BloombergNEF estimates that lithium-ion battery demand across EVs and stationary storage came in at around 950 gigawatt hours last year

Global battery manufacturing capacity was more than twice that, at close to 2,600 GWh

China’s battery production in 2023 alone was similar to global demand.

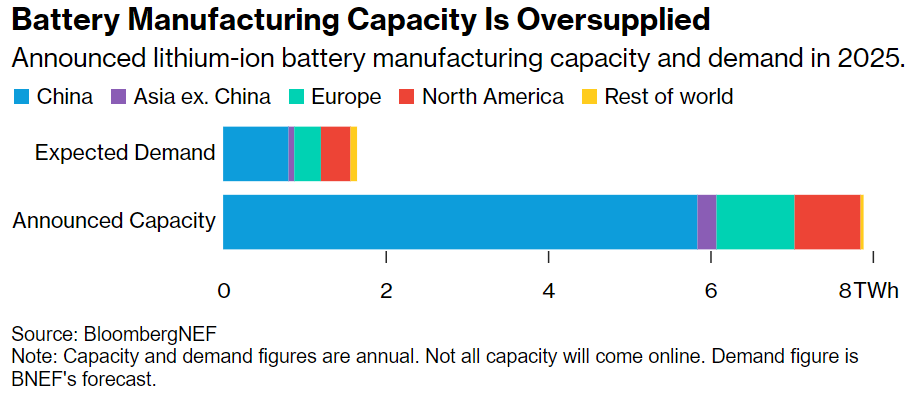

BNEF is tracking 7.9 TWh of annual battery manufacturing capacity announced for the end of 2025

compared to demand projections of 1.6 TWh, and even that assumes steady EV demand growth and very rapid growth in batteries for storage applications

quite a lot of that announced capacity simply won’t come online

Much of it will either be behind schedule or outright cancelled as the realities of scaling up become clearer and the list of contenders thins out

Other parts of the supply chain are not able to deliver at that level, and we can’t perfectly match supply to demand anyway, because EV batteries are not yet a commodity product

prices will fall and margins will get squeezed

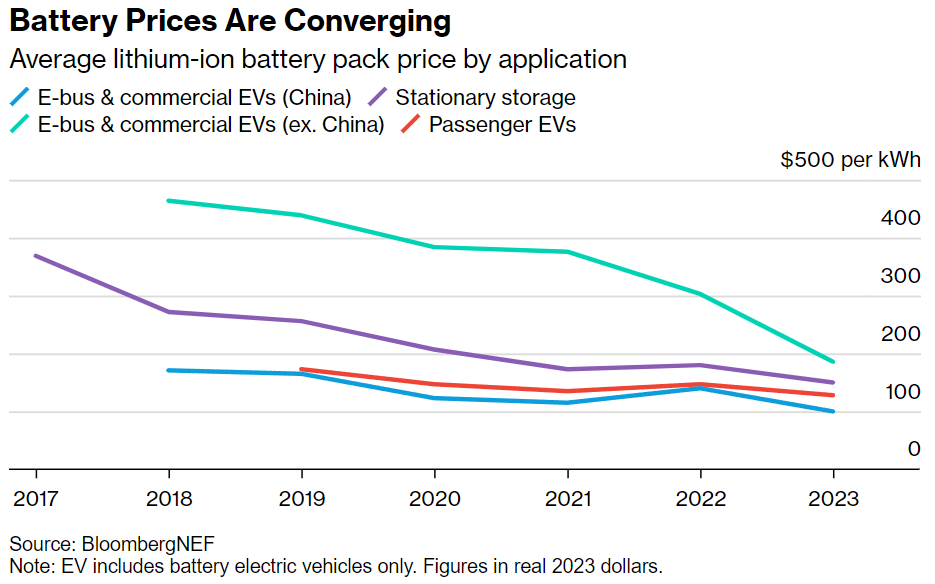

14% dip in average battery pack prices in 2023, and China’s CATL announcing that it expects to be able to sell battery cells at the equivalent of less than $60 per kWh this year

Battery prices also are converging across sectors as manufacturers look for new markets for their products

biggest question is how sustainable the low battery prices will be after the industry shakeout that invariably comes from overcapacity

Some of the current prices are simply driven by lower raw material costs for things like lithium