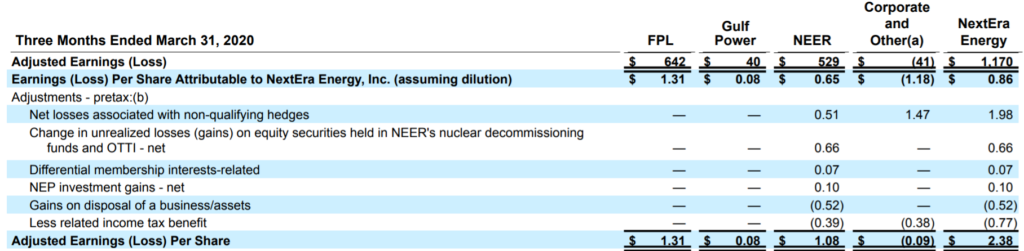

NextEra, the most valuable energy company in the United States and the nation’s largest renewable energy company, announced 8.2% year over year growth. This number was near the top end of the projections.

Energy Resources, their wind+solar+storage subsidiary, grew 11.3%.

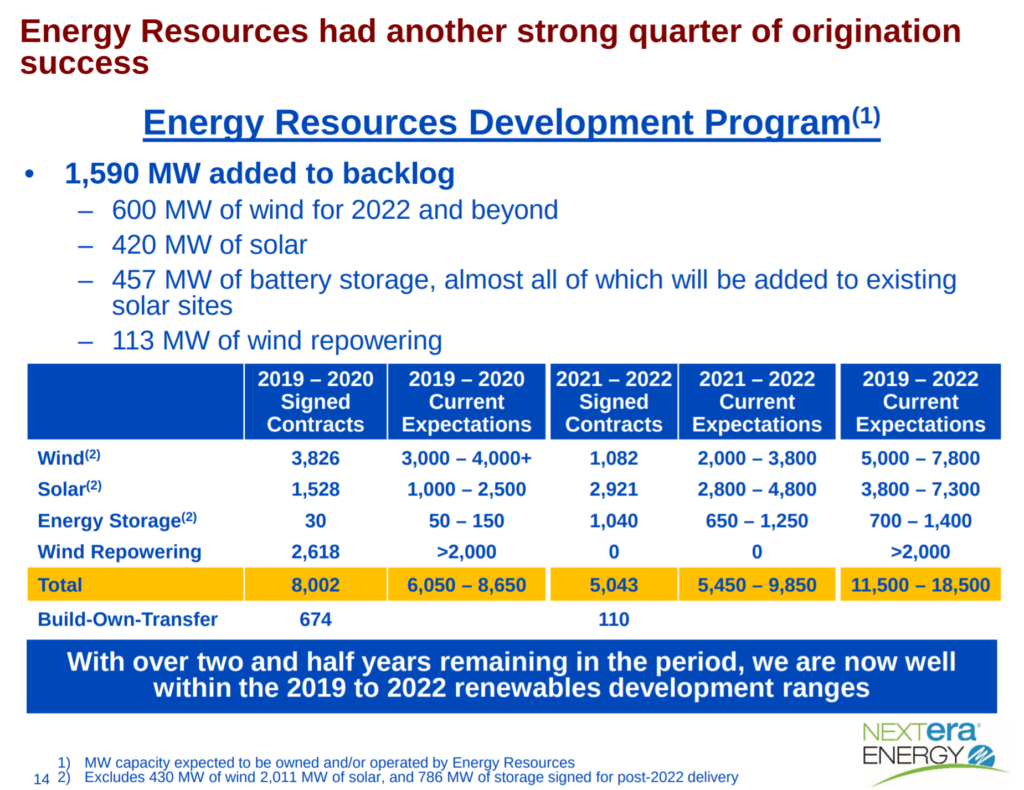

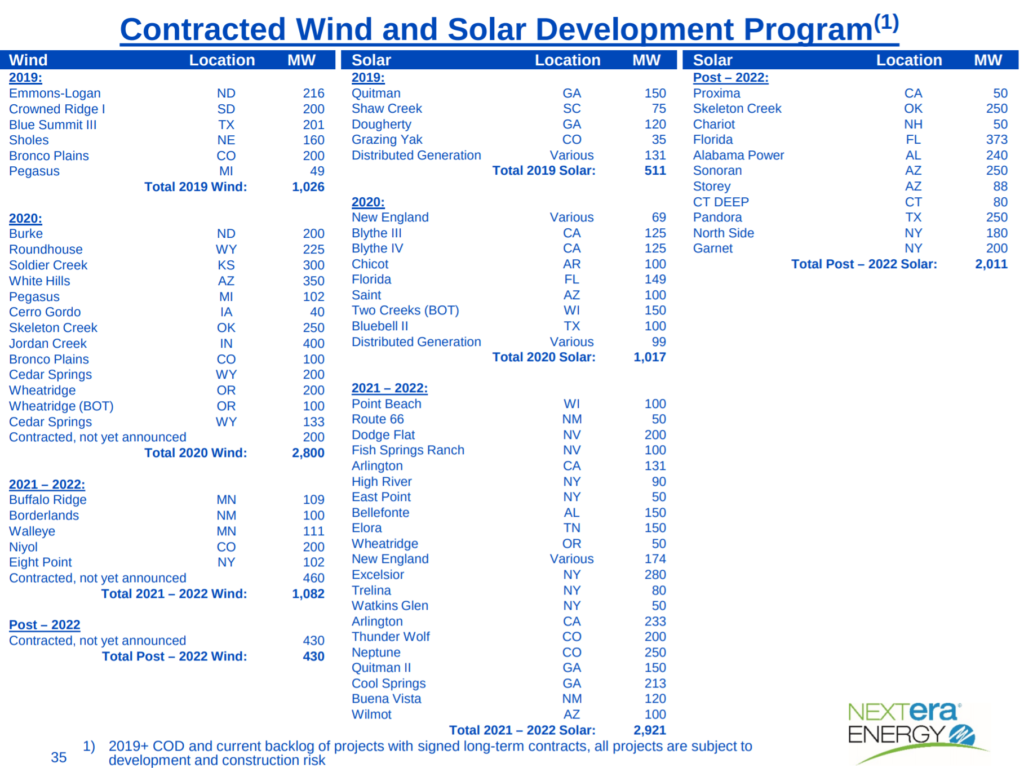

The Energy Resources team added 1,590 MW to their construction backlog. This includes 600 MW of wind, 420 MWac of solar, 457 MW/~4 hour capacity battery storage, and 113 MW of wind repowering projects. Most of this quarter’s additions were negotiated remotely, while employees operated under stay at home orders.

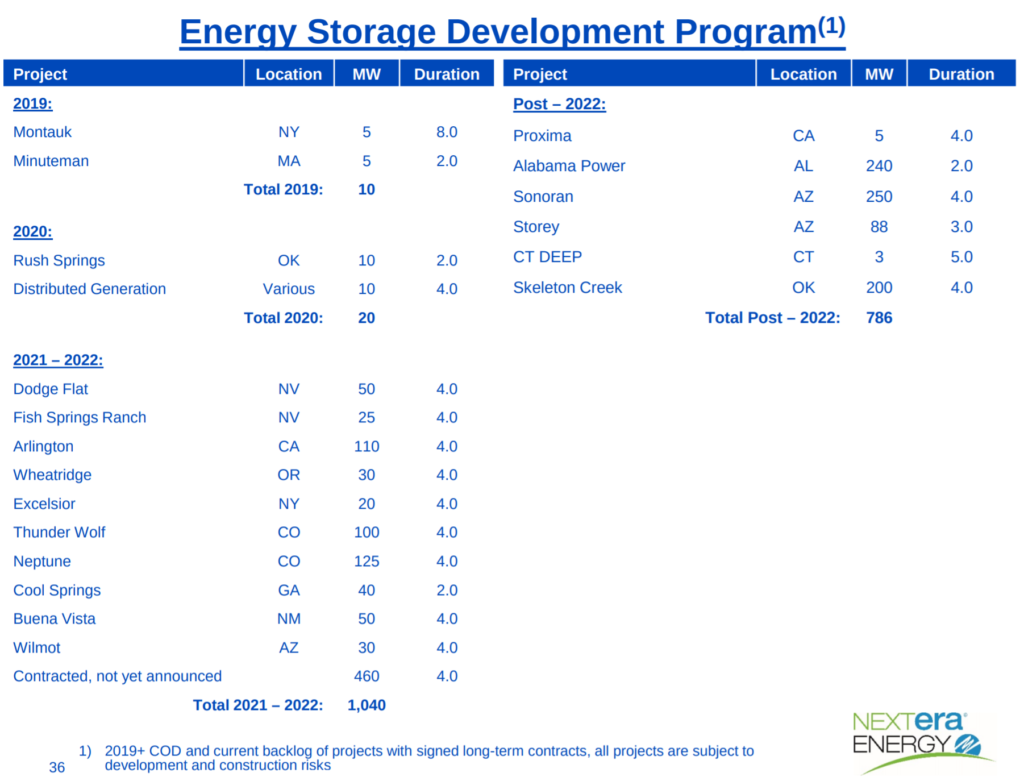

Almost all of the batteries will be added to existing solar sites, “to take advantage of the ITC and enhance the value of our existing projects for customers.” NextEra expects battery investments in 2021 to exceed $1 billion.

Which we believe would be the largest ever annual battery storage investment by any power company in the world, and have a total gigawatt hour capacity that discharges enough electricity to power the entire State of Rhode Island for four hours.

The groups says they’re not experiencing, “any significant equipment or labor issues at any of the more than 5,000 megawatts of wind and solar projects that we expect to complete this year.”

The renewables+storage group earned $318 million, with adjusted earnings of $529 million. Energy Resources, on its own, brought in $1.08 of adjusted earnings per share – 45% of total earnings for the world’s most valuable electric utility. The Energy Resources division grew 11.3%, representing 61% of the company’s total growth.

Commissioning more than 1,500 MW of new wind and solar during 2019 was 8¢ of that per share growth.

One nice big fat number, is that the company owns just over $97 billion of “electric plants in service, and other property.” Just over $36 billion of those assets are held by Energy Resources.

Commercial Solar Guy’s insight

You watch NextEra because they’re among the smartest. They’re building cutting edge wind+storage+storage projects, are brewing an energy storage+ management system secret sauce, and they’re the world’s second largest renewable energy company – behind the Chinese state industry that owns the world’s largest dam.

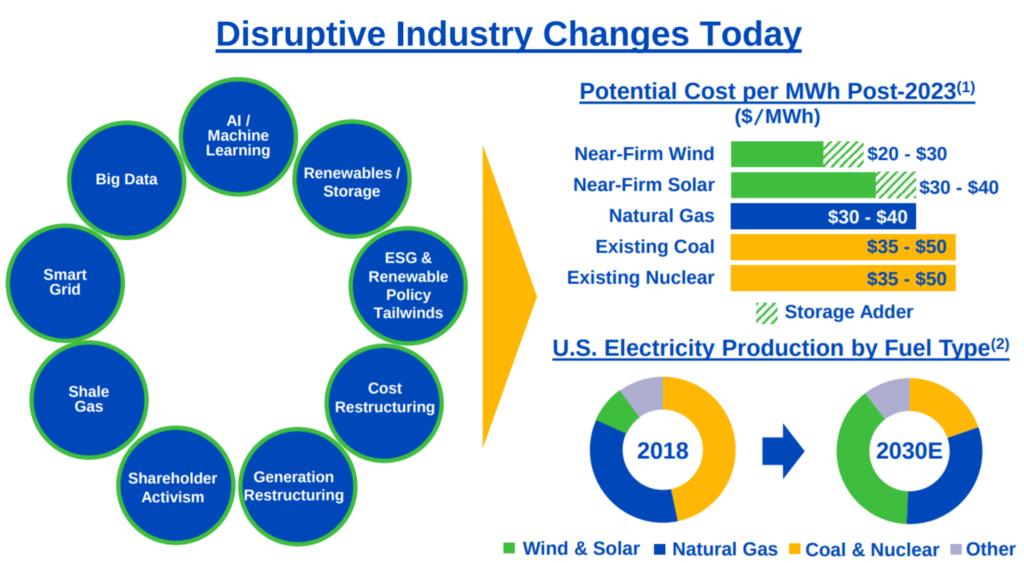

One drum they’ve been beating for a long time is future price competitiveness of wind or solar+storage.

We continue to expect that by the middle of this decade without incentives, new near-firm wind and new near-firm solar will be cheaper than the operating costs of most existing coal, nuclear and less efficient oil and gas fire generation units…we expect that the long-term projections for wind and solar that we have previously shared will be achieved or exceeded over the coming decade representing a tremendous growth opportunity for Energy Resources.

The company’s price projections:

The company’s cash cow, Florida electric utility FPL, says a new solar power program “is expected to generate $249 million of total net cost savings for participating and non-participating customers over its life. This plan, with less future gas plant construction, reflects our belief that renewable generation and particularly solar paired with battery storage in Florida, is an increasingly cost-effective form of generation in most parts of the US.”

An analyst asked, “Natural gas has had a — has gotten a lot cheaper. I’m just wondering is how does — how do renewables stack up on an LCOE basis these days against fossil fuels? Fossil fuel prices have really come down.”

We have now removed the two combined cycle natural gas plants that we had previously in the forecast (in FPL territory) in the mid-2020s as a reflection of where we think costs are…Battery storage costs have come down such that we mentioned the large stand-alone storage build that we have, the $1 billion going in ’21. There is a significant opportunity in almost every part of the country where batteries are now more economic than gas-fired peakers, even at today’s natural gas prices.

The company says this most recent ten year plan has “dramatically increased” battery storage plans, bringing the projected total to 1.2 GW of power by 2029 in the Sunshine State alone.

Other analysts asked about whether NextEra could deliver in these times of COVID, supply chain challenges, and an altered tax equity reality:

Given the size and the sophistication and the buying power that we have, we’re usually a manufacturer’s largest supplier…Smaller developers might struggle, particularly to the extent that banks have less amount of taxable income, notwithstanding the five-year operating loss carryback that was passed…We are actually seeing more opportunities come our way. So actually, the current environment has created a better environment for us.

“Perfect,” the analyst responded.