There have been a few headlines regarding flow batteries recently:

- Form Energy’s First Project Tries Pushing Storage to 150 Hours

- How zinc-air battery capacity might reach a cost of $45/kWh

- Avalon and redT unite in $70 million merger of vanadium redox flow battery startups

- Schmid JV to begin building 3GWh Saudi Arabia flow battery factory this year

These headlines are mixed though. They show potential, but are lacking in deployment. The first two articles are of projects that hope to deploy by 2023, the third a merger of two financially challenged companies now becoming one financially challenged company, and the last is of a factory to be built in a country that makes many announcements.

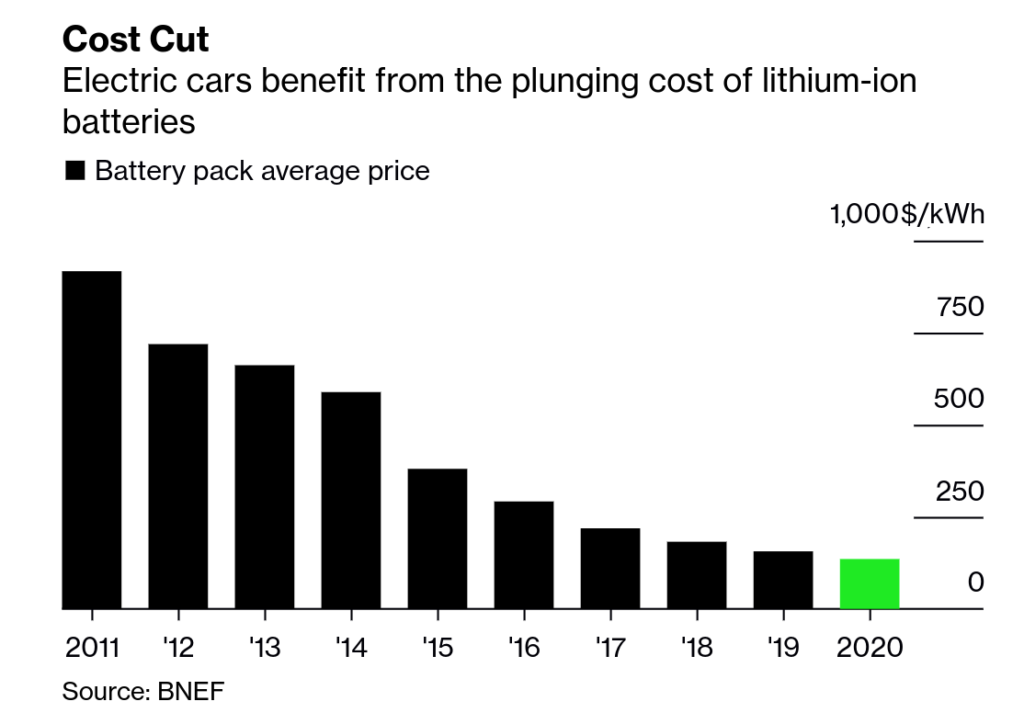

Considering that flow battery competition (lithium-ion) is getting deployed in cars and in the grid, and have hundreds of gigawatt hours of annual manufacturing factory capacity planned – there’s a long climb.

However, I remember being told as recently as 2015 that solar panels would never make that climb, and those parties were wrong.

2017 is when flow batteries first caught my attention in the form of a multi location installation in China of massive capacity – 200 MW/800 MWh. No news of that installation has popped up since, nor has much of any additional flow battery information from China at all.

Later in 2018, a NexTracker-backed 35 battery, 350 kW/1.1 MWh Avalon+solar power project was deployed. The project was installed by Ideal Energy in Idaho, and what a nice looking system it is. But as the third link at the top of the article points out, Avalon hasn’t performed well financially.

The main pitch of flow batteries is that over periods of 20 to 40 years (time frames that electric utilities think in terms of) the cost of the electricity delivered from these units will be cheaper than lithium-ion because the products pretty much last forever. A few filter and pump changes, and back to work.

What happens though if someone releases a lithium-ion battery at a price competitive – or even remotely close – to that of future flow battery pricing? What about if they do it in June?

Battery prices 🧐https://t.co/rFyphN8vqm pic.twitter.com/0AJY28CyGL

— Simon Evans (@DrSimEvans) May 17, 2020

And then, what if lithium-ion no longer has a ten year lifetime, but instead a 20 year or longer expected operating life?

The question becomes: will we need flow batteries? Many suggest the product will be necessary for long term energy storage (many weeks or months on end) to balance out the intermittency and seasonality of wind and solar power.

There are hints of research though that suggest this might not be the case. If HVDC power lines in the United States, hydrogen, or winter time right sizing takes off – my gut says flow batteries will remain a niche product never getting the massive development capital needed for the broad learning curve benefit that hammered solar pricing downward, and are doing the same with lithium-ion currently.

In all fairness, we’re very early in the energy storage game. For instance, California electricity utility Southern California Edison recently announced a 770 MW/3,080 MWh batch of projects. These projects alone are equal to all of what was deployed in 2019 in the United States – and its not that this facility is that big, it’s just that we’re that early.

One could reasonably argue that we’re so early, that it’s too soon to consider what’s going to win in the long game. As well, the market will be large and multiple products may fit in multiple niches.

We do however have a lesson from the solar industry that might guide us. Thin film versus the standard silicon modules we use today. Many thought that silicon would be too expensive, and so First Solar was seen as a potential savior.

Something happened though. Polysilicon feedstock first popped from $50/kilogram up to $400, but then it collapsed and most recently was priced under $10/kg. What if that happens with lithium? What’s the place for ‘cheap’ flow batteries then?

First Solar is still around, representing 3-5% of the market.

Hey @JustinHGillis, the learning rate of ~20% is usually from module prices since 1976. @ramez gets his LCOE learning rate of ~40% from 20GW-on—only since 2008 (understandably, as utility PV wasn't a thing before that + data is hard to find). Here's the data + fits! pic.twitter.com/Uhfvz0a0Lz

— Joel Jean (@joeljean9) May 16, 2020