than $185 billion in assets. In 2018, the Q Cells division generated just short of $3 billion in revenue.

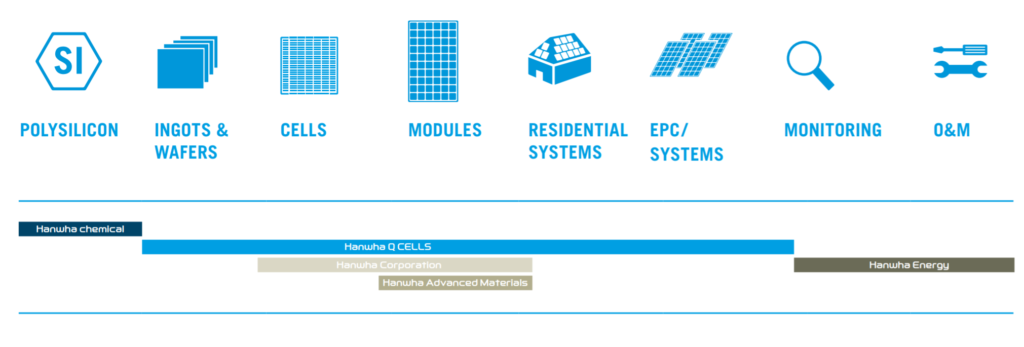

As well, they’re a fully vertically integrated group. They make the polysilicon that goes into solar panels, they make the machines that make solar panels, they make solar panels, and they also own some solar power plants.

A company that has significant amounts of revenue outside of the solar panel business is good for building solar panel longevity trust. The big bankers call this “bankability.” Whether a product is bankable or not, is driven by whether a bank trusts the warranty enough to fund a project using this product. Remember, these are 25 year warranties – who’s going to be around here is 25 years? Hanwha is predicted as such.

The company lists four products available for the residential and small commercial market:

- Q.Peak Duo BLK-G5 and the Q.Peak Duo-G5

- Q.Peak BLK-G4.1 and the Q.Peak-G4.1

The difference within the pairs are that one has a black backsheet and the other has a white backsheet. Black backsheets are more aesthetically pleasing, while white reflect more photons back into the solar cell and are slightly more efficient (roughly 5 watts per module). Note that all of these products have black powder coated aluminum frames.

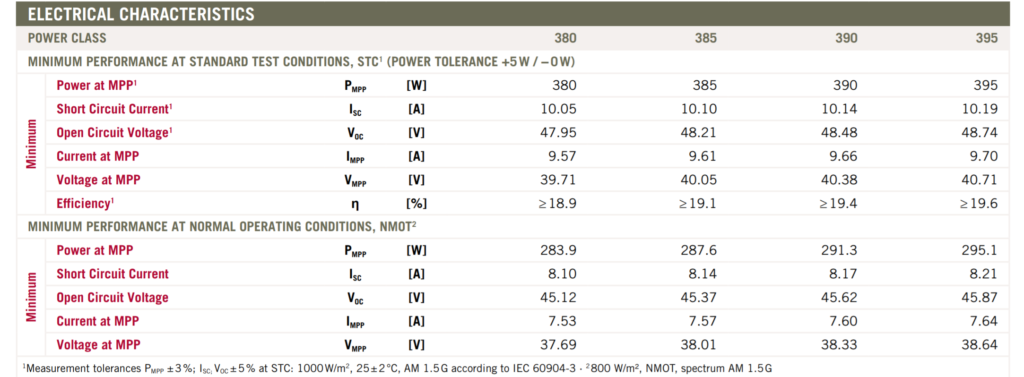

The company’s utility scale product – Q.Peak Duo L-G5.2 – comes with a silver frame, is 1,500 volts, and tuned for the best price per unit of electricity generated (levelized cost of electricity).

CommercialSolarGuy is a licensed and insured Massachusetts construction firm. Our electricians and engineers are experienced with Hanwha products. If you’re interested in a quote, please contact us at 508-499-9786 or fill out the below form: