Riddle me this – if India is the cheapest place to install solar panels globally, why is it that they aren’t at the tippy top of our Top ten list of lowest solar power prices in the world – but instead an honorable mention? Well, it’s complicated how these ‘lowest prices’ come to be.

Source – Renewable Power Generation Costs in 2019

The discussion of this question is a great place to start when trying to understand any piece of land or rooftop, and its solar revenue potential.

In the document, India Unable to Compete With Record Low Solar Tariffs in Gulf Region: An Analysis of why the Gulf Region Has the Cheapest Solar Tariffs, the ‘Institute for Energy Economics and Financial Analysis’, and JMK Research & Analytics put together an argument focused on why India, and really the whole world, might not be able to match the Gulf Region’s pricing. More importantly, the researchers suggest maybe India shouldn’t try.

In summary, the main reasons put forth by the document are:

- Lower cost of US$ denominated, long-dated financing

- Lower expected return on equity (ROE)

- Higher solar resources leading to higher capacity utilization factor (CUFs)

- No corporate taxes nor duties on equipment and power sales

- Negligible land cost for solar projects

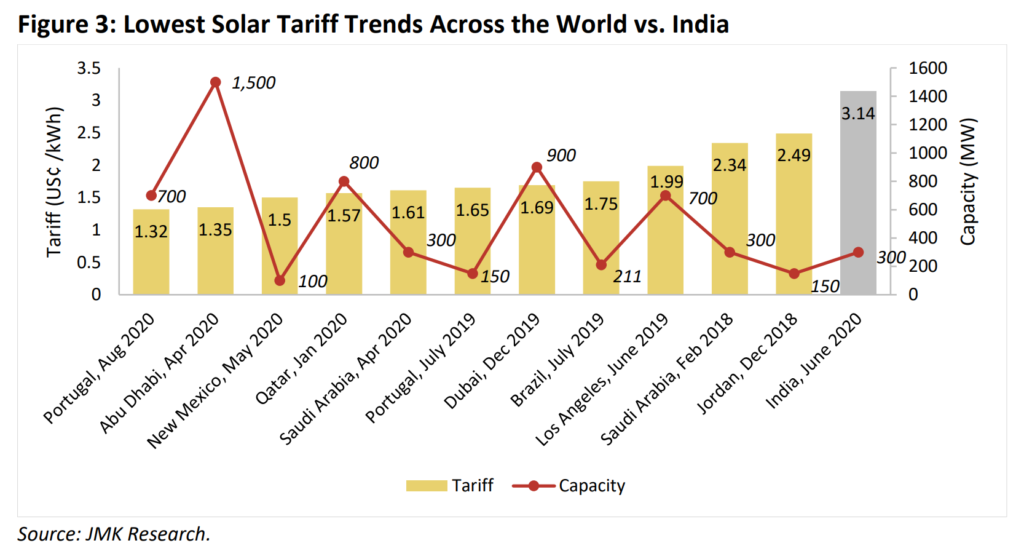

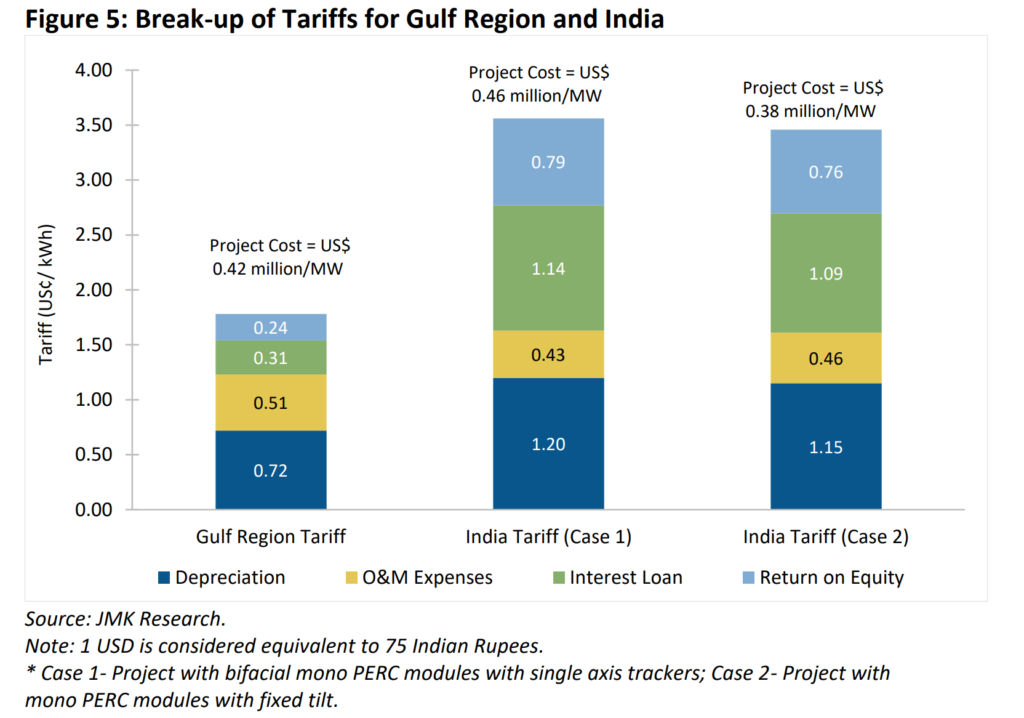

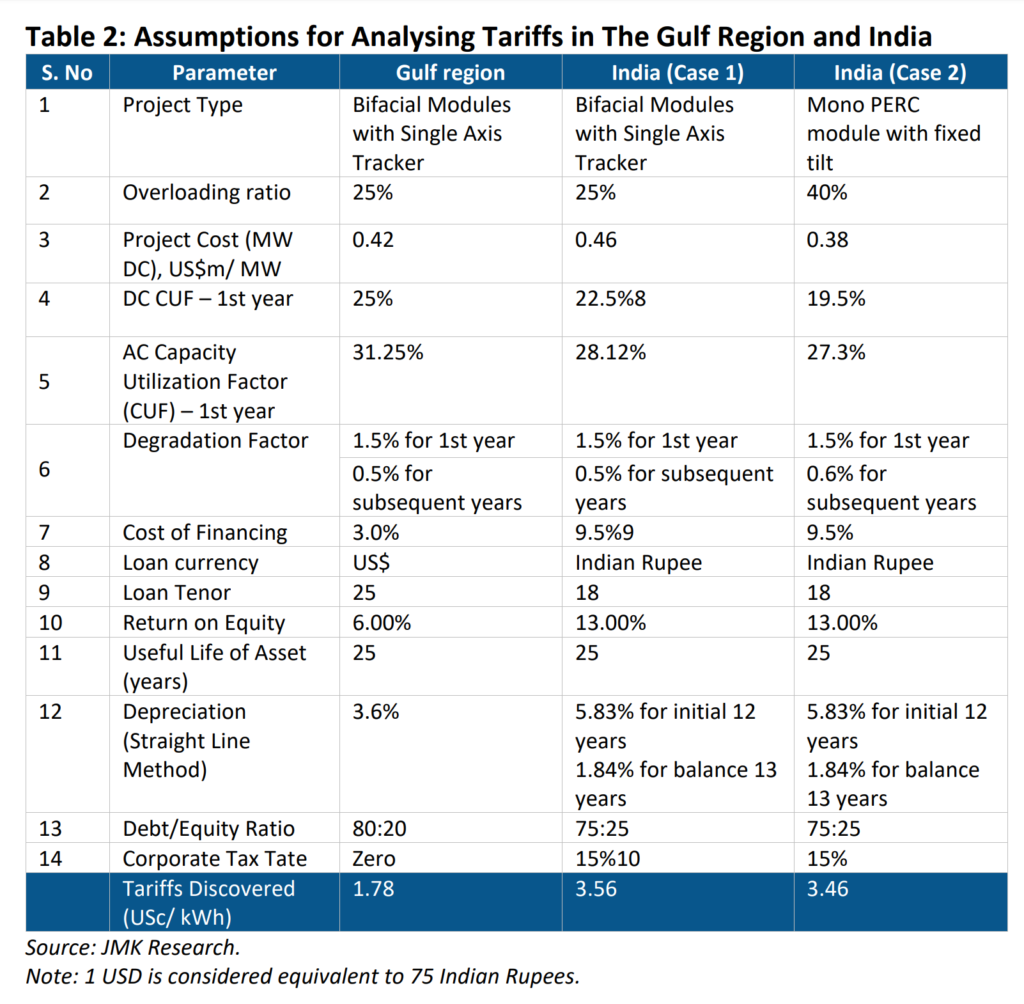

The researchers got to the above conclusions by building a financial model that represented what they believed was happening within solar power deals in Gulf countries Abu Dhabi, Qatar, Saudi Arabia, and Dubai. They then took the exact same financial model, and changed the inputs to match conditions in India (including a higher cost to construct). They saw projects in the Gulf who could reach ~1.65-1.93¢/kWh, able to reach ‘only’ 3.46-3.56¢/kWh in India.

There are only so many variables that drive cost of electricity. Hardware, labor, cost of land, and sunlight available are the main cost drivers. Additionally the cost of money, operations and maintenance, and profit drive long term electricity costs.

The differences driving the variances above can be seen below, and really, almost every variable is different even with the same hardware.

The project costs are lower for similar systems because land costs, and grid upgrade costs are zero. That’s right, if you can win a project in Saudi Arabia – interconnection is free.

There’s better sunlight. The research notes that a 2.5% increase in electricity produced, the difference in sunlight between the Gulf and India on average, will lower the price of profitable electricity by almost 10%.

The finance differences are really large though. Interest rates are 300%+ greater in India, hardware in the Gulf is purchased in the US dollar which drives costs down, loan terms are longer in the Gulf, depreciation rules better, and – drum roll please – no corporate taxes in the Gulf vs 15% in India.

These sorts of differences occur much the same in the United States as we move from state to state. While interest rates, loan years, money type, tax rates and other items are fixed in the more similar US markets – there are still great differences.

The biggest driver of difference in contracted rates of electricity from solar plants in the USA are the state incentives, and legal structures surrounding how energy can be sold.

In Massachusetts, CommercialSolarGuy has offered customers solar+storage coupled with a power purchase agreement under 3¢/kWh over twenty years. However, even that number isn’t necessarily possible anymore because the incentive program that was signed under, now pays less for clean electricity.

Funny, but if we travel less than ten miles from our New Bedford office to Fall River, Massachusetts we cross into a new electricity utility territory – and that 3¢ goes up to 6¢, and probably higher. Drive another ten minutes into Rhode Island, and the rules change again.

Add in another 48 states, different project sizes, unique incentives, local power lines challenges, costs to develop land – and so much more – and you get why solar developers are working at an accelerated rate.