The term the industry strove for was investor grade. Anything otherwise suggests risk. Risk is expensive.

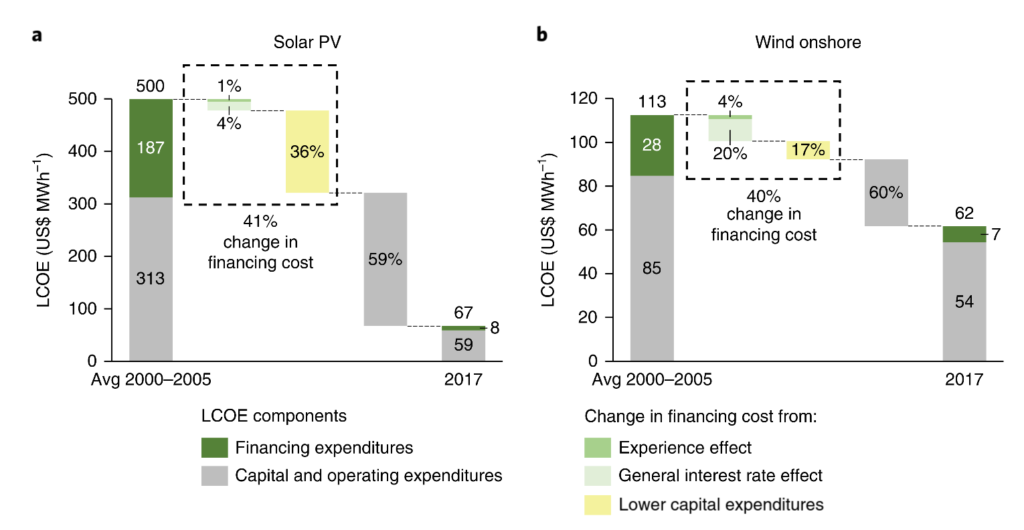

Researcher at ETH Zurich, Florian Egli has published his first single authored publication – A dynamic analysis of financing conditions for renewable energy technologies. The analysis found that between the early period of the renewable finance industry (2000–2005) and 2017, the cost of capital declined by 69% for solar photovoltaics and by 58% for onshore wind in Germany. This led to solar power’s cost per kilowatt hour to fall from 50¢ to 6.7¢.

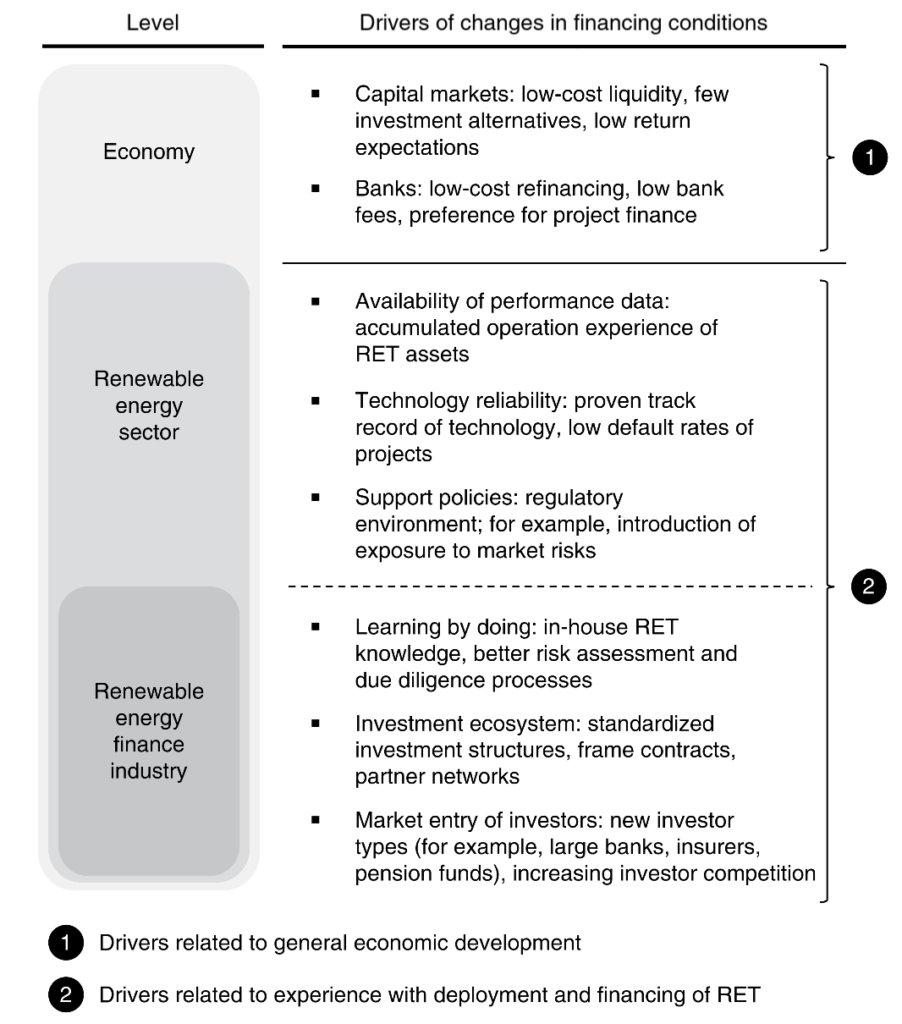

A key point noted by the author is that macroeconomic conditions were a significant part of these price decreases. Though general industry hardware and operational experience cost reductions were the main driver, 41% of those price falls came due to lowered cost of capital. Additionally, a significant amount of that lowered cost of capital was due to broad economic health in Germany. The author cautioned policy makers to consider this variable in future decisions surrounding the energy transition.

The data in this report was collected from 133 representative utility-scale solar photovoltaic and onshore wind projects in the country, over the last 18 years. The researchers then used qualitative insights from in-depth interviews with 41 investment professionals to identify the drivers of the observed changes in financing conditions.

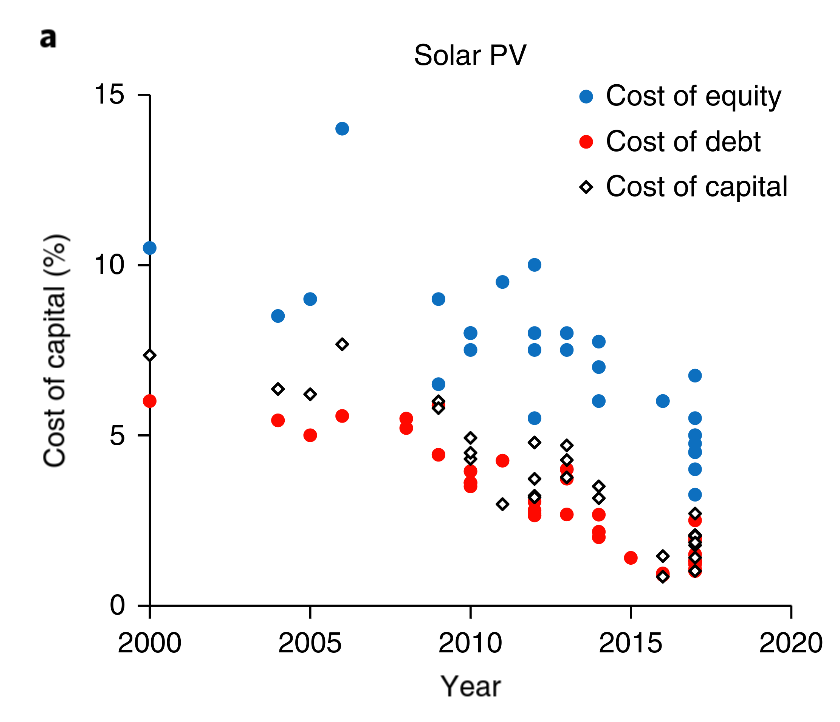

The authors found that cost of debt from banks decreased more than cost of equity from return driven partners. The lower bound of cost of debt dropped from around 5% to less than 0.5% – a 95% decrease. The lower bound equity returns fell from around 10% to below 4%, a greater than 60% decline.

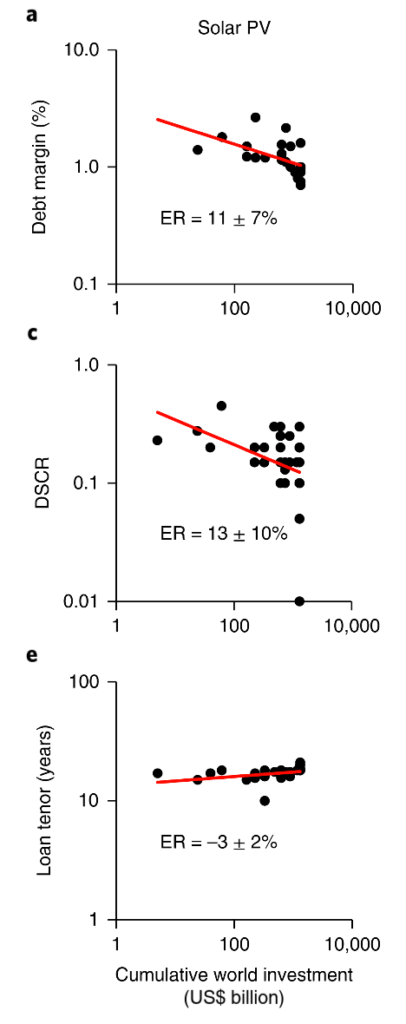

Among the data collected, Egli believes he identified a financing experience curve:

For each doubling of cumulative investment, the debt margins decreased by 11% for both technologies.

The cost of capital in 2017 for utility scale solar projects was in the range of 1.6%, corresponding to a low-risk, relatively mature, corporate bond of a financial service firm (BB+ to BBB).

The interviewers found that the capital inflow from these institutional investors created an incentive to build larger projects which also compressed debt margins. These lower margins led to lower leveled costs of electricity, but also increased the demand for solar assets.

Information available from the industry of its performance was part of the increasing maturity that drove the trust of hardware. Solar panels, inverters, and racking components were able to live up to the warranties, and the electricity generation met projections, leading to a low default rate on projects.

Concurrent with the above two drivers, was in increase in the use of standardized deal structures, frame contracts and partner networks. As volumes deployed grew significantly, these efficiencies became necessary. This increased throughput rate allowed for lower fees as fewer bankers were needed per megawatt installed.

The debt margins that finance firms allowed for increase greatly. These greater debt margins allowed project developers to spend less of their own capital, and more of the banks, to get projects built.

One value as part of this equation, the debt service coverage ratio, also declined for solar power plants as trust in the generation projections increased greatly.

A report on solar performance by Fitch Ratings noted, “Solar projects are demonstrating lower operational risk, better generation performance and lower volatility. Solar projects also tend to meet or exceed initial volume estimates while wind projects more often underperform against expectations.”

Financial tools have arisen to bridge the gap between those who trust solar, and the lending entities still learning about these high levels of performance.

kWh Analytics has created the Solar Revenue Put – “an all-risk insurance policy that guarantees up to 95% of forecasted P50 energy production.”

Per kWh Analytics, this guarantee of 95% of generation has saved developers up to 5¢/watt on finance fees by increasing the allowable debt size by 10% on average.

Note, that the cost of debt versus equity fell all the way to 0.5% on large projects.

Specifically noted, kWh Analytics states that by using their tool, you’re able to your lower debt service coverage ratio down to 1.10 from 1.30. That means, banks will allow investors structure their loan payments very tightly relative to projected revenue.

These tighter payments allow more cash to low to investors, again, increasing asset class demand.

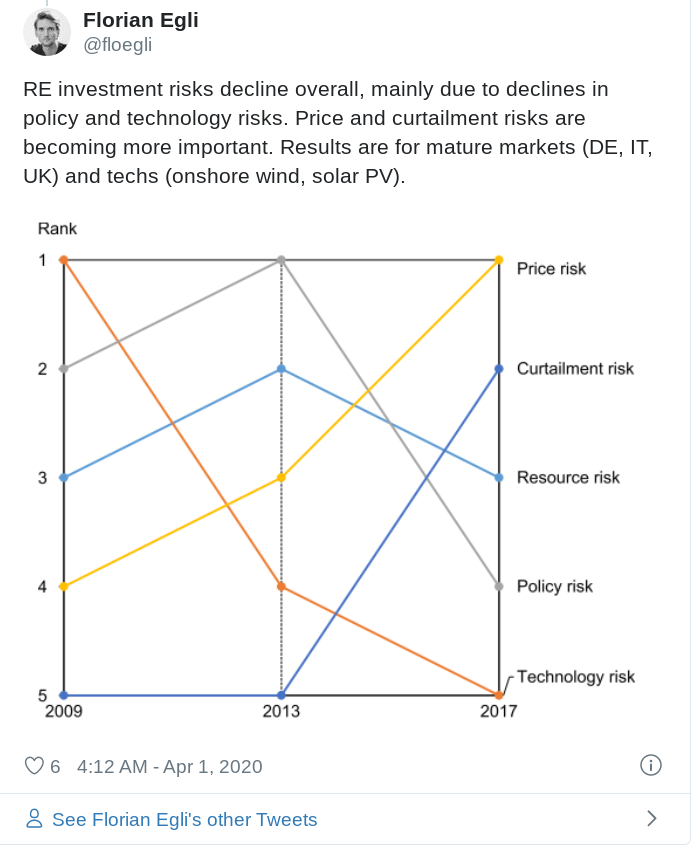

More broadly though, Egli also suggests that renewable energy investment risks have declined overall as policy and technology risk has fallen. And now, price of electricity generated and curtailment risks are rising are becoming more important in mature markets.

However, much of the benefits of a strong economy can quickly disappear, which could slow the capital heavy renewable industry – and the policy makers ought be very conscious of this as we strain to clean of energy sources of CO2 and other pollutants.

CommercialSolarGuy is a solar power developer and construction firm located on the East Coast of the United States. We offer a feasibility analysis service to help you determine whether solar makes sense for your business. As part of this service we support you in gaining finance approval from your preferred lenders. Often, banks will accept 26% down payments – with our most credit worthy customers getting 0% down, ten year terms.

Let CommercialSolarGuy support your investment in solar power – contact us at info@commercialsolarguy.com or call 508-499-9786.